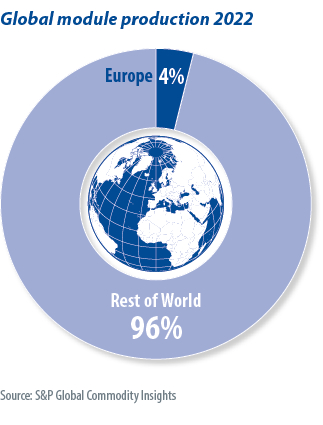

China has dominated the solar module supply chain for the last 15 years but the status quo is shifting as multiple emerging factors pose a threat to the nation’s dominant position. These include increasing scrutiny of solar supply chain sustainability and traceability along with a growing global subsidy race, with the United States, India, and European Union announcing plans to provide funding support to their own manufacturers.

A suite of policy levers has recently been used by global markets to support the growth of domestic PV manufacturing directly and indirectly, including the Inflation Reduction Act in the US and the Basic Customs Duty and Production Linked Incentive scheme in India.

At the policy level, Europe is lagging. The REpowerEU initiative sets ambitious 2030 targets for renewables but does not say much about supporting local manufacturing. The recent Net Zero Industry Act (NZIA) proposal aims to spur local manufacturing. While that is a step ahead, it could take up to two years before the European Commission approves the policy. In other words, the European Union has set very ambitious targets for renewables installations in Europe until 2030 but such targets will not automatically increase demand for products manufactured locally.

US contrast

The United States is ahead in timing and financial support so US incentives have the potential to become a risk for European manufacturing to scale up as the country is already pulling investment resources from major players. That risk increases the longer it takes to get EU policy and incentives firmed up.

To provide some context, the EU is targeting a minimum of 45% self-sufficiency across all manufacturing nodes despite the fact there is currently almost no ingot or wafer capacity to process polysilicon in Europe. It would require the building of more than 40 GW of annual ingot, wafer, and cell capacity – plus another 30 GW of module capacity – to reach these targets. To have any chance to get anywhere near this ambitious target, the European Union would need to introduce a combination of high manufacturing incentives and barriers of entry for lower-cost imports (such as its proposed carbon border adjustment mechanism to punish products with higher carbon footprints) as well as potentially setting quotas for local content in public tenders.

Cost gap

The large production cost gap between regions is the biggest challenge to overcome to spur local module supply chain manufacturing. A recent S&P Global Commodity Insights report revealed production costs in Europe could be as much as 50% higher than in mainland China – mostly thanks to higher EU power prices and labor costs.

The recent low-price module environment could become another unexpected hurdle to the reshoring of European module supply chains. High polysilicon prices have kept module costs elevated in the last two years, closing the gap between best-cost manufacturing locations in mainland China, Southeast Asia, and other regions (including Europe and the US). If the anticipated low module prices return, it will make onshoring module supply chain manufacturing increasingly challenging.

Local manufacturers could be competitive in other dimensions, however. European module production costs are higher compared with other regions but may hold advantages due to a reduced carbon intensity of the end products. This sustainability dimension will be particularly relevant given the current trend to tax imported materials and components with higher carbon footprints. European governments could also set quotas for locally-made, low-carbon content in public tenders – the current NZIA proposal includes a clause related to carbon footprint and equipment origin for public tenders plus a 15% to 20% sustainability and resilience weight-scoring system.

pv magazine print edition

Another dimension where EU manufacturers can be competitive concerns technology. There are opportunities for EU manufacturers to lead the development of new technology such as perovskites or new wafer technologies with lower cost production methods and higher efficiencies. Partnerships have emerged in several European markets aiming to commercialize next-generation cells and modules based on silicon-perovskite tandem technology. These ongoing research partnerships could promote European technological leadership across emerging cell and wafer technology, enabling a lower levelized cost of energy and reduced supply-chain risk.

Despite all the policy uncertainty, there were around 20 GW of module manufacturing capacity announcements in Europe to May plus a surge of new announcements in the last few weeks. These figures show evidence of new manufacturing activity in markets including Romania, Germany, France, and Italy. Even if all these announcements come online, however, Europe would still be highly dependent on imported cells from mainland China or Southeast Asian countries.

Recent discussions at the Intersolar Europe exhibition confirmed this view. Few among the main industry stakeholders (developers, utilities, investors, supply-chain companies) expect any major reshoring of module supply chain capacity in the next few years. The general industry view is that the European Union will prioritize the achievement of ambitious renewables deployment targets to 2030, ahead of reshoring-manufacturing ambitions that would make the energy transition more expensive.

About the author: Edurne Zoco is an executive director in the Clean Energy Technology group at S&P Commodity Insights. She leads research across solar PV, supply chains, and carbon sequestration. She has been involved in the PV industry for more than a decade and has written cost-breakdown models, company benchmarking reports, price forecasts, supply chain analysis, and technology outlooks. She has presented at major industry events and conferences since 2007 and her commentary and analysis appear regularly in industry reports and mainstream media outlets. Zoco holds a PhD from the University of Notre Dame in the US.

About the author: Edurne Zoco is an executive director in the Clean Energy Technology group at S&P Commodity Insights. She leads research across solar PV, supply chains, and carbon sequestration. She has been involved in the PV industry for more than a decade and has written cost-breakdown models, company benchmarking reports, price forecasts, supply chain analysis, and technology outlooks. She has presented at major industry events and conferences since 2007 and her commentary and analysis appear regularly in industry reports and mainstream media outlets. Zoco holds a PhD from the University of Notre Dame in the US.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.