Solar photovoltaic, solar thermoelectric and wind energy production

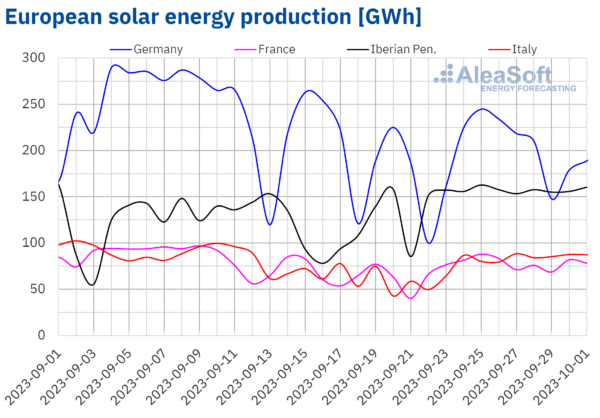

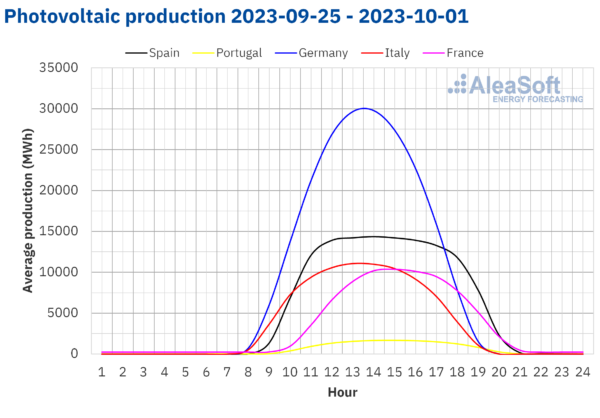

In the week of September 25, solar energy production increased in all analyzed markets compared to the previous week. The Italian market registered the largest increase at 38%. In the rest of the markets, the increase in solar energy production was very homogeneous, ranging from 15% in Spain to 18% in Germany. Furthermore, although solar radiation decreases as winter approaches, the Iberian Peninsula produced 163 GWh of solar energy on Monday, September 25, a volume of solar energy production not seen since September 1.

For the week of October 2, according to AleaSoft Energy Forecasting’s solar energy production forecasts, solar energy production is expected to decline in the analyzed markets.

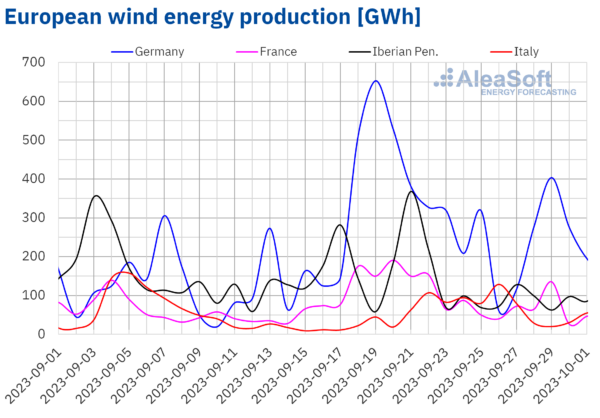

As for wind energy production, there was a decrease in production from the week of September 25 in all markets analyzed by AleaSoft Energy Forecasting. The largest fall, 55%, was registered in the French market and the smallest decrease, 2.4%, in the Italian market. In the remaining markets, the decline in wind energy production ranged from 44% in Germany to 49% in Portugal.

For the week of October 2, AleaSoft Energy Forecasting’s wind energy production forecasts indicate that wind energy production will continue to fall in Italy and France, but it will increase in the rest of the analyzed markets.

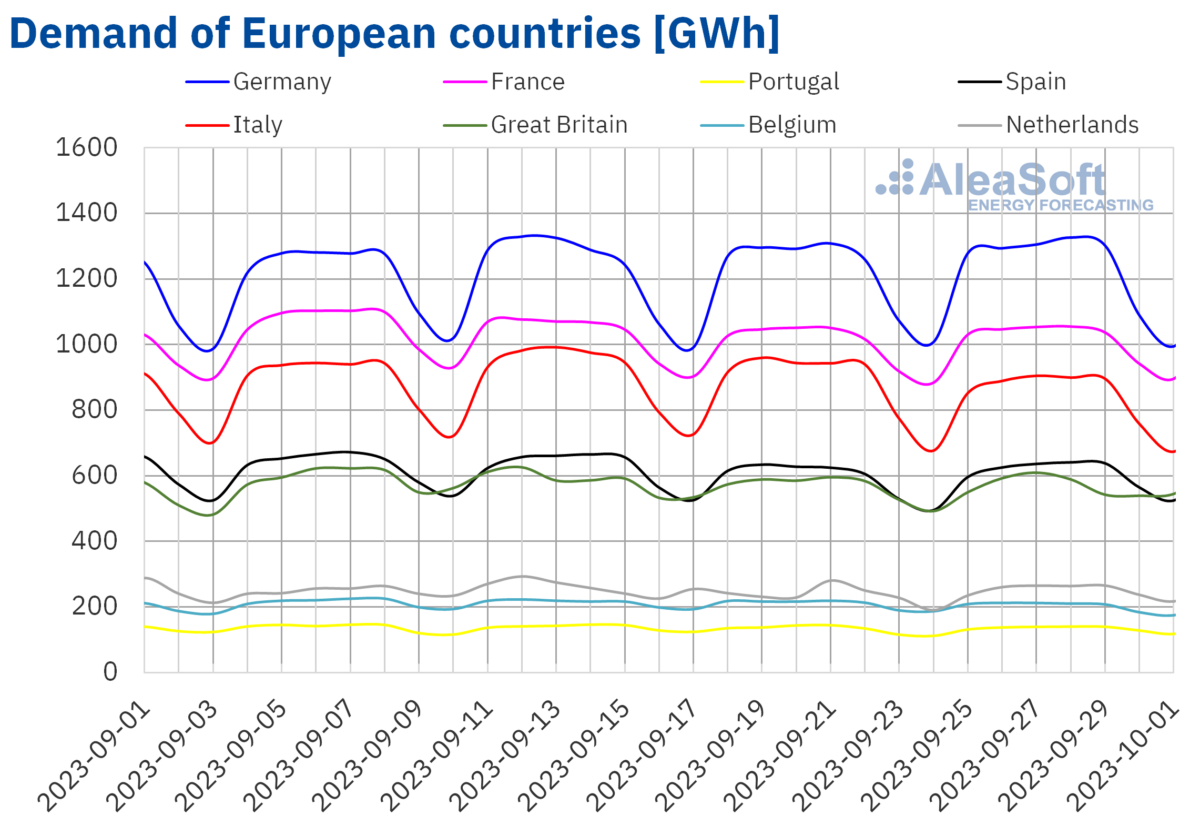

Electricity demand

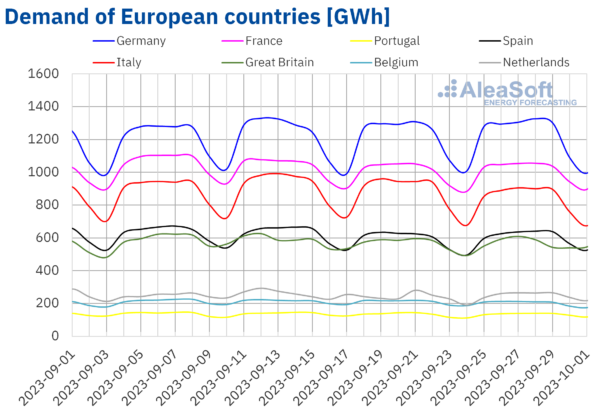

In the week of September 25, electricity demand increased in most European markets analyzed compared to the previous week. The largest increase, 5.6%, was observed in the Dutch market, followed by a 2.3% increase in the Spanish market. The smallest increase, 0.5%, was registered in Great Britain. Electricity demand fell in only two of the analyzed markets, by 4.5% in Italy and 3.4% in Belgium.

Over the period, average temperatures increased in most markets, ranging from 0.7 °C in the Netherlands to 3.0 °C in Portugal. However, in Italy and Germany, average temperatures decreased by 1.8 °C and 0.1 °C, respectively.

For the week of October 2, according to AleaSoft Energy Forecasting’s demand forecasts, electricity demand is expected to continue to increase in most European markets analyzed, except France, Germany and Italy.

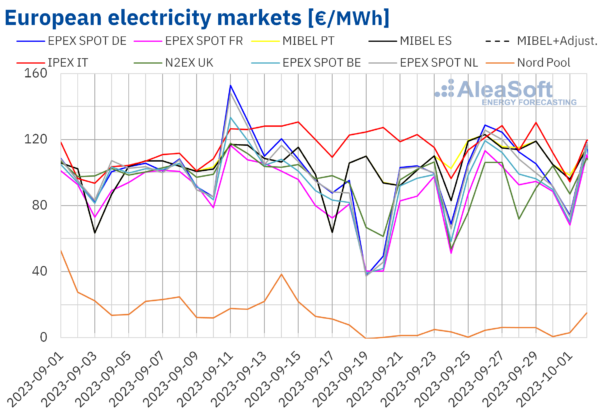

European electricity markets

During the week of September 25, prices in almost all European electricity markets analyzed by AleaSoft Energy Forecasting increased compared to the previous week. While in the week of September 18, daily prices were often below €100/MWh, on several days in the week of September 25, daily prices exceeded this amount and even €120/MWh in some markets, resulting in higher weekly averages in most of the analyzed markets, in many cases above €100/MWh. The exception was the IPEX market of Italy, where the price fell slightly, by 1.7%.

On the other hand, the highest percentage price increase, 46%, was reached in the Nord Pool market of the Nordic countries. Although daily prices remained below €10/MWh, they increased compared to the previous week, when a negative daily price was registered.

In the remaining markets, prices increased between 11% in the MIBEL market of Portugal and the N2EX market of the United Kingdom and 35% in the EPEX SPOT market of Belgium and France.

In the fourth week of September, weekly averages were above €90/MWh in most of the European electricity markets analyzed. The exception was the Nordic market, where the lowest average price, €3.82/MWh, was reached. On the other hand, the highest weekly average, €116.21/MWh, was reached in the Italian market. In the rest of the analyzed markets, prices ranged from €91.68/MWh in the British market to €113.67/MWh in the Portuguese market.

In the Nordic market, negative hourly prices were registered on September 25, 26 and 30 and October 1. In the British market, negative prices were registered on September 25 and 28. The lowest hourly price in this market, ‑£19.78/MWh, was reached on Thursday, September 28, between 5:00 and 6:00. This was the lowest price in this market since July 16. In addition, negative prices were registered in the German, Belgian, French and Dutch markets on Sunday, October 1.

However, in the fourth week of September, hourly prices above €200/MWh were also reached in several markets. On Monday, September 25, this amount was exceeded for two hours in the Belgian market. In the German and Dutch markets, in addition to the 25th, prices above €200/MWh were registered on September 26, 27 and 28. The highest price, €379.59/MWh, was registered on Monday, September 25, from 19:00 to 20:00 in Germany and the Netherlands.

During the week of September 25, the increase in the average gas price, the rise in electricity demand in most markets and the general decline in wind energy production led to higher prices in the European electricity markets.

AleaSoft Energy Forecasting’s price forecasts indicate that in the first week of October prices in most European electricity markets analyzed might decrease, influenced by increased wind energy production in some markets.

Brent, fuels and CO2

Brent oil futures for the Front‑Month in the ICE market registered their weekly minimum settlement price, $93.29/bbl, on Monday, September 25. This price was 1.2% lower than the previous Monday, but $0.02/bbl higher than the previous Friday. Increases continued until reaching the weekly maximum settlement price, $96.55/bbl, on September 27. This price was 3.2% higher than the previous Wednesday and the highest since November 7, 2022. Subsequently, prices declined slightly but remained above $95/bbl. The settlement price on Friday, September 29, was $95.31/bbl, 2.2% higher than the previous Friday.

In the fourth week of September, production cuts by Saudi Arabia and Russia, along with data on declining US crude stockpiles, pushed settlement prices of Brent crude oil futures higher to $96.55/bbl on September 27. However, concerns about economic evolution led to slight price declines in the last sessions of the week. Data released on Saturday, September 30, on the evolution of the Chinese economy might support price increases in the first days of October. The increase in demand associated with aviation due to increased travel during the holiday period in China might also exert an upward influence on prices.

As for TTF gas futures in the ICE market for the Front‑Month, on Monday, September 25, they reached the weekly maximum settlement price, of 44.44 €/MWh. This price was 29% higher than the previous Monday and the highest since early April. In contrast, the weekly minimum settlement price, €39.30/MWh, was registered on September 27. Despite the decline, this price was still 5.4% higher than on the previous Wednesday. In the last sessions of the week, prices increased again. As a result, on Friday, September 29, the settlement price was €41.86/MWh, 5.2% higher than the previous Friday.

In the fourth week of September, expectations of higher demand due to the approaching winter and the decline in renewable energy production led to the highest price in recent months on Monday. However, high levels of European stocks and the prospect of mild temperatures and higher supply levels allowed lower prices to be registered subsequently.

As for CO2 emission rights futures in the EEX market for the reference contract of December 2023, the weekly maximum settlement price, €85.27/t, was reached on Monday, September 25. This price was 5.5% higher than on the previous Monday. However, this price was already slightly lower than the previous Friday’s price, €85.48/t. Price declines were registered in most sessions of the fourth week of September. As a result, the weekly minimum settlement price, €81.67/t, was registered on Friday, September 29, and it was 4.5% lower than the previous Friday.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the financing and valuation of renewable energy projects.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.