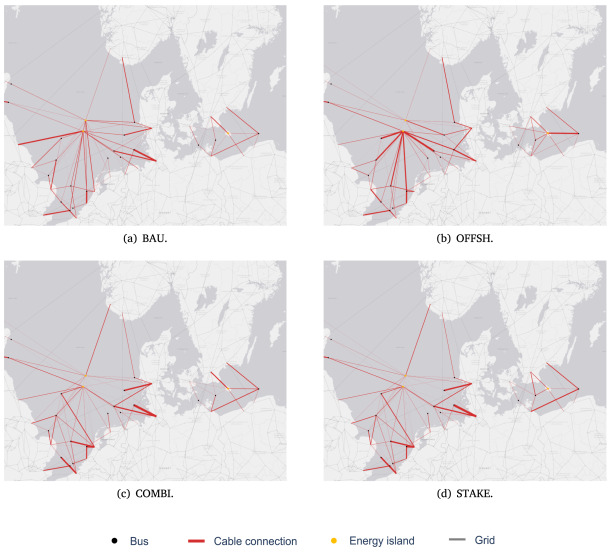

A Danish-Norwegian research team analyzed how renewables-powered energy islands could be integrated into a region's energy system via power cables or hydrogen infrastructure. They found that connecting close-to-shore wind farms via power cables benefits the electricity system more. “We find that the electricity system benefits more from connecting close-to-shore wind farms via power cables,” they said. “In turn, electrolysis is more valuable for far-away energy islands as it avoids expensive long-distance cable infrastructure.” The capacity investment in electrolyzers depends on hydrogen prices and onshore network congestion, they wrote in “How to connect energy islands: Trade-offs between hydrogen and electricity infrastructure,” which was recently published in Applied Energy.

DNV says that repurposing pipelines could cost just 10% to 35% of new construction costs, leading to a potential saving of more than 50% of hydrogen pipelines globally, and up to 80% in some regions with significant natural gas infrastructure. Transporting hydrogen in pipelines presents safety and financial risks, and end-user demand may limit the quality and quantity of hydrogen transported. DNV is expanding its testing capabilities in its labs in Groningen (Netherlands) and Singapore.

The Danish Energy Agency has announced the launch of a support scheme for renewable hydrogen. It is allocating DKK 1.25 billion ($184 million) to reach 5 GW to 6 GW of electrolysis capacity by 2030. The Power-to-X (PtX) tender is now moving into the tendering phase, and the agency invites applicants to submit their bids. The deadline is Sept. 1.

E.ON said in a new report that Germany needs to quickly invest in electrolysis capacity, hydrogen import infrastructure, and a “high-performance H₂ network. The German government wants to build up at least 10 GW of electrolysis capacity to produce green hydrogen by 2030. Its current electrolysis capacity stands at 68 MW.

Canada is stepping up its hydrogen investments, betting on contracts for difference (CfD) supported by the Canada Growth Fund and on refundable investment tax credits under its 2023 budget. “The levels of support will vary between 15 and 40% of eligible project costs, with the projects that produce the cleanest hydrogen receiving the highest levels of support,” said the Canadian government. “If we are to preserve this advantage and position Canada to compete in the next generation of electricity-intensive sectors, such as clean hydrogen and green steel and aluminum, significant investments must be made today. Industry's need for electricity is only slated to grow.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

6 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.