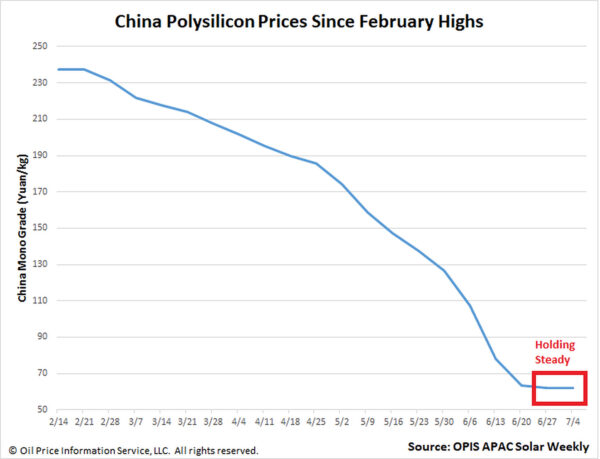

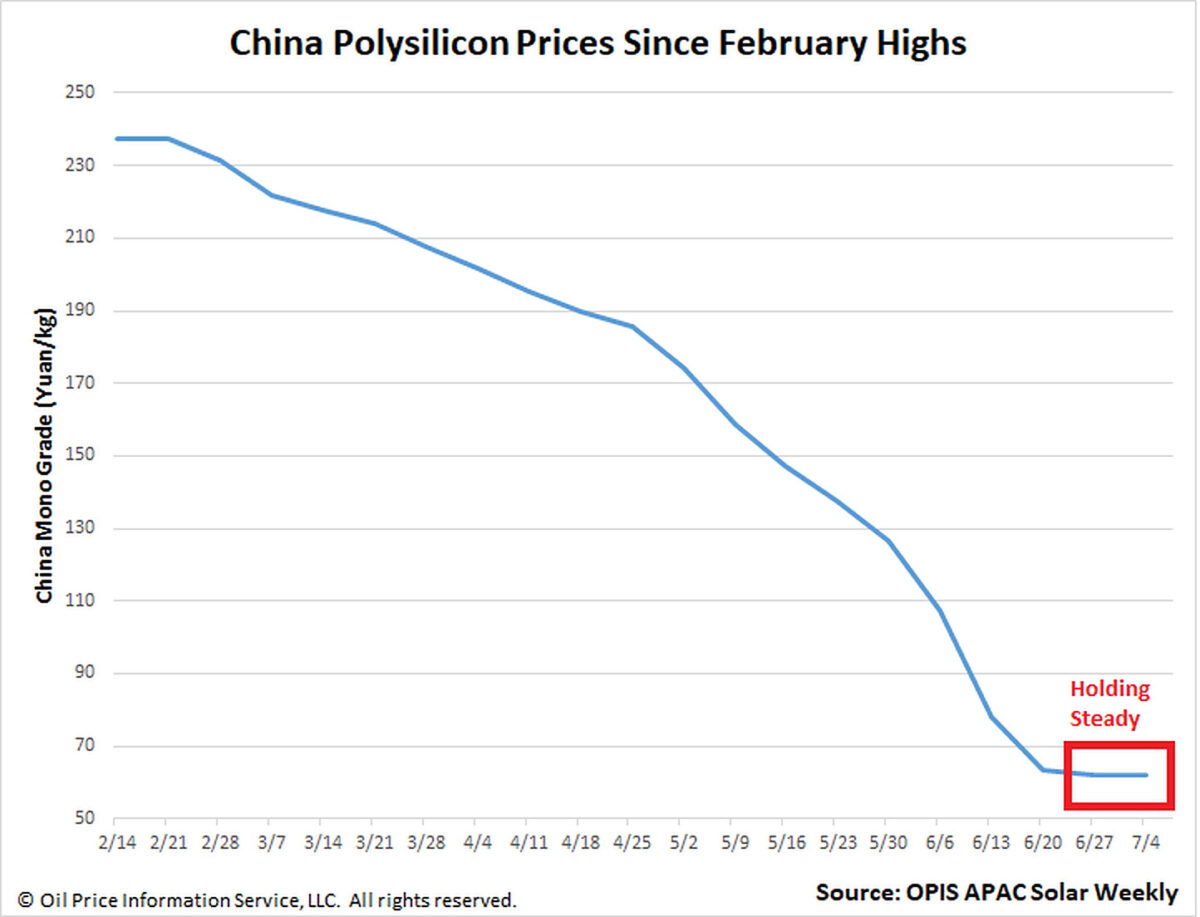

China Mono Grade, the OPIS assessment for polysilicon prices in the country, held steady at CNY62 ($8.56)/kg on July 4. What looks like a moment of calm – arresting almost six months of successive, sometimes-dramatic downslides – reflects a market busily assessing what happens next.

Industry players diverged on where they saw prices heading after an important polysilicon conference in China last week, with bearishness as the predominant mood. Low values around the CNY60/kg mark, generally regarded as China polysilicon’s cost figure, continued to be the majority of figures revealed during OPIS’ market survey early this week, although talk of a price rebound has emerged.

A source who saw polysilicon climb to CNY67/kg read the lower prices of the prior two weeks as manufacturers are clearing inventories before the second quarter ended. One polysilicon maker’s inventory, estimated at 10,000 MT last week, was said to have halved by the week’s end. Power cuts have affected the operating rates of monocrystalline plants, a source said, noting cuts in Baotou, Inner Mongolia, and claiming the same in Leshan, Sichuan.

Discussions of price upticks even extended downstream. Wafer prices have found their bottom, concurred most market participants, and the wafer segment is starting to signal possible notches up to come. Numerous sources confirmed to OPIS that limited new wafer capacity will come online in the second half of 2023, potentially keeping more than 140 GW of annual nameplate capacity off the market, according to OPIS data.

Chatter aside, the specter of oversupply continues to loom over the China polysilicon market. “It is obvious that polysilicon is in excess,” one contact reiterated, while another said that overall “stockpiles are very large.” A major producer’s new June capacity of around 120,000 MT has been delayed, but only till the third quarter.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.