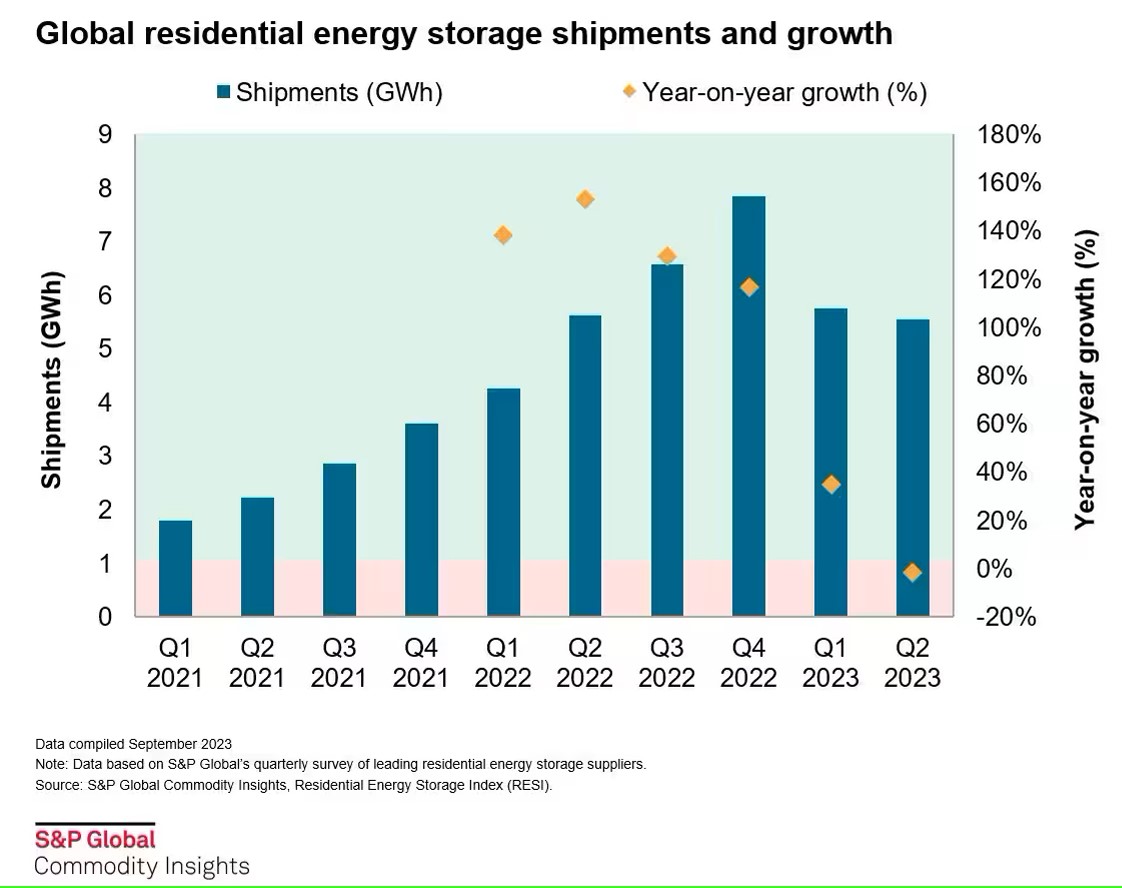

The second quarter of 2023 was the first quarter on record in which global residential energy storage shipments have declined year on year, down by 2%, according to S&P Global Commodity Insights.

Shipments to Europe have slowed significantly, with Belgium and Spain reporting year-on-year declines of 60%, while Italy saw a drop of more tham 40%. In contrast, South Africa has emerged as a standout market, with shipments surging by more than 300% year on year.

Europe's residential inventory levels, particularly for imported systems, rose considerably by the end of 2022. Coupled with subdued demand in the first half of the year, this surplus inventory contributed to the decline in shipments.

Overall, the shipments to various European markets tracked by S&P Global Commodity Insights contracted by 3% year on year in the first half of 2023. However, German system suppliers bucked this trend, posting a remarkable increase of nearly 30% during the same period.

“By the end of 2022, S&P Global estimates that inventory levels in key European markets had reached nearly 5 GWh,” Susan Taylor, senior analyst for S&P Global, told pv magazine. “It's worth noting that this also includes products that are in transit from Asia, as well as those waiting to be installed.”

According to Taylor, inventory levels equal to around six months of installations – around 3 GWh – are seen as normal. But the levels that S&P Global calculated in Europe at the end of 2022 were far higher.

“This certainly poses a challenge for the market in the event that demand stops growing as quickly as it had been, as we've seen in the first half of 2023,” Taylor said. “Another knock-on effect from the oversupply and high inventory will be aggressive prices, similar to what is happening with residential PV at the moment, as distributors have to clear their stock.”

Despite high inventory levels, new Chinese suppliers are entering the market and scaling quickly to ship large volumes. This trend will further exacerbate high inventory levels in Europe relative to slowing demand, according to analysts.

In the United States, supply and demand is more balanced. However, S&P Global has also tracked quarter-on-quarter declines in residential storage shipments to the US market since the fourth quarter of 2022.

“This is due to a couple of reasons,” Tiffany Wang, an analyst for S&P Global, told pv magazine. “High interest rates are the main driver, which makes the financing for storage systems looks less appetizing. Marketwise, a backlog of NEM 2.0 solar-only installations, plus decreases in electricity prices in central US means that people are delaying storage installations.”

However, the analysts said that the minor oversupply issue will probably be rectified by the end of the year, thanks to higher demand from NEM 3.0 solar and storage installations in California, which will help to deplete inventory.

Globally, S&P Global said it expects residential energy storage installations to rise by approximately 15% in 2023. However, shipment growth is expected to be more gradual as inventory levels are gradually depleted.

“Residential storage growth in mature markets like Germany will continue, driven by a strong residential PV market and supportive subsidies,” Taylor said. “In general, short-term limitations will stem from reduced consumer spending, while longer-term growth will be driven by retrofitting existing PV systems coupled with the increasing advancements in sophisticated home energy management systems incorporating EV charging, heat pumps, and virtual power plants.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Funny- the next “glut”- reminds me of the rystad module “glut” miscalculations.

I would like to critically question these conclusions:

How can S&P (at least in the article) conclude high (and thus very costly) inventories without further details on the sales market?

The chart shows increasing global shipments until the end of 2022, which already decrease significantly at the beginning of 2023. In this context, a smaller market is mentioned.

For Germany, with a very large home storage market, this is probably an incorrect statement, because by the end of June 2023, approximately 240,000 new home storage units had been installed.

This means that more home storage systems were installed in Germany in the first 6 months than in the whole of 2022. A market decline looks different.

Perhaps such claims can therefore be explained in more detail by market researchers or at least questioned very critically.

Translated with http://www.DeepL.com/Translator (free version)