Researchers at Sweden's Luleå University of Technology have developed Flexcon, a contract-based power flexibility trading system between variable renewable energy producers (VREPs) and electricity retailers (RET). Flexcon aims to provide an alternative to the day-ahead market (DAM) and balancing market (BLM) for VREPs, who face penalties for system imbalances caused by the intermittent nature of their supply.

“Comparing the DAM price and BLM price, the lower price is applied when the VREP wants to sell its surplus of energy in the BLM, and the higher price is used when it wants to buy its shortage of energy in the BLM stage,” the Swedish group explained, noting that the dual-price imbalance system gives an incentive to VREPs to bid as accurately as possible.

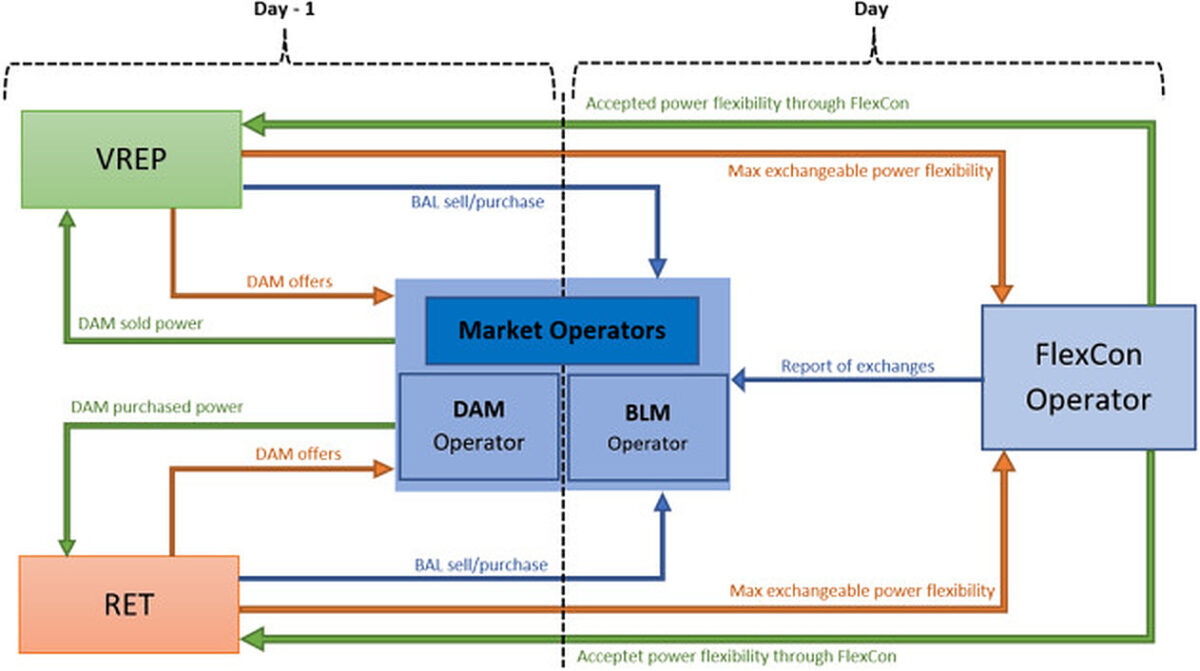

The proposed contract allows VREPs and RETs to sell their power flexibility through a short-term bilateral approach facilitated by the Flexcon operator. Both parties provide their maximum exchangeable power flexibility, and VREPs can include their imbalances as a power flexibility source within the contract, priced between DAM and BLM prices. The Flexcon operator then determines the final price.

“The offer from VREP is considered a decision parameter in the RET’s decision-making problem,” they said, claiming that the bid from the RET is also a decision parameter from the VREP. “When it is negative, it means the VREP is willing to sell and when it is positive, it states that the VREP is willing to purchase.”

Based on multiple case studies, the researchers discovered that the proposed contract could potentially raise the expected profit of participants. VREPs may experience up to a 4.8% increase, while RETs could see a 7.15% increase.

“The effect of FlexCon on the parties’ profit is higher when the difference between the DAM price and the BLM price is higher,” they said. “The effect of FlexCon on the parties’ profit is higher when the uncertainty of maximum exchangeable power flexibility is higher.”

The researchers presented their findings in “A contract-based trading of power flexibility between a variable renewable energy producer and an electricity retailer,” which was recently published in Sustainable Energy, Grids and Networks.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Sticking plaster stuff. All new RES (& indeed existing) should be sold onto the market @ the auction strike price (working on the basis that most RES projects are built on that basis). Real-time system balancing is then accomplished by the TSO using whatever assets are available (probably a combo of batts and dispatchable assets – which would be hydro in the case of Sweden).

Fact of the matter is, the old marginal pricing system is a dead duck – but for a range of reasons including blindness and/or religion (marginal pricing like all belief systems has its adherents/believers – who daily chant “our market which art in heaven” etc.)