India's investments in renewables and grid upgrades provide the necessary assurances for investors to fund long-term hydrogen projects. By leveraging borrowing in dollars and euros, the country aims to reduce risks and costs, with export-oriented projects forming a key component of its hydrogen strategy.

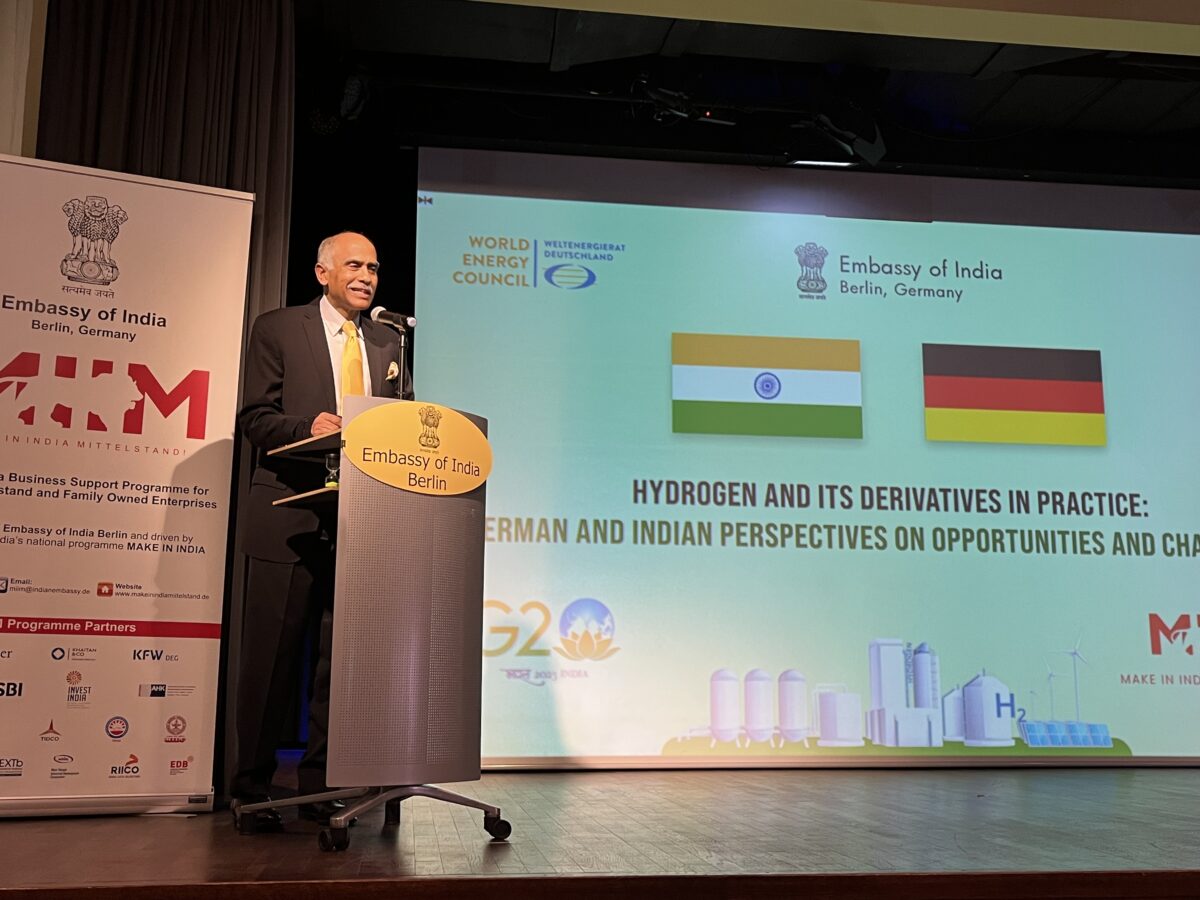

In other words, German partners play a crucial role in reducing investment costs and enabling the launch of new projects, while India's domestic market provides the necessary long-term assurances for the sector. Panelists at a conference organized by the Embassy of India in Berlin, Thyssenkrupp, and the World Energy Council highlighted India's position as the third-largest producer of grey hydrogen, following Russia and China, and the world's leading importer of ammonia.

“India has the largest electricity grid,” said Indian Ambassador Parvathaneni Harish, adding that the pandemic and a year of war in Europe showed the need to restructure Europe's industries. “But markets need to remain open.”

The two countries will collaborate not only in the financial sector but also in technology, providing significant benefits to various German companies, including major ones.

Thyssenkrupp, with its vertically integrated companies in Germany and India, holds a strategic advantage. The group possesses expertise in demand, supply, and infrastructure, making it well-positioned. In other words, the company requires hydrogen, has the capability to produce it through Nucera, an electrolyzer company, and already operates hydrogen infrastructures via Uhde. The CEO of Uhde said that the company will soon announce a demo plant for hydrogen cracking.

Representatives from Germany's MAN Energy&Solutions and RWE Supply & Trading, along with Indian companies Greenko Group, Avaada Group, and ACME Group, actively participated in the conference. High-profile executives from these companies highlighted the enduring engineering collaboration between Germany and India.

Diversified strategies

Greenko Group, in collaboration with Belgium's John Cockerill, aims to double its OEM electrolyzer production capacity within a few months, according to the company's founder. They express confidence in the Indian market and production capacity.

“We don't need subsidies. In India, the cost of green hydrogen without subsidies is already below $3/kg,” said Greenko Group's founder, Mahesh Kolli.

India and Germany aim to diversify their investments and import/export strategy. Indian hydrogen companies are actively involved in projects in Oman and Egypt. Meanwhile, the German government is developing its hydrogen strategy, focusing on tenders and auctions with various schemes. Currently, Germany sees South America, Australia, Canada, Namibia, and Mauritania as its ideal hydrogen partners.

“India will be part of Germany's hydrogen national strategy. I am quite sure, yes,” said Till Mansmann, innovation commissioner for green hydrogen in the German Ministry of Education.

Trained physicist Mansmann highlighted Germany's prolonged delay in investment decisions, but emphasized that the country's experience with LNG terminals will inform the forthcoming Hydrogen acceleration law.

Panelists emphasized that top officials from the German government actively travel to shape this strategy, suggesting that one should examine the trips of Chancellor Olaf Scholz and Minister for Economic Affairs Robert Habeck to comprehend the future hydrogen strategy of the country.

“We will import 70% of hydrogen needs in 2030, and the situation will not change till 2045,” said Mansmann.

The conference did not highlight any diverging interests between Germany and India in the hydrogen sector. However, India aims to sell energy carriers and low-carbon products at a premium price, expanding its presence in higher value-added markets, which have historically been a German specialty. Additionally, some participants proposed the idea of large German conglomerates establishing or utilizing subsidiaries in India.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

4 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.