Australia's Clean Energy Regulator said in a recently published report that utility-scale PV deployment is sluggish due to a rangte of challenges, including rising costs, global competition, and regulatory issues.

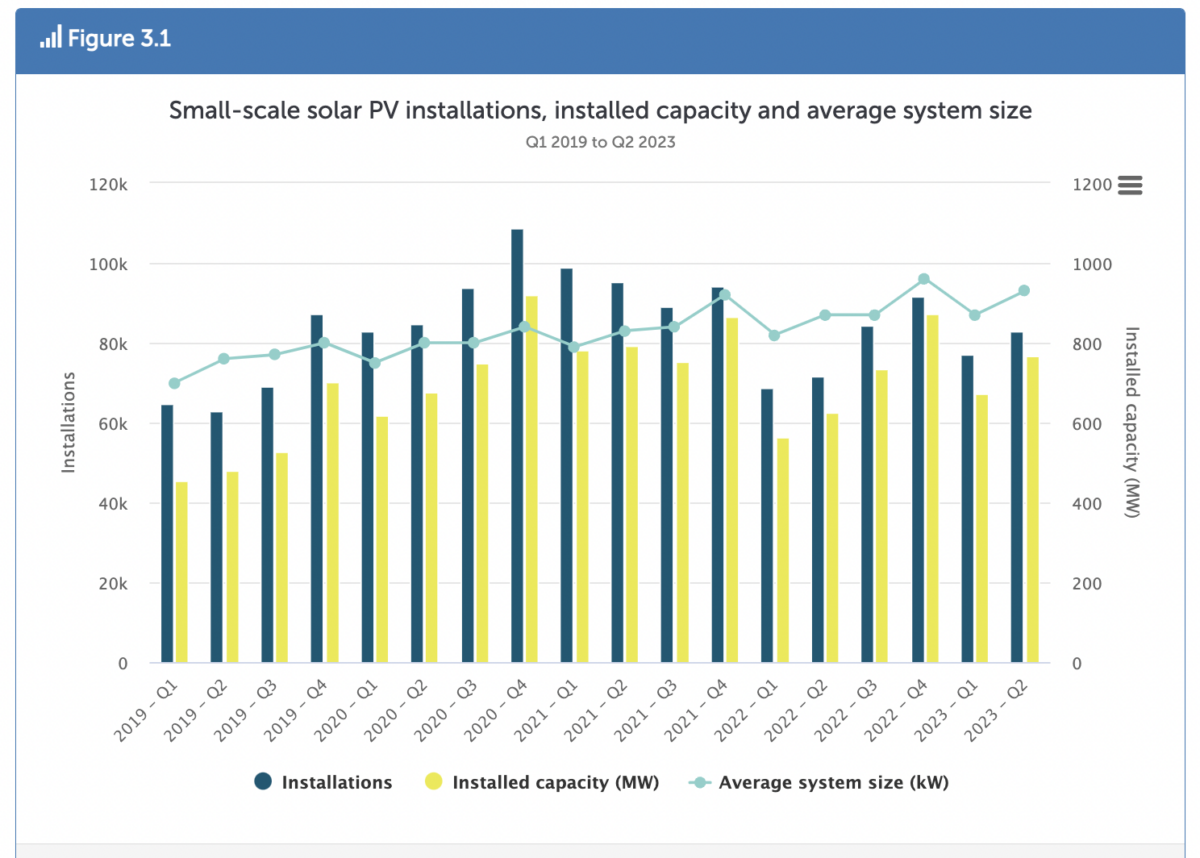

Rooftop solar installations have been a bright spot, with almost 160,000 systems installed in the first half of the year. This trend suggests that 2023 could surpass Australia's previous record of 3.2 GW in total capacity for rooftop solar installations.

In the first half of 2023, 1.4 GW of rooftop solar PV capacity was added, up 21% year on year. If this growth continues throughout 2023, it is possible that the 2021 record of 3.2 GW could be exceeded. The average size of rooftop systems has also increased, reaching a new high of 9.3 kW.

“The increased capacity saw the share of renewable electricity rise to over 36% of demand in the National Electricity Market. This is expected to grow to 40% by December,” said the regulator.

Last weekend, South Australian rooftops provided 101% of the state's electricity demand, an unprecedented feat, according to energy advisory firm Global Power Energy. This achievement in South Australia is exceptional, both within the Australian National Electricity Market (NEM) and on a global scale.

Clean Energy Regulator CEO David Parker, described the first half of the year for new large-scale renewable energy investment commitments as “quiet … We’ve downgraded our expectations and now expect 2023 investment may not reach 3 GW.”

Although the regulator had anticipated that 3.5 GW of new renewable projects would reach a final investment decision (FID) in 2023, only 0.5 GW hit this milestone before July. However, the second half of the year is expected to see more significant activity, with industry engagement indicating approximately 2.5 GW of projects moving towards FID.

“Wind and solar remain the cheapest options for new energy supply. Unfortunately, rising costs for components, engineering and construction combined with strong international demand for these products and services are slowing progress,” the regulator said. “Finding ways to streamline grid connection and fast-tracking new transmission will also be critical for success.”

Increasing prices and decreasing durations of power purchase agreements (PPAs), which are crucial for large-scale projects as they secure offtake and guarantee income, are impacting the number of projects reaching FID, according to the regulator.

“Increased cost and risks [for large-scale renewable projects] are flowing through to the PPAs prices,” the report says. “A higher price is needed on a per megawatt hour basis to get projects to FID. These higher prices may be leading to less demand for PPAs from electricity retailers and corporates.”

The regulator noted a growing trend towards shorter-term PPAs. but achieving Australia's 82% renewable energy generation target by 2030 will require a significant increase, it added.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

4 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.