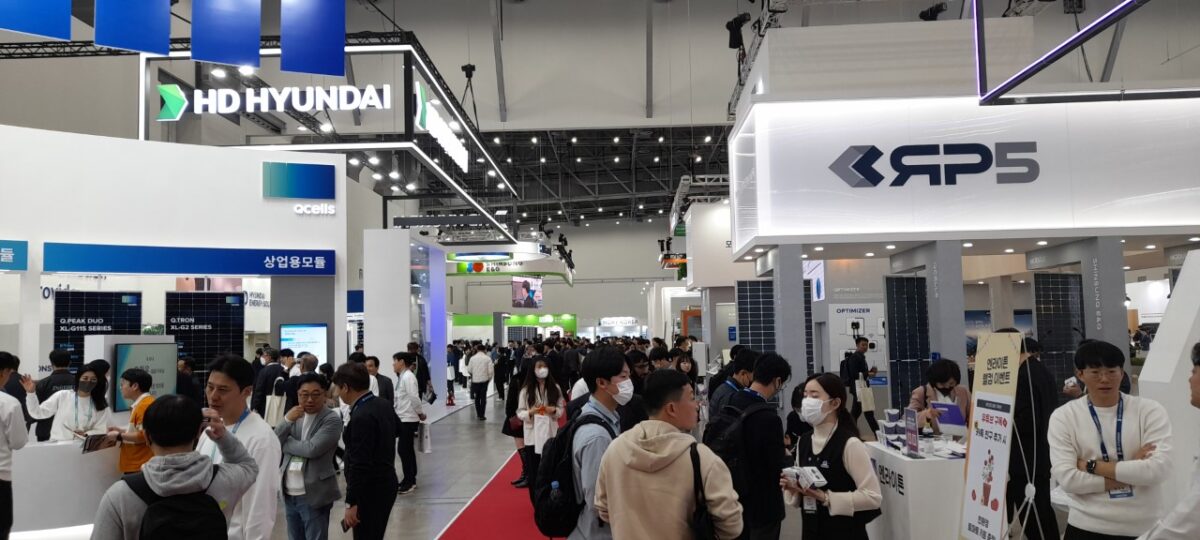

The 20th International Green Energy Expo and Conference – held last week in Daegu, South Korea – underscored the strength of the nation's solar industry, despite a political environment that appears to offer little room for clean energy.

The 10th Basic Plan of Long-Term Electricity Supply and Demand, which was recently published by the South Korean government, reduces the 2030 renewable energy target from 30.2% to just 21.6%. The government has also announced plans to scale back its feed-in tariff policy and reduce the amount of renewable energy certificates (RECs) issued under the renewable portfolio standard (RPS) scheme for 2023 and onwards. These changes could reduce the size of the South Korean solar market from around 4.4 GW in 2021 and 2.7 GW in 2022 to a bit more than just 2 GW in 2023, according to several analysts.

However, event organizer Exco said the trade show has not suffered from these setbacks. It noted that 300 companies from 25 countries participated this year, with 32,800 visitors. “The 2022 edition hosted 21,124 visitors,” an Exco spokesperson told pv magazine, noting that the fair was also bigger in terms of total floor space, although it did not provide any specific figures.

Domestic industry

The event's success was partly ensured by the strength of the domestic module and inverter industry. The country is home to big players such as Qcells, Hyundai and OCI Solar, and all of them presented their latest products at the show.

Qcells, for example, has currently 4.5 GW of annual production capacity for both cells and panels at its South Korean facilities. “But we are planning to raise our cell capacity to 5.3 GW by the end of 2023,” a spokesperson told pv magazine.

Hyundai currently has 1.4 GW of module capacity and 1.1 GW of cells. “We are now almost ready to present our new heterojunction modules,” said company spokesperson.

OCI Solar presented two new inverters at the show. It said it plans to expand its overseas sales due to rising inverter demand.

Other South Korean module manufacturers at the trade show included Shinsung E&G Co. which operates an 800 MW module assembly facility. SDN, which currently operates two panel assembly factories, was also present at the show, as was Hansol, which owns a 500 MW module assembly facility.

In addition, inverter maker DASS Tech brought some of its devices to the trade show. It said that demand from outside South Korea is now on the rise. “We currently have an annual capacity of 600 MW, but we may raise it depending on future market conditions,” a spokesperson said.

The resilience of this domestic industry depends in part on recent carbon footprint rules. These are helping South Korean manufacturers because the country has extensive nuclear capacity. However, the rules do not completely exclude foreign manufacturers from entering the market.

“Despite the carbon footprint requirements, Korea remains an open market with a lot of opportunities,” said Cindy Hu, managing director of Yingli Solar. “However, we are considering identifying some local partners to qualify for these requirements, but it may take some time.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.