From pv magazine USA

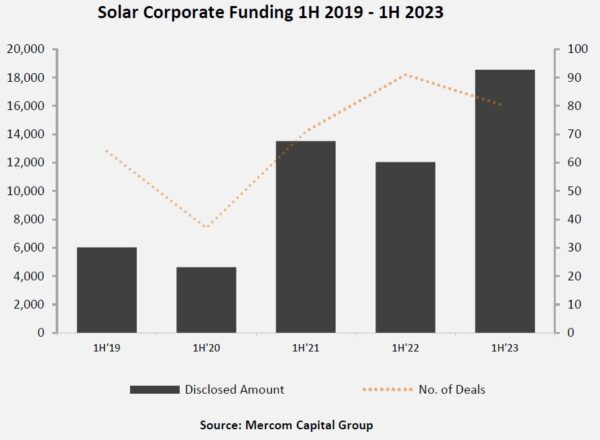

Mercom Capital Group’s “Solar Funding and M&A, 2023 First Half Report” finds healthy financial activity in the solar sector in the first half of 2023. And while the number of deals went down, total funding went up.

Total corporate funding – including venture capital funding, public market, and debt financing – rose 54% year over year, from $12 billion raised in the first half of 2022. The number of deals dropped from 91 in the same period last year to 80 in the first half of this year, down 12%.

“Even amidst the tightening financial market conditions and high interest rates, the solar industry remained strong in the first half of the year. Besides AI, cleantech is one of the few sectors still attracting venture capital interest,” said Raj Prabhu, CEO of Mercom Capital Group. “Demand due to the Inflation Reduction Act (IRA) is so strong that even interest rate-sensitive public market and debt financing in solar was up year over year. The lack of easy money, however, affected M&A activity negatively.”

Global venture capital funding rose 3% year over year, with 33 deals worth $3.8 billion, compared to 53 deals in the same period of 2022, worth $3.7 billion.

Top five venture capital deals:

- 1KOMMAS, $471 million

- Silicon Ranch, $375 million

- CleanMax Solar, $360 million

- Amarenco, $325 million

- Amp Energy India, $250 million

To continue reading, please visit our pv magazine USA website.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.