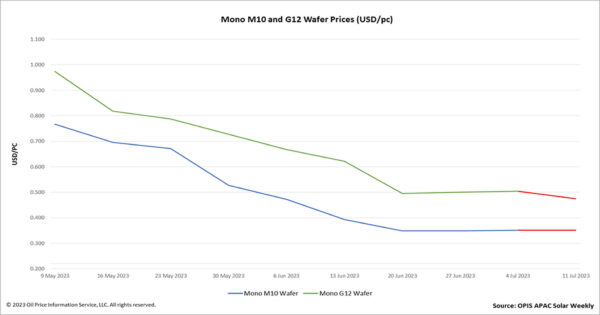

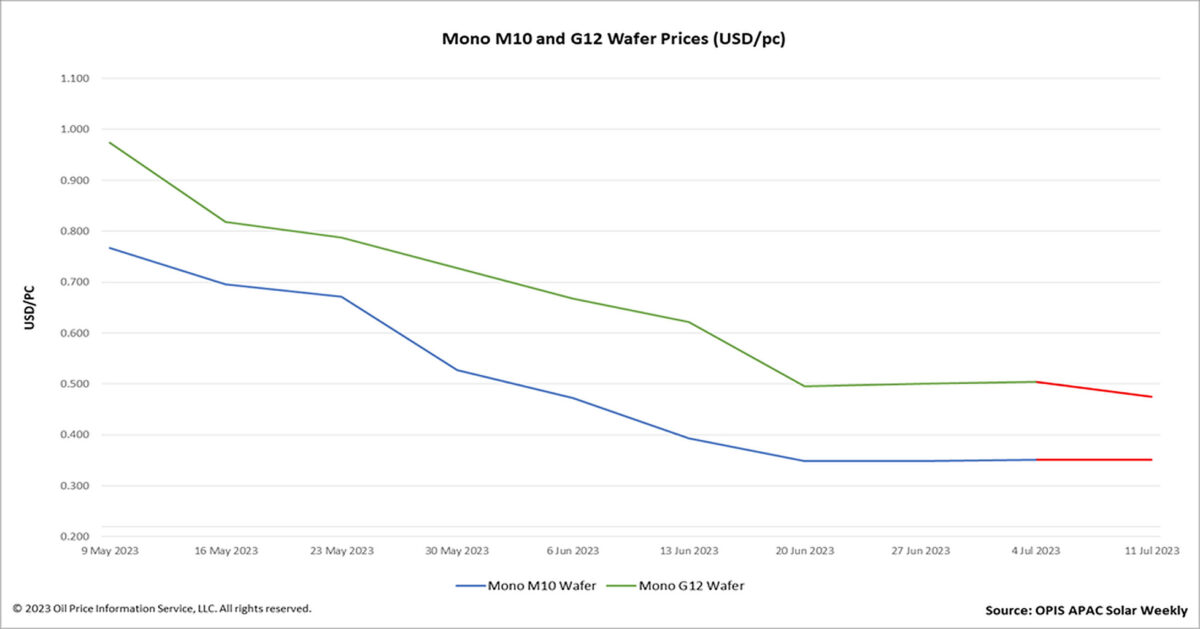

This week, the Mono M10 wafers trended flat after last week’s price notch upwards, reporting in at $0.351 per piece (pc). Several sources verified this week that the price of Mono M10 wafers has grown to the level reported by OPIS last week, which is approximately CNY2.85 ($0.40)/pc.

One of the factors contributing to the price increase is the decrease in wafer stockpiles, with some inventory shifting to cell producers’ plants. Cell makers have increased wafer purchases in the previous few weeks when wafer prices were low. Fewer than 1 billion pieces of wafers are currently stockpiled at wafer facilities, equivalent to three to five days’ worth of production and regarded as a low inventory level, according to a source from a large wafer manufacturer.

Additionally, manufacturers are trying to recover profit now by boosting prices as the year’s second half starts, and so improve this period’s financial report, a source explained.

On the other hand, the prices of Mono G12 wafers saw a week-on-week fall of 5.75% to $0.475/pc, marking their lowest point of the year, according to OPIS' assessment.

According to a source from the wafer segment, the price reduction of Mono G12 wafers appears to be a pricing strategy rather than a price adjustment in response to supply and demand in the market. The price of G12 wafers per W must be comparable to or even lower than the price of M10 wafers per Watt if manufacturers are to emphasize the cost advantage of G12 wafers and grow G12’s market share.

While polysilicon prices are low, wafer manufacturers have accelerated their purchases of the material and raised operating rates, with the typical operating rate of wafer businesses having climbed to 80–100%, several sources claimed.

According to a source, overall wafer output is anticipated to reach 52 GW in July based on an average operating rate of 85%, representing a month-on-month growth of roughly 15%. Another source claimed that since at least two major wafer producers will release new capacity in the second half of this year, wafer market fundamentals will remain dominated by oversupply in the near future.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.