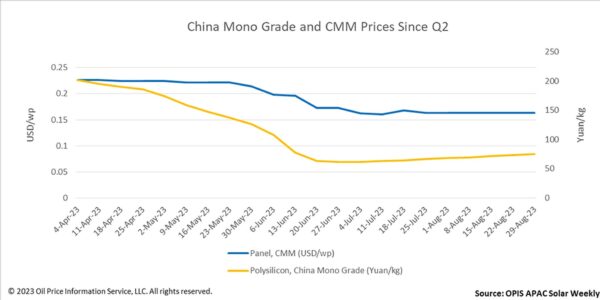

China Mono Grade, OPIS’ assessment for polysilicon in the country, extended gains for an eighth week, edging up 2.38% on-week to 75.50 CNY ($10.36)/kg.

This market continues to contend with some short-term bullish factors. The increase in polysilicon production in August was still lower than expected, “mainly due to the shortage of electricity in summer,” explained one source.

Right now, the China polysilicon market is maintaining a monthly production capacity of around 120,000 MT, “with some more polysilicon added from imports,” said a source. This is just enough for the approximately 50 GW of modules on production lines, the source added.

Moving forward, China polysilicon prices are expected to decline as oversupply issues again cloud the market. Current high module production rates cannot be maintained for long, as end-user demand will probably decline by the end of November till December, according to a source. Meanwhile, some new polysilicon players who had halted production might have it start up again in the fourth quarter, which may lead to a noticeable increase in polysilicon supply, she added.

Though this week saw China’s polysilicon and wafer segments wend upwards yet again, the Chinese Module Marker (CMM), the OPIS benchmark assessment for Mono PERC modules from China, held steady for a fifth week in a row at $0.163 per W, and the price of TOPCon modules also held steady for a fifth week running at $0.17/W.

Modules are trading sideways, concurred multiple sources during OPIS’ market survey as the market’s fundamentals remain unchanged. Upstream prices continue gaining, but it is challenging for module sellers to raise prices owing to the intense competition they face in this segment.

Moving forward, oversupply will continue to be the theme of the module market. Module prices are at their bottom and cannot fall further, with tier-2 and -3 players unable to start operations and tier-1 players keeping prices depressed as they compete with one another, one source explained. Smaller players might shut their doors: “Companies closing down are a good thing, as it means the solar market is consolidating and less efficient players have quit,” a different source said.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.