From pv magazine USA

Residential solar and storage marketplace and informational site EnergySage has released its market intelligence report for June 2022 to July 2023, highlighting a shifting market under raised interest rates. The report tracks millions of data points based on homeowner shopping transactions in its marketplace.

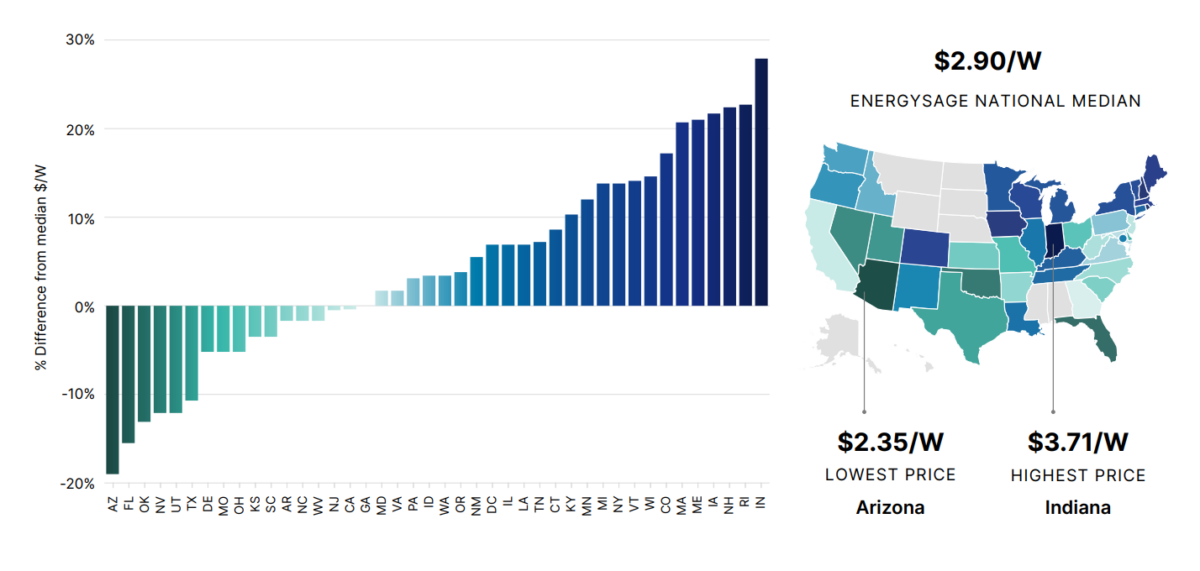

Reported solar prices have now climbed for two years consecutively, though more gradually in the first half of 2023. EnergySage said its average solar quote was $2.90 per W, up 1.8% in the first half of 2023. The company said that early Q3 data shows that solar prices have begun to cool off, decreasing about 3.5% so far in-quarter. Prices bottomed out in the first half of 2021 at $2.67 per Watt.

Energy storage prices also increased 1% in the first half of 2023. Over 50% of solar quotes on EnergySage included a battery, a trend that continues to rise steadily. Storage in the first half of 2023 averaged $1,352 per kWh, with batteries often sized as 10 kWh in major markets.

Headwinds have hit the residential solar sector hard this year, with major public companies in the space like Sunrun, Enphase, and SolarEdge down 50% or more in 2023. Rising interest rates and sharp cuts to compensation for exporting solar, or net energy metering, have put a damper on installation rates.

“While the first half of 2023 was tumultuous at times for the solar and storage industries in the U.S., we remain optimistic: solar and storage have proven to be resilient in the past, surviving–and even excelling–irrespective of expiring tax credits and incentives, changing net metering policies, shifting tariffs, supply chain issues, and labor shortages,” said Vikram Aggarwal, chief executive officer and founder, EnergySage.

EnergySage said typical loan offerings have shifted from 2.99% interest rates in the second half of 2022 to 4.99% interest rates for a 25-year loan in the first half 2023. This leads to an average monthly cost of $30 more for a $30,000 loan.

For products, EnergySage’s most-commonly quoted solar panels were Qcells, while Enphase was the highest-quoted provider for both energy storage and inverters. Breaking into the top ten most-quoted list or gaining in significant market share were Waaree solar panels and FranklinWH batteries.

The average estimated payback period for residential solar is 8.3 years, averaging 10.4 kW. This has improved slightly from the average breakeven return on investment of 8.7 years. A typical solar array can produce local, predictable-cost, and clean energy for 20 to 30 years or more.

The five largest markets for solar averaged lower quoted prices when compared with the national median. California averaged $2.89/W, Texas $2.59/W, Florida $2.45/W, New York $3.30/W, Nevada $2.55/W.

California was the only top-ten market to have price increases on a median per W basis in the first half of 2023. California also had the nation’s smallest average quoted system size at 8.05 kW, while the median was 10.4 kW, and Arkansas had the largest median system size at 14.88 kW.

Over time, quoted panel power ratings have increased on the EnergySage market. Nine out of ten quotes in the first half 2023 included 390 W or larger panels. In the first half of 2020, nearly half the quotes on the marketplace were 330 W or less.

The report noted a steep uptick in consumers showing interest in storage in order to self-supply solar generation, suggesting that lowered net metering rates are discouraging the export of local, clean electricity. Nearly 40% of consumers reported self-supply as a reason for getting a storage quote, up from less than 20% in 2022. Backup power for outages and savings on utility rates were also listed as top reasons for including energy storage in a quote.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

When you say 10 kw, is it panel/inverter rating or average daily output

Storage prices are crazy. Based on the cost of batteries (~$110/kWh) they should be 20% of this cost (~$200/kWh) or less. Not over $1000/kWh.