From pv magazine 06/23

It can feel like old news to talk about 2022 halfway through 2023 but the impact of the most pivotal year for energy markets in decades will be felt through 2030. The European Commission doubled down on solar targets to cut Russian natural gas under its REPowerEU plan, targeting 415 GW of total solar by 2025, and up to 750 GW this decade. The scale of ambition is unprecedented: Europe wants to triple its capacity in eight years. Decarbonization is imperative and energy security has also come to the fore, under the EU Solar Strategy.

On the regulatory front, taxes and caps on member-state energy company windfall profits have increased risk premiums, particularly for merchant solar and power purchase agreement (PPA)-backed projects, with further extensions likely to slow buildout.

With electricity bills rising an average 38% in the euro area in the last 18 months, distributed solar’s annual capacity growth shattered records last year. Residential installations hit almost 15 GW across major EU markets while commercial and industrial additions rose to 13 GW.

Corporate PPAs

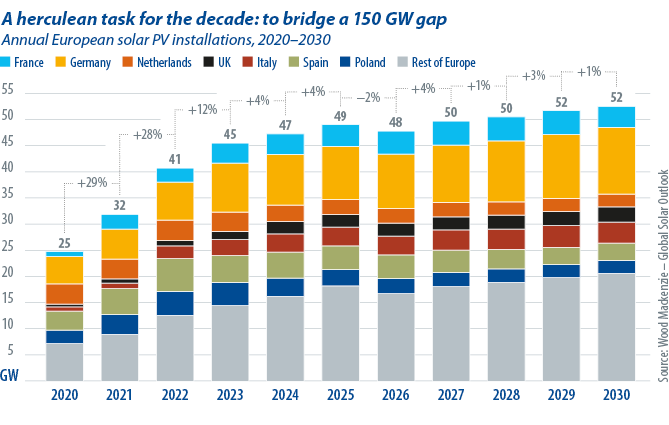

Wood Mackenzie’s base case scenario sees Europe adding almost 400 GW of solar to 2030, meaning the EU will fall short of its target by nearly 150 GW – with today’s cumulative capacity at around 200 GW. The only way to bridge that gap is to tackle grid, permitting, and supply chain constraints.

Corporate PPAs will drive utility scale solar as tightening environmental, social, and corporate governance (ESG) requirements and structurally higher electricity costs incentivize business take-up. Spain remains Europe’s largest PPA market but volumes are accelerating in Germany, France, and Poland.

Local opposition and permitting processes will continue to slow growth, particularly in Italy, and grid issues are acute in the Netherlands, where congestion management has been used in recent years.

REPowerEU is betting on rooftop solar because of its modular nature and the continent’s vast, untapped potential. The European Solar Rooftop Initiative targets 52 GW to 58 GW more capacity by 2025 in its conservative scenario. This is an ambitious but achievable objective amid structurally higher retail electricity rates and a return to a downward trajectory in component costs. We predict distributed-solar’s levelized cost of energy (LCOE) will decline almost 30%, on average, this decade.

Rooftop settings

With net metering being replaced by less generous compensation for prosumer electricity grid exports, the European Commission’s toolbox to maximize rooftop PV relies on building mandates which will kick in from 2026 to 2028 and will also back energy communities. It is unclear how many member states will apply mandates, what exemptions will be granted, and whether additional capital expenditure subsidies or tax incentives will help rollout.

Regardless, household solar will keep pace to 2030 and the sector must attract low- and-medium-income customers and collective systems for apartments. Energy communities will help democratize residential solar.

Upfront expense will remain the biggest entry barrier for households. Third-party, subscription-based ownership models could relieve financial constraints and alleviate technology risks associated with subpar installations.

Heating and transport electrification will gain steam by 2025. Heat pump and domestic electric vehicle (EV) charging stations will further push residential solar. As home loads climb so will electricity costs, strengthening rooftop PV.

Upfront cost will again be a hurdle so heat pumps and EV chargers will require subsidies and interest-free finance as well as bans on natural gas heaters and internal combustion engine vehicles.

Along with home energy storage solutions, heating and transportation electrification will help harmonize home energy consumption and peak generation profiles, providing grid flexibility. This will be an invaluable benefit as governments phase out compensation for surplus-electricity grid exports. The case for maximizing self-consumption will only grow.

On the commercial solar front, the 2026-27 rooftop mandates for commercial buildings will be major drivers for growth; along with volatility in retail electricity rates, and improvements in installation and operational cost efficiencies.

Prices critical

Supply chain volatility poses a significant downside risk to increased solar buildout across segments. Equipment cost inflation since 2020 has already led to project cancellations and auction undersubscription all over Europe, as ceiling bid prices remain low compared to LCOE levels and corporate PPA prices.

However, PV component prices have started to come down and will continue to fall as supply and demand stabilize. But this story of generalized cost declines could look different if the European Commission achieves its objective of enforcing uptake of domestically manufactured equipment for public auction tenders, increasing costs for developers.

This localization strategy is in part a response to the Inflation Reduction Act in the United States but is also a push to diversify Europe’s PV technology supply away from China, in an environment of heightened geopolitical tension. If these efforts solidify, and are complemented by local content requirement policies, we could see PV component prices soar anywhere between 10% and 40%. That will depend on how much the EU enforces reshoring of the overall PV manufacturing supply chain.

About the authors: Juan Monge is a principal analyst on Wood Mackenzie’s power and renewables team, covering distributed solar market developments across Europe. Prior to his current role, Monge was a senior conference content manager, leading content development for Wood Mackenzie/Greentech Media’s energy transition conference portfolio in collaboration with WoodMac research practice heads.

About the authors: Juan Monge is a principal analyst on Wood Mackenzie’s power and renewables team, covering distributed solar market developments across Europe. Prior to his current role, Monge was a senior conference content manager, leading content development for Wood Mackenzie/Greentech Media’s energy transition conference portfolio in collaboration with WoodMac research practice heads.

Daniel Tipping is a solar analyst in the energy transition practice at Wood Mackenzie, focusing on European PV markets and PPA trends. Prior to joining WoodMac, Tipping worked as an offshore energy analyst for a consulting firm in London where he also helped forecast wind turbine vessel dynamics. He graduated from the University of Bristol with a master’s degree in civil engineering, specializing in solar and renewable energy technology.

Daniel Tipping is a solar analyst in the energy transition practice at Wood Mackenzie, focusing on European PV markets and PPA trends. Prior to joining WoodMac, Tipping worked as an offshore energy analyst for a consulting firm in London where he also helped forecast wind turbine vessel dynamics. He graduated from the University of Bristol with a master’s degree in civil engineering, specializing in solar and renewable energy technology.

This copy was amended on 31/05/23 to indicate the European Solar Rooftop Initiative aims for 52 GW to 58 GW of new generation capacity rather than the “almost 60 GW” stated in our print edition.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Solar panels in 2023 will not be the same as solar panels in 2030. The one sin 2030 could be 1/2 or less the price they are now, and 50% (from 22% to 33%) more powerful. Those figures for installs may well, be, and hopefully will be, way too conservative.