The terawatt era has arrived, and the world is unprepared. As the industry explodes in volume, solar and related professionals must prepare, adapt – and deploy.

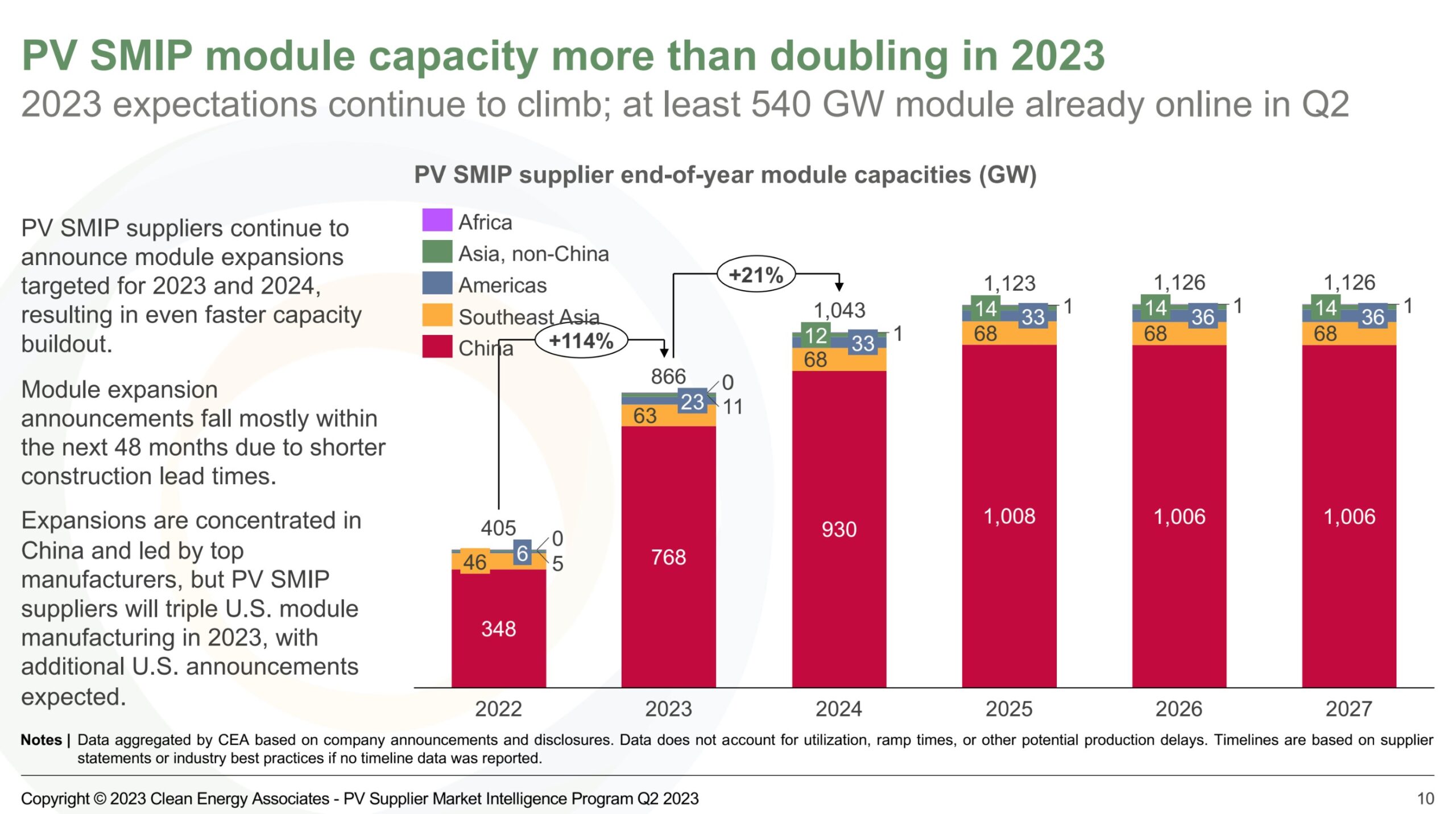

In its recent Q2 PV Supplier Market Intelligence report, Clean Energy Associates (CEA) highlighted significant growth in solar module manufacturing by Chinese solar module manufacturers. From a 405 GW manufacturing capacity in 2022, a projected 114% increase is expected, reaching 866 GW by the end of 2023. Following that, a subsequent 21% surge in 2024 will bring the total to an impressive 1.043 TW globally.

This rapid growth surpassed many industry predictions. Still, insiders within the Chinese government, having played a pivotal role in this boom, likely foresaw such a rise.

A closer look at the numbers reveals that by the end of 2024, Chinese domestic capacity could be responsible for approximately 0.93 terawatts of their total global capacity. Southeast Asia is anticipated to account for less than 7% (0.068 TW), the Americas just over 2% (0.023 TW), and non-China Asian markets might contribute about 1% (0.011 TW).

Major, European and American manufacturers, such as Meyer Burger and First Solar, were not considered in this study. The assessment predominantly revolved around:

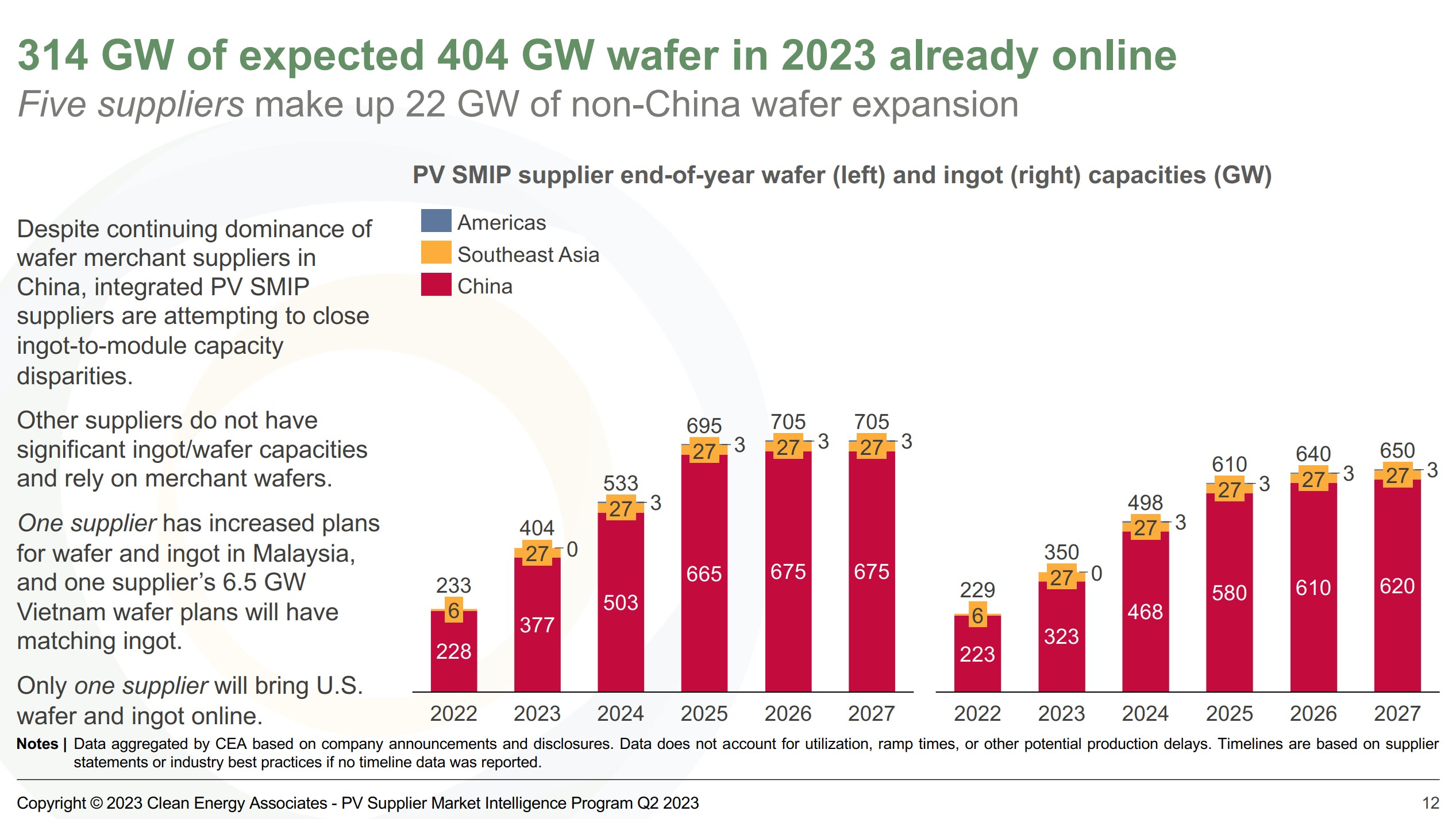

The majority of this capacity is earmarked for n-type solar cells. Yet, a bottleneck seems evident in the production process. CEA’s data suggests that cell production lags behind module manufacturing, with wafer and polysilicon ingot capacities trailing by several hundred gigawatts.

China’s heavily centralized solar power market, underpinned by extensive governmental oversight, might see these predictions shift. Whether solar module manufacturing capacities will be fine-tuned remains uncertain.

Aligning with – and surpassing – these projections, Bernreuter Research suggests that long term Chinese plans include up to 3.5 TW of manufacturing capacity by 2027. PVEL’s findings indicate that the 3.5 million metric tons of capacity might be operational by the end of next year. Considering 2.2 grams of polysilicon are required for a watt of solar panels, PVEL estimates that polysilicon supplies could generate 1.6 TW of solar modules.

If we build it, will they come?

The question remains: if this manufacturing capacity is available, will there be adequate installers, grid capacity, and batteries to absorb the surplus daytime production?

Analyst Jenny Chase of BNEF splashed a little cold-water on our enthusiasm, pointing out the reality that oftentimes, solar module factory capacity is 1.5 to 3 times greater than actual installed capacity. Underutilization of manufacturing capacity is normal.

Chase noted:

Maybe 1TW will be installed in 2025, but not just because the module factories exist.

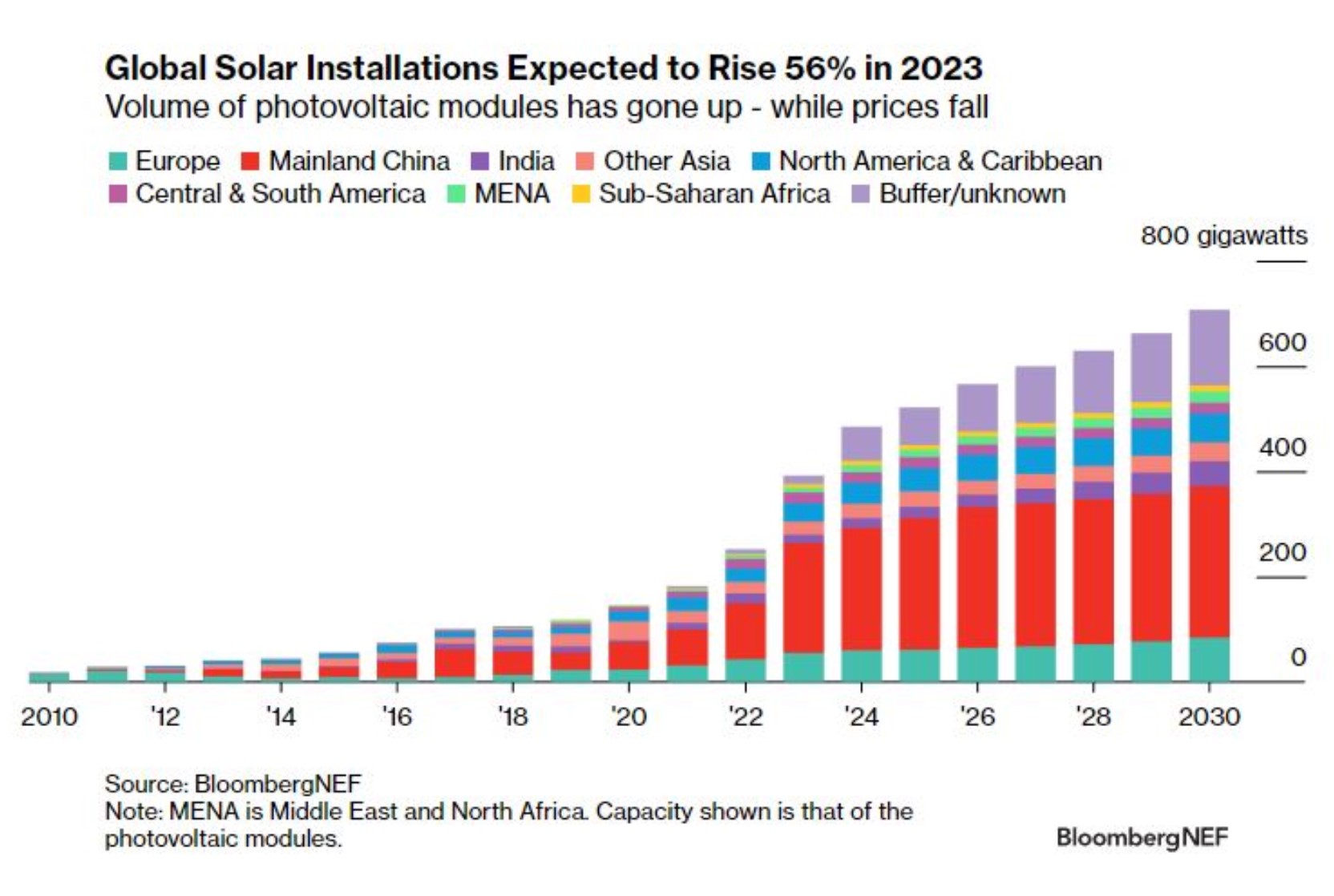

BloombergNEF’s recent projections estimate 392 GW to be installed in 2023 and around 500 GW in 2025. These figures are based on their medium volume projections, though they also offer both lower and higher range projections.

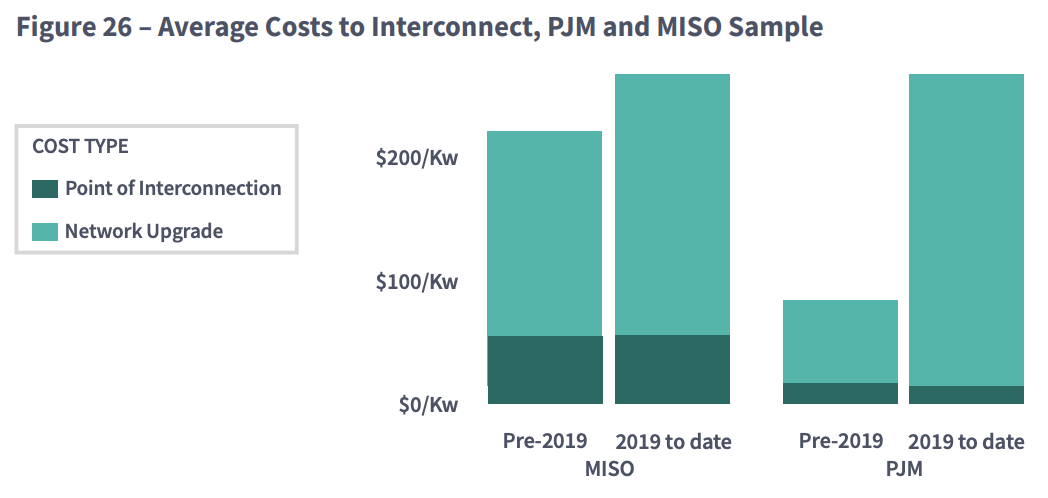

Integrating such a large volume safely into the power grid poses daunting technical challenges. The U.S., the world’s second-largest solar market, has experienced delays in interconnections, slowing solar’s rapid ascent. Specifically, the PJM territory, within the broader United States’ Eastern Interconnection region, halted all new renewable energy projects for two years while grappling with hundreds of gigawatts of projects vying for grid access. As the U.S. interconnection queue nears 2 TW of capacity, both the time and cost of connections have escalated.

State markets have also put the brakes on their local distribution markets. When Massachusetts’ SMART program was launched, National Grid’s territory was overwhelmed with applications, causing unforeseen halts in development. Using public data, pv magazine USA predicted that National Grid’s area would instantly fill its entire 800 MW project tranche. Our prediction was spot on. Yet, the utility expressed astonishment, stating, “we’re all a little surprised by how quickly we got to this saturation.” As a result, they slammed the brakes on development, putting a billion dollars of projects on standby.

This unexpected turn prompted a state investigation. Despite this, grid connections remained sluggish, and currently, numerous substations within the state can’t accommodate additional solar projects.

China, the world’s largest renewable market, initially managed the surge in wind and solar by curtailing excess generation. They later developed a nationwide high voltage direct current (HVDC) network to channel power from the interior regions to the densely populated coast.

The growth rate of solar energy is undeniably accelerating. Having achieved our first terawatt of installed solar in early 2022, discussions swiftly transitioned to reaching 1 TW of capacity annually before the end of the decade. We then speculated that a second terawatt might be realized in just three years.

There’s a budding optimism that we might witness a unique milestone: a terawatt installed within a single year in the near future. Truly, that would be an accelerating transition.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.