Global solar PV manufacturing capacity is set to nearly double next year, reaching almost 1 TW, according to the IEA. This expansion would be sufficient to meet the agency's annual net zero demand for 2050, which anticipates PV deployment of nearly 650 GW in 2030 and almost 310 GW in 2024. However, the industry is grappling with the challenge of oversupply.

In 2022, global PV manufacturing capacity increased by more than 70% to nearly 450 GW, with China accounting for more than 95% of new additions across the supply chain. In 2023 and 2024, global PV manufacturing capacity is expected to double, with China again accounting for more than 90% of the increase.

Chinese manufacturers are investing in expanding wafer, cell, and module manufacturing in Southeast Asia. Additionally, manufacturing plants are expected to be deployed in India and the United States due to new industrial policies introduced last year.

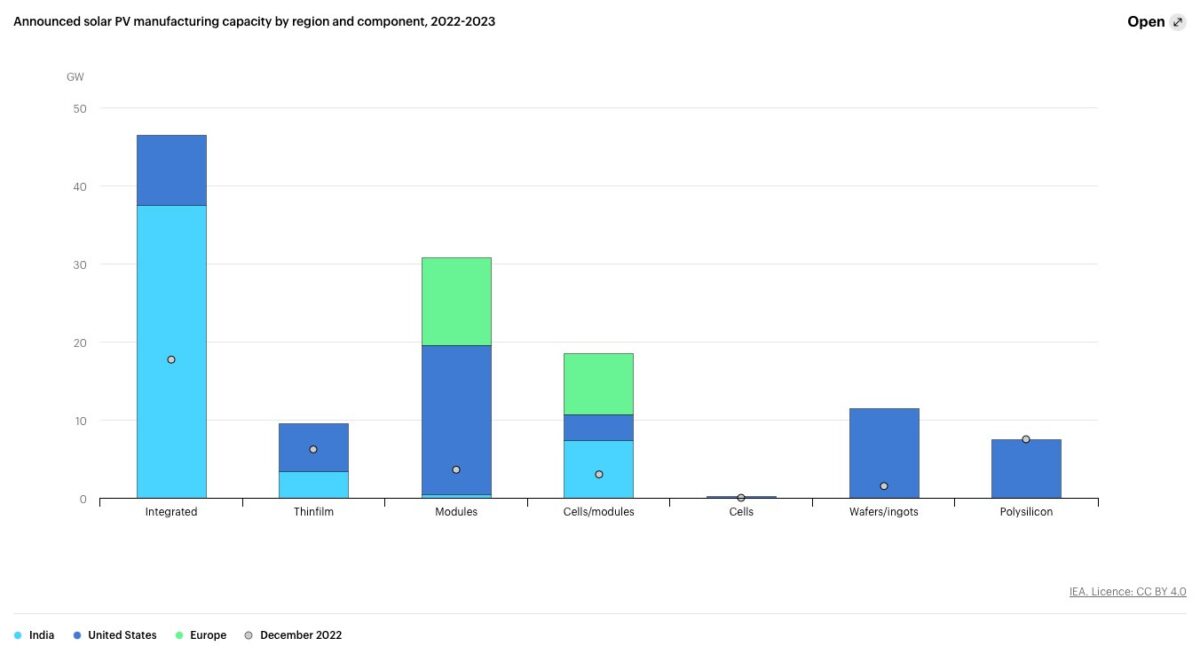

India's production-linked incentive (PLI) scheme and the US Inflation Reduction Act (IRA) have led to a surge in new solar manufacturing projects. Between November 2022 and May 2023, more than 120% of such projects were announced, potentially creating national supply chains with more than 20 GW of capacity in each region.

In Europe, new manufacturing capacity accounts for just 14% of the announced projects since August 2022. The EU Green Deal Industrial Plan and the Net-Zero Industry Act aim for Europe to produce 40% of its PV targets by 2030, but specific incentives are not currently included. High prices of industrial energy have also increased the cost of manufacturing solar PV equipment in EU countries.

“Without a manufacturing policy or domestic content premiums, solar PV manufacturing in the European Union is less competitive than in India or the United States,” said the IEA.

In Europe, less than 1% of manufacturing capacity is dedicated to new cells, while ingots and wafers account for 9%, and polysilicon production is at only 6%. Integrated manufacturing facilities produce three or more components, but nearly 80% of their announced capacity excludes dedicated polysilicon production. Additionally, the capacity of new module assembly plants, which is almost 30 GW, does not align with the announced capacity for other components, particularly cells and polysilicon. As a result, these new plants will still need to import cells and other components from China.

The combined new solar PV manufacturing announcements in India, the United States, and Europe amount to 30 GW for polysilicon and 100 GW for module assembly.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

These Wesyern Experts better be prepated to “bite dust” as their projections OF PV Panel needs will turn out to totally wrong..

China is the ONLY NATION that appears to stand a chance in ushering inna ZERO POLLUTION CHINA by 2050… that will require 15TW of PV Panels generating 18,000 TWh/yr by 2050.. and will be ably supported by their 400+GW PV Industry today.. and growing annually too..

Countries like USA, India that also need a similar sized PV Panel Industry.. will just watch as Imports (mostly from China) fill the gap.. thanks to Organizations like IEA, GOI, DOE, etc. miscalculations…. based on their myopic vision of a future filled with Polluting Fuels, PreMature Deaths & Suffering due to Pollution.

There is still time to wake up, take charge and gallop ahead by first determining the needs of a Zero Pollution Earth… and then .. DO IT..!!!

Today, it appears that only China seems to have seen “this light.. path.. future”.. so far.. and are “leaving the pack”… way way behind.. !!! .