From pv magazine Brazil

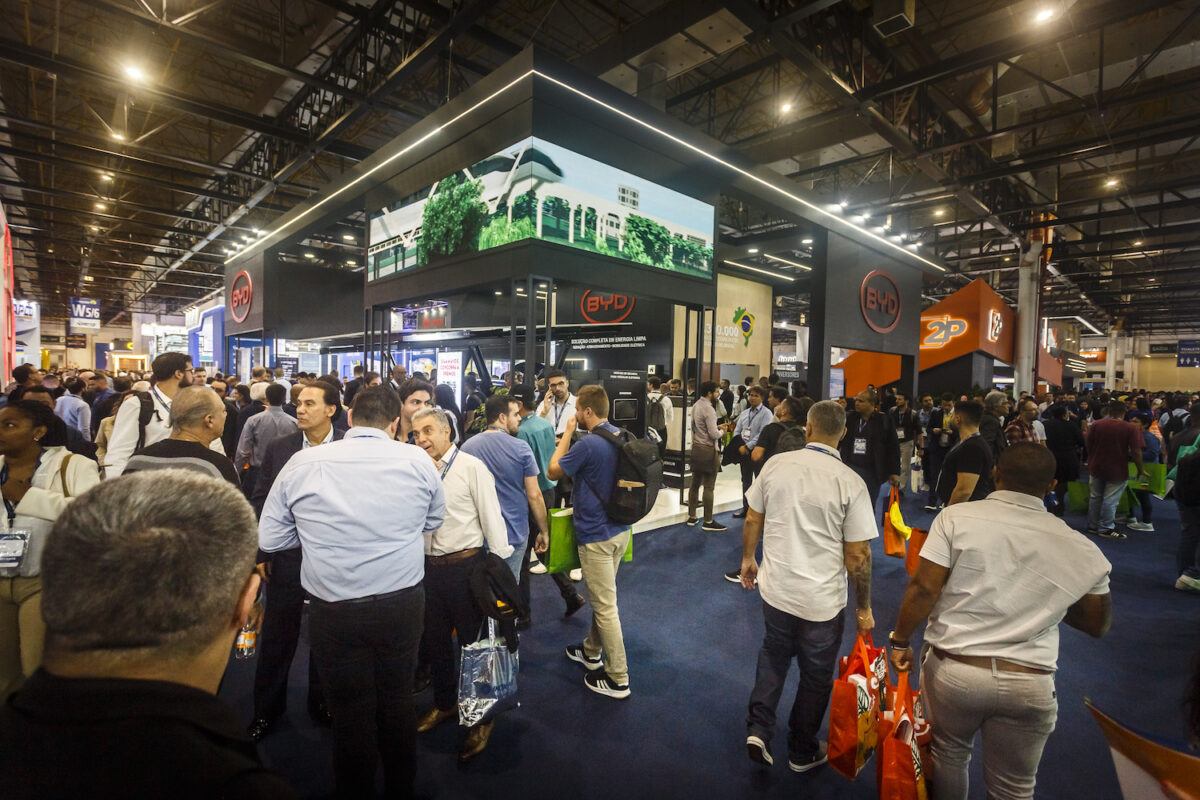

The 10th edition of Intersolar South America hosted 530 exhibitors and attracted 50,000 visitors over three days, marking substantial growth from the 2022 show, which had 400 exhibitors and 44,000 visitors.

Throughout the fair last week, there was a noticeable mix of caution and enthusiasm among participants. The Brazilian solar market is anticipated to experience limited growth in 2023, marking a departure from years of exponential expansion. Nonetheless, achieving a feat like the previous year, adding 11 GW, would still position the country as one of the world's major PV markets this year.

In 2022, a total of 8.2 GW of distributed generation and 2.5 GW of centralized generation were added. By August of this year, an additional 8 GW of solar capacity had already been installed, comprising 5.2 GW of distributed generation and 2.8 GW of centralized generation.

Sources told pv magazine that Brazil is expected to see a continuation of this level of new installations in 2024, with growth to recover in 2025. Over the long term, there is still a lot of room for the expansion of solar, which currently accounts for 15% of the national electricity mix, with more than 23.2 GW of distributed-generation PV and 10.4 GW of utility-scale capacity.

Although sales of small rooftop systems declined in the first half of the year, the market for larger distributed generation projects is heating up. Power plants exceeding 75 kW can still be connected until the start of 2024 under the previous regulation (prior to Law 14,300), which offers more favorable terms for shared generation projects involving multiple consumers.

Collective projects generally fall within this category, and while they currently represent only 2.67% of distributed-generation PV installed capacity (622 MW out of 23.2 GW), they already account for 9.88% of consumer units receiving credits (300 thousand out of 3 million). Brazilian consultancy Greener estimates that this segment has the potential to attract BRL 40 billion ($8.0 million) by the end of 2024.

Market consolidation

The smaller distributed solar generation sector, traditionally leading the Brazilian market with 18 GW of systems installed up to 74.99 kW, faces a significant challenge due to a lack of competitive financing and intense price pressure. This situation arises from the recent reduction in module costs, which has led to a surplus of inventory estimated at between 2 GW and 4 GW among equipment distributors.

Fernando Castro, JA Solar's country manager, notes that the decline in module prices, from approximately $0.25/W a year ago to $0.16/W today, has put pressure on equipment distributors who purchased modules at higher prices. They are now compelled to sell at lower costs, often resulting in negative profit margins.

This challenging scenario may trigger consolidation and a reduction in the number of distributors and integrators within the sector. To navigate this period successfully, companies will need to professionalize their operations and innovate to offer new solutions to end consumers.

Manufacturers, distributors, and companies in the sector showcased a diverse range of offerings at Intersolar, aligning with concepts like the energy ecosystem and integrated energy solutions. In addition to photovoltaic generation, they presented products such as batteries, electric vehicle chargers, and services encompassing management, monitoring, and optimization.

Although Brazil currently lacks a highly competitive business case for batteries, experts consulted by pv magazine anticipate a shift in approximately two years. Module manufacturers such as JA Solar, Canadian Solar, and Jinko Solar have already introduced storage systems, with Jinko Solar supplying batteries to three small-scale projects in the country. The rural consumer segment is expected to be an early adopter of this technology, supported by accessible credit options and the need for improved energy supply quality.

Absolar CEO Rodrigo Sauaia pointed to the significant tax burden on batteries, exceeding 80% and rendering the market unviable. He noted the potential for regulatory recognition and remuneration for ancillary services, which could incentivize broader battery adoption, enabling services like distribution network management.

Intersolar South America is also embracing these new technologies for future growth, as it announced plans for a new pavilion and a dedicated pillar for electric mobility in the 2024 edition.

“By 2024, The smarter E South America will have four pillars: solar generation, batteries and storage systems, energy management and electric mobility,” said Florian Wessendorf, the general director of Solar Promotion International. “We are going to launch Power2Drive, which will have the fair, conferences and technical workshops.”

Local manufacturing

Distributors are diversifying their offerings, including their own assembly structures and trackers, providing solar kits that can be financed through Finame, offered by the Brazilian development bank, BNDES, with imported modules.

Companies such as Fortlev, based in Espírito Santo, introduced a new ballast solar assembly structure made of polyethylene, promising a 50% reduction in construction time for ground or slab-based installations. Sou Energy, based in Ceará, showcased fixation structures made of fiberglass-reinforced polyester. MTR, a distributor specializing in systems ranging from 1 MW to 5 MW, presented their in-house manufactured fixed structures, skids, and trackers located in Juiz de Fora, Minas Gerais.

Amid discussions about the development of the local industry and which links in the chain should be prioritized for competitiveness, two new factories were announced at the fair. Trina Tracker is establishing a photovoltaic tracker factory in Salvador (BA) to expand supply options with imported modules. Livoltek, also a Chinese manufacturer, is setting up a new inverter factory in Manaus (AM).

Regarding local production, Rodrigo Sauaia, CEO of Absolar, noted the country's potential to become a manufacturing hub for the production chain, emphasizing the importance of avoiding artificial barriers and maintaining reduced import taxes.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.