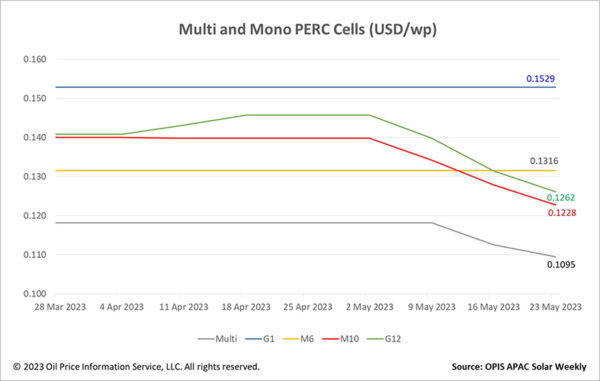

Cell prices slipped for a third consecutive week as a result of persistent upstream price reductions. On May 23, OPIS assessed the market’s mainstream options, Mono M10 cells at $0.1228 per W and Mono G12 cells at $0.1262/W. Prices of both cell sizes sustained an average 4% drop week on week.

Prices of Mono G1 and M6 cells remain unchanged on-week at $0.1529/W and $0.1316/W respectively; very few transactions around Mono G1 and M6 cells have been reported in the market. Multi cell prices, however, dropped 2.75% to $0.1095/W this week with a source from a major Multi cell manufacturer explaining that the price is expected to drop further due to the significant price cuts in upstream materials.

Although prices along the PV value chain are currently falling, a market participant disclosed that cell prices are expected to stabilize in the coming weeks due to the limited expansion in the production output of p-type cells. Despite this anticipation, cell manufacturers are still maintaining high operating rates on their lines since the market inventory in the cell segment is still at a manageable level.

According to a source at a leading Tier-1 cell manufacturer, they have switched a big part of their production lines from M10 cells to G12 cells due to the high demand for G12 cells which has also resulted in the wider price difference between Mono G12 and M10 cells. The current 20-80 ratio of market share between n-type TOPCon and p-type cells are expected to level off to 50-50 by the middle of 2024, the source expounded further.

Moving forward, cell price trends are expected to mirror upstream prices, but with smaller and gradual drops.

Meanwhile, market players downstream confirmed that module prices remain unchanged this week despite upstream price movements. Like his peers, a source at a leading Tier-1 manufacturer declared that they have no announcements of pricing until after SNEC, suggesting that deals struck between industry players during the trade show will “shift pricing”.

OPIS, a Dow Jones company, provides energy prices, news, data and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.