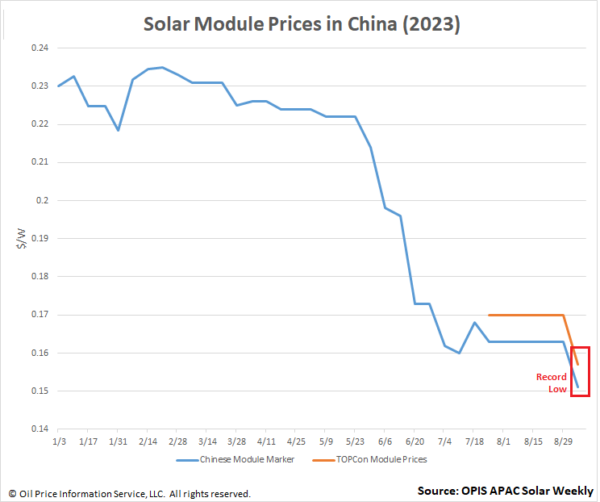

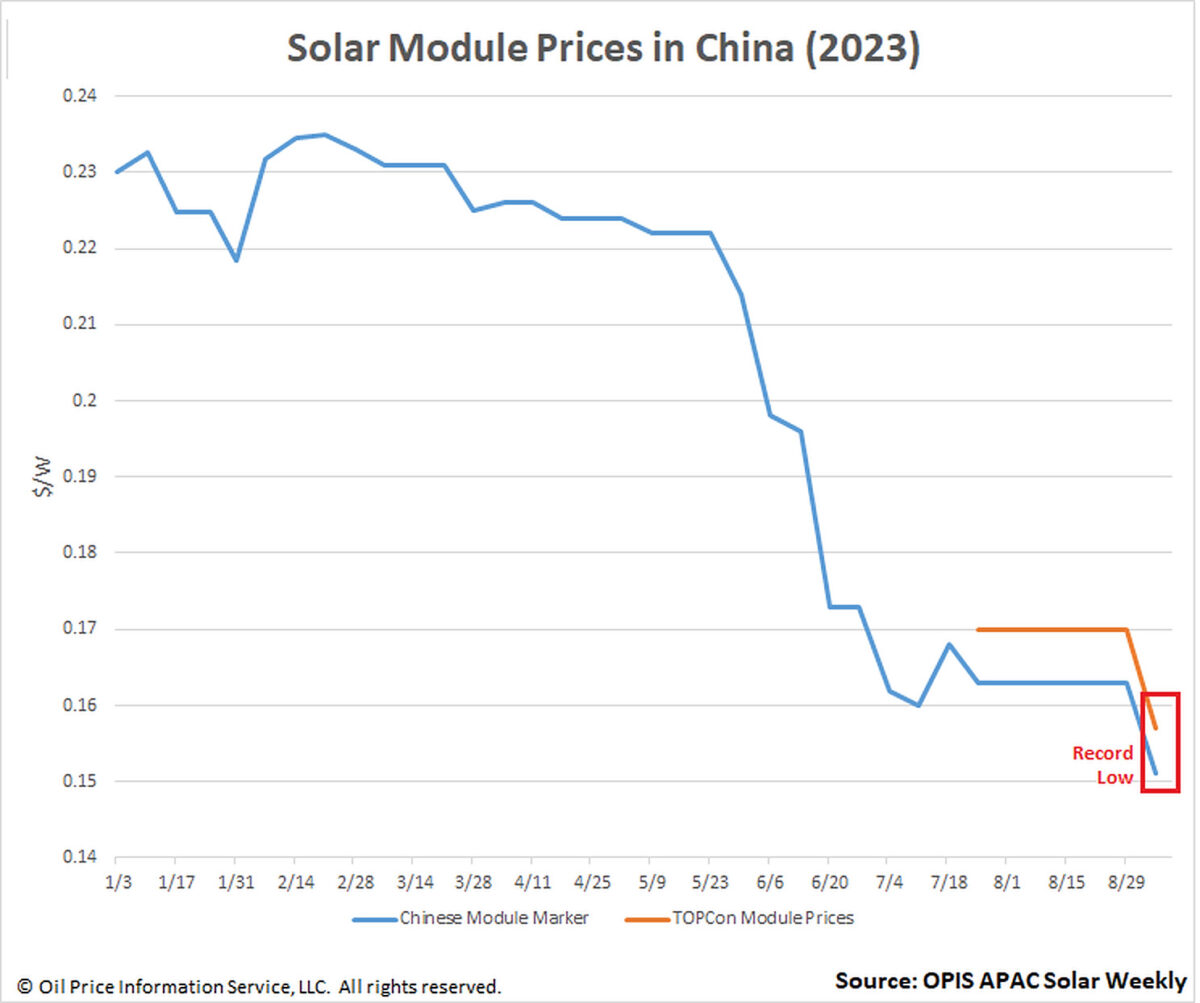

China solar module prices have fallen to their lowest values ever, as buyers and sellers alike reiterate that the module market continues to see intense competition and weakening demand, according to OPIS data.

The Chinese Module Marker (CMM), the OPIS benchmark assessment for Mono PERC modules from China, and TOPCon module prices plummeted for the first time in five weeks to $0.151/W and $0.157/W respectively this week.

The more than 7% plummet in both CMM and TOPCon prices comes as many sellers fight for market share. There are “more kids on the block who want to get their products sold and can pretty much only compete on price” with major tier-1 module makers, a solar market veteran explained.

One such major manufacturer could offer prices as low as $0.150/W for Mono PERC modules if cash is paid in advance, a source there said, while TOPCon prices as low as $0.153/W – to the disbelief of some – were reported during OPIS’ weekly market survey. Even at these low price levels, developers are not buying as they expect prices to fall even further and will only enter the market then, the source added.

“We are now entering an interesting period” shaped by, among other factors, “high inventory levels abroad,” according to an experienced market observer. Module suppliers in Europe are facing a heavy inventory burden, so much so that this is a “red sea market,” a source at a leading module manufacturer said.

Weakness is evident in other export markets, too. In Southeast Asia, a module seller at Bangkok’s ASEAN Sustainable Energy Week (ASEW) told OPIS that it saw very limited sales on the event’s first day, which is usually when transactions peak. Even as module prices dive, EPCs still face a “red ocean” as module costs still constitute 50% of a solar project’s total cost, a Thai EPC also told OPIS at ASEW. Over in Latin America, the lowest price quoted for Mono PERC modules at Brazil’s Intersolar South America was $0.130/W, a source said.

Looking ahead, the market speaks of prices gaining in the short term on the back of increasing costs for different module components. Soda ash prices, used to make photovoltaic glass, have gained significantly, noted one source, while another said the same of Ethylene Vinyl Acetate (EVA), used as the encapsulant for modules.

More broadly, however, overcapacity concerns continue to loom on the horizon and could pull prices back down eventually. “Remember, 1 CNY/W before year-end,” a market veteran warned.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

8 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.