Energy communities have the potential to incentivize investment in clean technologies, coordinate groups of prosumers, and reduce their energy bills. However, there are challenges on both the operational and economic levels that need to be addressed to promote different energy community models.

Researchers at the University Carlos III of Madrid have modeled the operation of an energy community with renewables and storage under different technical and economic conditions and analyzed the impact of new hydrogen production and storage technologies on community operation and risk management.

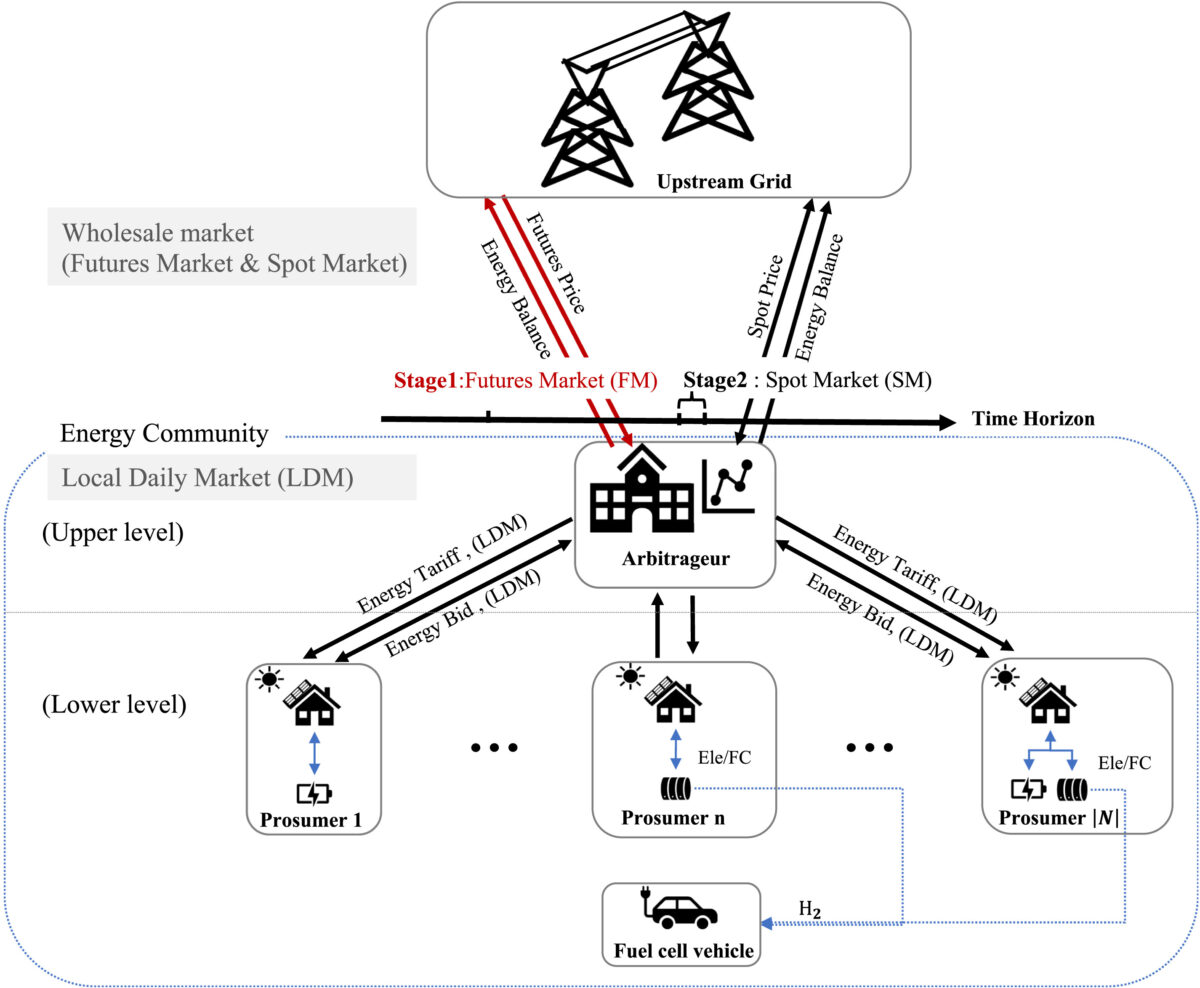

They studied how community management can be directly undertaken by an arbitrageur that, making use of an adequate price-based demand response (real-time pricing) system, serves as an intermediary with the central electricity market to coordinate different types of prosumers under risk aversion.

Their results indicated that the optimal involvement in futures and spot markets is highly conditioned by the community’s risk aversion and self-sufficiency levels. They also found that the external hydrogen market has a direct effect on the community’s internal price-tariff system, and depending on the market conditions, may worsen the utility of individual prosumers.

“We show how an arbitrageur can effectively coordinate the operation of several prosumers and manage uncertainty by participating in two-stage wholesale markets and by setting an adequate demand response program,” the researchers wrote in “Risk management of energy communities with hydrogen production and storage technologies,” which was recently published in Applied Energy.

The arbitrageur hedges its risk by allocating an adequate trading amount in the futures market and by charging the prosumers with a real-time pricing mechanism when the spot market trading takes place.

“Regarding the risk trading part, we can observe that the higher the self-sufficiency level of the energy community, the lower the impact of potential unfavorable scenarios,” said the researchers.

They have also observed how high-risk aversion levels may decrease forward trading in periods with low renewable generation while increase forward trading in periods with high renewable generation. Moreover, they found that the battery storage system could effectively assist in load shifting for the prosumers, reducing their operating costs and benefiting the entire community. Meanwhile, an external hydrogen market could help prosumers to bring in additional profits, while also managing cost volatility.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

4 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.