At the 40th edition of the EU PVSEC conference, which took place in Lisbon last week, the mood was upbeat within the PV community. And why shouldn’t it be? As Nancy Haegel from NREL pointed out in her closing presentation, 2022 marked the first time in history that, on a global scale, solar power accounted for more than 50% of the net expansion of electricity capacity. In terms of global electricity generation, solar still only contributed 4% last year while fossil fuels stood for more than 66%. By 2035 wind and solar together could account for roughly 50% of the global electricity generation, if all countries finally realize the enormous social, environmental and economic gains that a rapid transition to renewables would entail.

Which brings us to the hottest topic discussed on the exhibition floor and during the coffee breaks in between the presentations: which countries outside of China will benefit from the massive growth in demand for photovoltaic hardware?

Manufacturing support

Both India and the US have already implemented ambitious support schemes to ensure that there will be a renaissance of solar manufacturing in their respective countries. First successes from these policies can already be observed this year, with local champions like Tata, Reliance and First Solar significantly increasing their domestic production capacities.

Europe has also formulated the ambitious goal that it wants to re-establish the entire crystalline photovoltaic value chain on its continent, with the aim that roughly 40% of the European PV demand can be supplied by domestic manufacturers going forward.

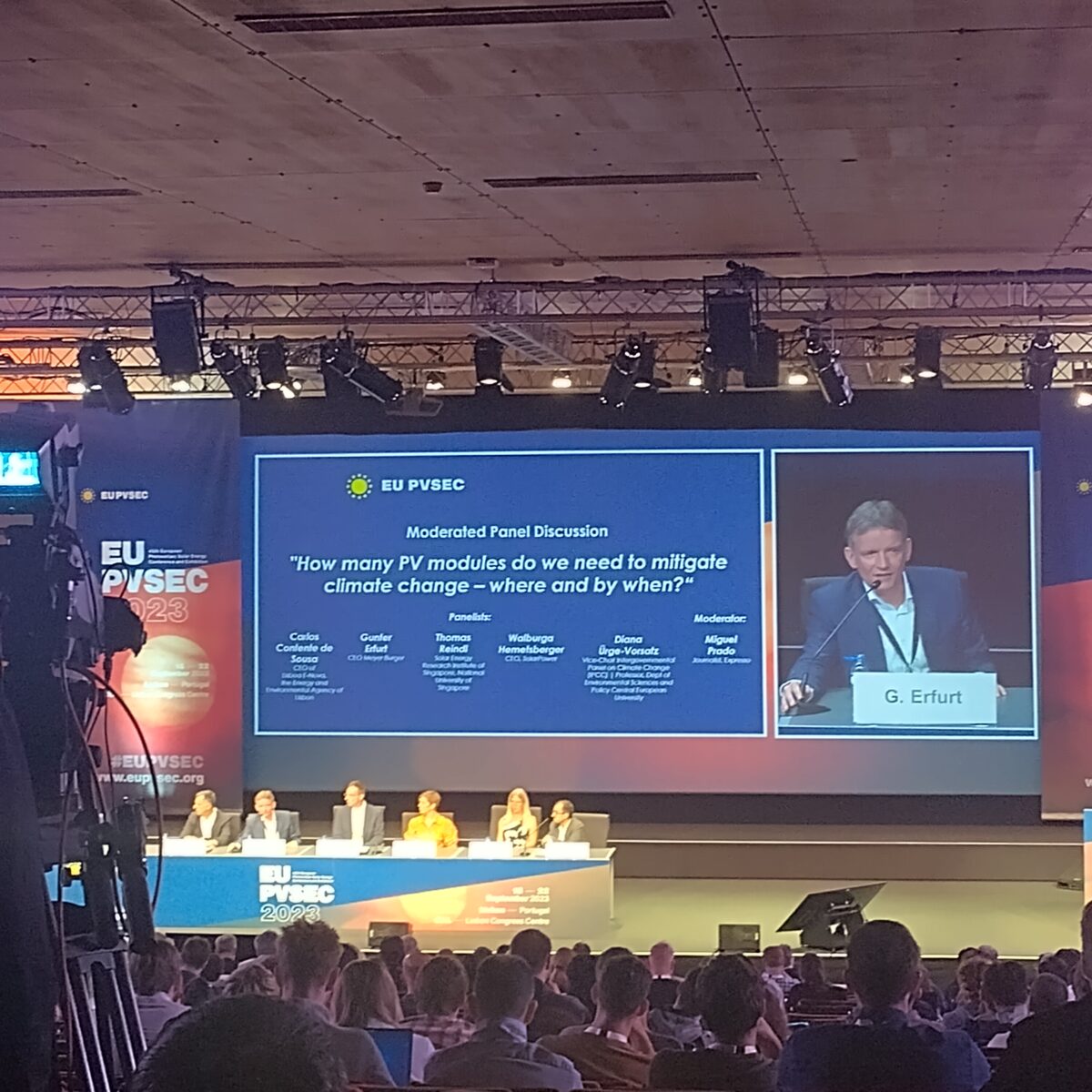

Yet until now the corresponding supportive measures have not been put into place to match these ambitions. This is why Europe thus far has had to settle for the more symbolic victories in this respect: this year’s Becquerel Prize was awarded to Gunter Erfurt, the CEO of Meyer Burger for his engagement in re-establishing advanced manufacturing of silicon solar cells and modules in Europe. Erfurt was bestowed the award at the opening ceremony of EU PVSEC.

Meyer Burger manufactures heterojunction solar cells and modules built on their own equipment in factories in Germany. Driven by the lure of a generous support mechanism available in the US, namely the Inflation Reduction Act (IRA), Meyer Burger has halted all of its European capacity expansion plans and now fully concentrates on establishing a 2 GW cell and module factory in the US instead.

In the run up to EU PVSEC in Lisbon, prices for crystalline PV modules have seen a pronounced drop in key markets, fueling the fear that the European PV industry, which was just beginning to re-establish itself might get crushed as a collateral victim of the infight between the leading Chinese PV manufacturers. The latter have aggressively expanded their production capacities over the past 18 months which has resulted in an increasingly pronounced oversupply situation. The extent of module oversupply became truly apparent in May of this year.

Module prices

On average module prices have declined by more than €0.06/Wp in just three months, with the effect that a number of European manufacturers had to scale back their production as it became increasingly difficult to bridge the rising price gap between modules manufactured in China and those assembled in Europe.

Both Solar Power Europe as well as the European Solar Manufacturing Council (ESMC) have turned to the European Commission asking for immediate relief actions in order to avoid another wave of bankruptcies, which they fear for their members, should prices continue to remain at levels between €0.15/Wp and €0.17/Wp – as have been observed in the market lately.

The biggest threat the current price deterioration causes is the consequence that it will be virtually impossible to attract any equity funding for the numerous hopeful European plans to re-establish the photovoltaic value chain. If the impression persists that the photovoltaic industry, namely the leading Chinese manufacturers, are again willing to sacrifice margins over market share and expand their capacities at a faster rate than is met by the rising demand.

This would equate to a fatal blow to all European dreams to re-establish the photovoltaic industry domestically. Every day of the week in Lisbon there were panel discussions and how this worst case scenario could still be avoided. One fraction of the industry voiced the conviction that without protective measures that would directly or indirectly reserve a certain market volume for European manufacturers they would stand no chance to survive. By contrast a second fraction suggested that convincing the leading Chinese manufacturers to establish joint venture PV production facilities in Europe could avoid trade disputes with China and ensure that the benefits of the incredible growth and success story of photovoltaics is more evenly spread around the world.

When it comes to its own ecosystem, the EU PVSEC event was able to demonstrate that it is possible to have an even split between different stakeholder groups even if they do not have equal starting conditions. As an example, both of the poster awards as well as the awards for the oral presentations by students – the so called student awards – were evenly split between the genders, despite female authors accounting for less than a quarter of the abstract submissions.

The strength of attendance at EU PVSEC 2023 was also encouraging. More than 1850 scientists and researchers from more than 60 countries had gathered in Lisbon. There were more than 1050 oral and visual presentations, discussing the latest findings in cell technology, module reliability and renewable policies around the globe.

In 2024 EU PVSEC will be held in Vienna, Austria from September 23 through 27.

Götz Fischbeck is a consultant and contributor to the pv magazine global editorial team.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

In the same week, the perma-tanned imbecile heading the ECB (Lagarde) wants to keep interest rates high to “beat inflation”.

“it will be virtually impossible to attract any equity funding for the numerous hopeful European plans to re-establish the photovoltaic value chain.”……..well of course one could use debt – but Mrs Imbecile wants to make that expensive – cos after all, beating inflation is sooo much more important than having a Europe PV industry. The whole saga is one of total & complete failure by all EU govs and the morons in the European Commission to formulate an indsutry strategy for PV, fund it & stick with it. I have no doubt the Chinese look on with a mixture of total bafflement and amusement.