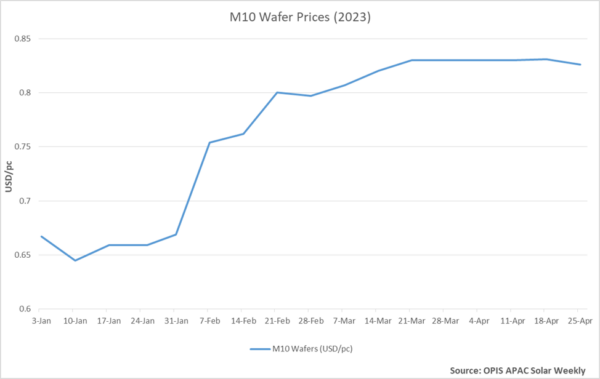

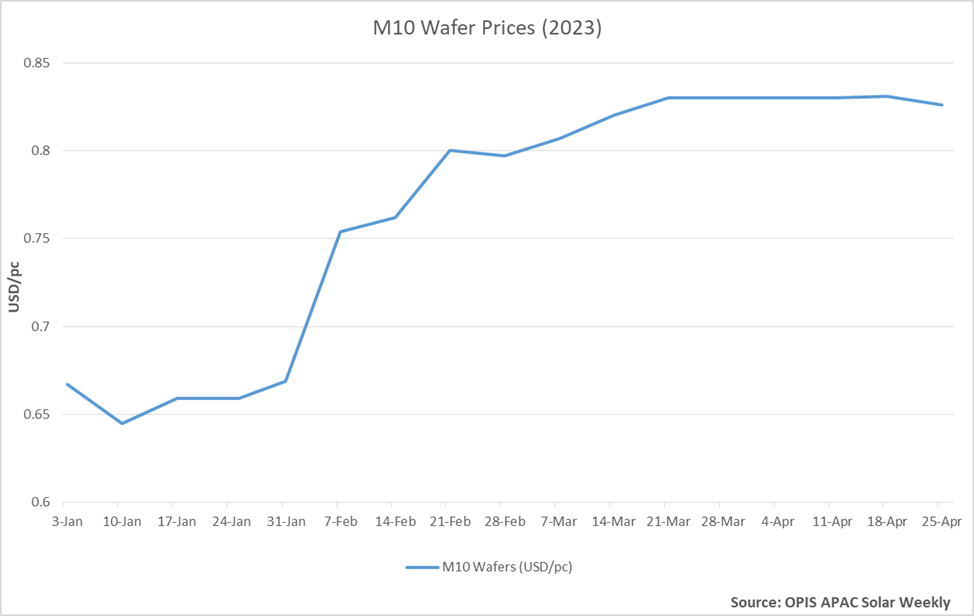

In its latest assessment on April 25, OPIS saw the price of Mono M10 wafers, the market’s current mainstream size, fall 0.6% on-week for the first time in two months to $0.826 per piece. The fragile equilibrium holding M10 prices steady in preceding weeks finally showed signs of cracking, as wafer output outstrips demand growth slightly.

China is estimated to produce around 48 GW of wafers in April, a 7% increase from March. Industry players concurred that wafer production is expanding more quickly than anticipated, with some who had been expecting wafers to continue trading sideways switching to more bearish outlooks.

The slight dip could signal that wafer prices are in for a gradual slide downwards in the near term, following the footsteps of upstream polysilicon’s continual decline in the preceding weeks. Weakness in the wafer segment comes as China’s high-purity quartz (HPQ) imports arrive, suggesting wafer manufacturers should be able to ratchet up now to full capacity.

While the current HPQ shortage has eased, concerns about future shortages continue to affect the market. Given Sibelco’s plans to double HPQ production capacity at its Spruce Pine facility by 2025 and that Spruce Pine in North Carolina is the world’s single largest source of HPQ, wafer makers may have good news – albeit on the distant horizon.

OPIS, a Dow Jones company, provides energy prices, news, data and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.