Turkish solar industry insiders say the nation boasts more than 60 module makers. Murat Guven, founder and CEO of Kaangokay, an independent PV manufacturing consultancy, charts 72 companies which are either active or qualify for “investment incentives” but “may cancel them or delay … investment.”

The picture offers stark contrast with a solar industry that numbered a handful of, mostly small-scale, operators between 2018 and 2020.

“We have very nice regulations now,” says Tolga Murat Özdemir, vice-president of GENSED (Güneş Enerjisi Sanayicileri ve Endüstrisi Derneği, the Turkish solar industry association) and CEO of Kontek, an engineering, procurement, and construction services business based in Izmir. Citing the net metering rules driving demand, Özdemir adds: “For 10 years we have been suffering but we have worked hard to have good rules [for solar] in place.”

The regulation in question makes for an attractive economic environment for commercial and industrial (C&I) solar, in particular, and fertile turf for domestic manufacturers. Chinese modules are prohibited in Turkey, under strict anti-dumping rules, and C&I arrays featuring domestic modules can attract tax incentives of 30% or 40%. An additional protectionist measure sees imported, non-Chinese modules attract tariffs – interestingly based on panel weight – of up to $95 per panel.

As a result, standard Turkish mono-PERC (passivated emitter rear contact) modules can cost $0.40 per watt of generation capacity to $0.43/W, compared to $0.22/W to $0.25/W in China and the rest of Europe.

Robust demand

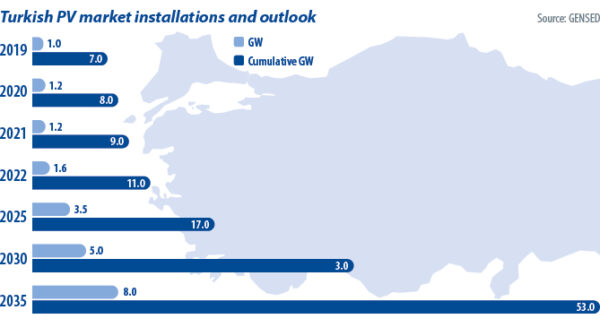

Nevertheless, the Turkish market is flourishing, if not thriving. While government installation figures require some deciphering, GENSED chief Özdemir says around 2.5 GW of solar was installed in 2022. “It will be not less than 3 GW next year,” he adds.

Others are less optimistic and place the 2022 figure at 1.5 GW but it is clear Turkey’s industrial base is turning to solar to reduce power bills. The country remains largely dependent on energy imports and big industrial consumers have sought to reduce outgoings. The 30% to 40% tax incentive available when domestic modules are used and the net metering tariff structure make C&I solar attractive. The ability to “wheel” off-site PV arrays via the grid and using net metering, is an additional kicker for companies with less solar-suitable rooftops or in higher-cost regions.

Enter more manufacturers

Turkey’s solar manufacturing sector has responded to the strong C&I conditions, high prices, and domestic-production tax incentives. PV module making and, to a lesser extent, cell production, is booming in Anatolia.

That manufacturing expansion was in full view at the Solarex trade show in Istanbul in April. There was a dazzling array of exhibition booths from new Turkish module makers. With panel prices relatively high, and incentives in place, large Turkish industrial companies are establishing module production lines to supply their own C&I projects.

“We do see a noticeable growth in the production segment,” says Kaangokay founder and CEO Guven. “The main reason for this is that panel prices were, artificially, kept very high in Turkey, especially at the end of 2021 and throughout 2022. Some Turkish textile manufacturers, who are aware of sales and global market costs and are especially concerned about border carbon adjustments, have decided to become panel manufacturers themselves rather than pay these high profit margins to producers.”

Evidence of those high margins is contained in some Turkish manufacturer disclosures. Antalya-based CW Enerji has been producing solar modules since 2010 and proudly claims to be the country’s “408th-largest company” based on sales – as tracked by the Istanbul Chamber of Industry and Commerce.

Alongside module production, CW Enerji is engaged in the entire PV project development supply chain, from investment through to operation and maintenance, and is planning to list publicly. “In its IPO documents, it can be seen that the company sold modules with a 19% net profit margin in 2022,” says Guven. This is compared to margins of 5.7% in 2020 and 0.3% in 2021. Guven estimates CW Enerji’s current production output is just shy of 900 MW.

Upstream expansion

At present, the bulk of solar manufacturing in Turkey remains module assembly. Given the strong demand, larger and more established producers have upgraded facilities to the latest technologies: M10 cell formats, dual glass encapsulation, large modules, and multi-busbar interconnection, for example. They are also adopting negatively-doped, n-type cells, namely TOPCon (tunnel oxide passivated contact) devices – enabled by policy vagary that permits the import of PV cells from China with limited trade barriers.

There is some cell production capacity in Turkey, most prominently the Kalyon facility outside the capital Ankara – which also features ingot and wafer production. Istanbul-based Smart Solar Technologies is understood to be pursuing expansion into cell production although some cell manufacturing equipment providers have reported progress has been slow.

China’s HT-SAAE has the longest track record of cell production in Turkey, with an annual manufacturing capacity of some 800 MW. However, as its production is located in the “Istanbul Free Trade Zone,” it is deemed outside the Turkish customs zone and operates on an export-only basis. The company currently produces cells and modules in its facility for export, free of trade restrictions, to the US market. It supplies Europe, not including Turkey, from its Chinese factories.

Vertically integrated manufacturer Kalyon, having recently achieved UL certification for its modules, reports that it has achieved its first 25 MW sale to the US and is also looking to increase overseas sales. Kalyon acknowledges, however, that “such low prices” present in Europe remain a hurdle. The company has started its “phase three” manufacturing expansion plan, under which it plans to add around 900 MW of TOPCon cell capacity – bringing its total cell output to 2 GW. Not all of those lines will be served by Kalyon’s in-house ingot and wafer production.

“Turkey’s solar export level, excluding free zone exports, is around $14 million – with the vast majority of these exports going to Syria,” says Kaangokay’s Guven.

Equipment supply

Given the strong demand for upgrades and expansion, China’s PV module manufacturing equipment providers are doing brisk business in Turkey. As the table below indicates, established solar manufacturers in the country are working almost exclusively with Chinese line integrators, including Jinchen, SC-Solar, and Confirmware.

Top 15 active PV module manufacturers in Turkey, 2023

| Brand | 2023 estimated output (MW)* | Year of factory establishment | Primary equipment supplier (module) | Investment location |

|---|---|---|---|---|

| HT-SAAE | 1,200 | 2016 | Jinchen | İstanbul (Free Trade Zone) |

| Schmid-Pekintaş | 1,200 | 2013 | SC-Solar | Düzce |

| Kalyon PV | 1,000 | 2020 | SC-Solar | Ankara |

| Elin-Sirius (OEM: Seraphim-Viesmann) | 970 | 2017 | Jinchen/SC-Solar | Ankara |

| CW Enerji | 900 | 2016 | Confirmware | Ankara |

| Alfa | 790 | 2013 | - | Kırıkkale |

| Energate (OEM: AE Solar) | 720 | 2021 | Confirmware | Kayseri |

| Smart Solar Technologies (OEM: Phono Solar) | 700 | 2017 | Jinchen | Istanbul |

| Daxler | 460 | 2019 | SC-Solar | Konya |

| Mir | 300 | 2017 | Confirmware | Sakarya |

| HSA Solar Maviçam (OEM: JA Solar) | 300 | 2021 | Jinchen | Manisa |

| Gazioğlu | 210 | 2012 | Confirmware | Ankara |

| Plurawatt | 200 | 2012 | Confirmware | Ankara |

| Ankara Solar | 200 | 2014 | Confirmware | Ankara |

| Parla | 200 | 2015 | Confirmware | Pamukkale |

Suzhou-based SC-Solar reports that it has supplied 16 production lines to Turkey, with its biggest line having an annual manufacturing capacity of 500 MW. Smaller production equipment providers are also gaining a foothold. Zenith Solar, with operations some 300 km outside Beijing, reports that its biggest project in Turkey is 750 MW of module production capacity supplied to CW Enerji. It has also sold individual tools to Kalyon and is targeting 500 MW of equipment sales in Turkey this year.

With the outlook for the Turkish market robust – GENSED forecasts 30% to 35% annual growth through 2035 – it is conceivable the country’s solar manufacturing sector could become an important link in the global PV supply chain, with its strong ties to the Chinese industry and proximity, on the edge of Europe. For this to occur, however, established players must continue to scale to increase competitiveness and to expand further up the production supply chain – a process Kalyon is currently embarked upon.

Such a development would also drive up solar factory utilization rates which currently sit at around 30% to 45%, according to Kaangokay CEO Guven. He notes, however, that “it is not possible to make an accurate estimate as the new manufacturers produce for stock and some new manufacturers produce for their self-consumption investment projects.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Let’s see how the election goes today, 14 may 2023. The geopolitical issues with Erdogan’s increasingly warm relation with Russia and, as you report, entrenchment of China manufacturing doesn’t bode well for European manufacturers. I suppose even with a new more open regime the China factor will not go away. If one views China as a benign influence on the global market then no worries.

Thanks for the timely, excellent reportage!