For many years, minigrids have been considered one of the best solutions for rural electrification in Africa, next to solar home systems (SHS). Over the past decade, SHS have dominated rural electrification, as they have progressively entered rural homes across the continent by providing them with the most basic needs of lighting, small appliance charging, and TV.

However, the challenge with SHS is that they are often too small to power larger appliances, especially those that can help users to generate revenue. And this is specifically where minigrids have a role to play. It is estimated that minigrids could eventually provide power to 380 million Africans, according to the World Bank, the most supportive institution with regard to minigrids.

But minigrids face a major problem: Without significant subsidies, they are rarely financially viable. Indeed, building a mini-grid is costly, because it involves the solar and storage equipment, as well as the distribution network. This high cost is then confronted with low average consumption of the villagers, because they simply need very little power (only for a few light bulbs for example) or because their purchasing power does not allow them to buy much electricity.

With a cost per connection of around $500 in the best case, and an average revenue per user (ARPU) of $2 per month, it would indeed take 20 years for investors to recover their costs. This is why commercial investors have ben shying away from minigrids, but things may be about to change.

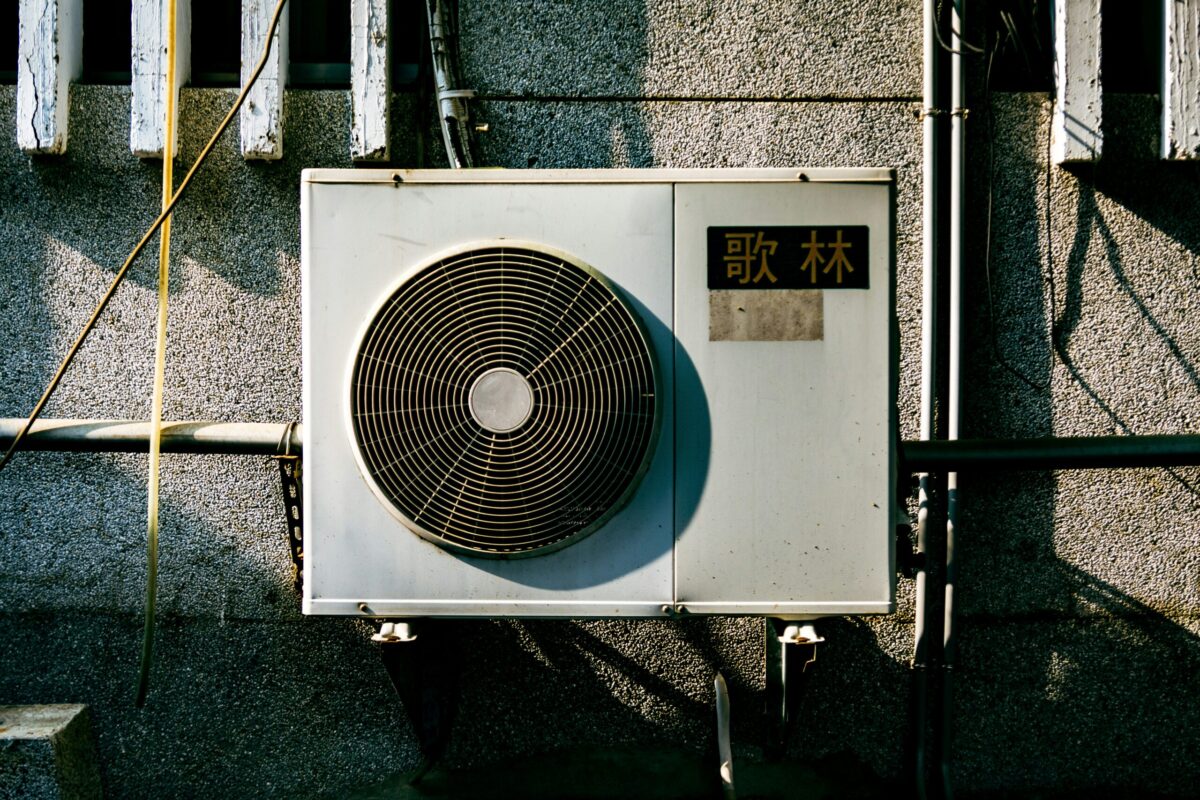

PUE appliances

Recent announcements by companies such as Husk Power and Engie Energy Access have shown that some investors have made profits with some of their minigrids in Nigeria and Uganda. The secret ingredient to making this possible is based on increasing electricity consumption by supporting the development of commercial and small industrial activity.

This is mainly happening by making “productive use of energy” (PUE) appliances available. Small businesses and artisans have had a chance to acquire equipment (most often through credit) based on electricity instead of diesel. This has created a virtuous circle of lower operating costs, more profit, more purchasing power, and more economic activity, which ultimately benefits minigrid companies.

As such, PUE appliances and solutions such as e-mobility can really be seen as the true enabler of minigrids across Africa. There already are dozens of different types of PUE appliances available on the market, fully off-grid or grid-connected. In some cases, they allow end-users to multiply their profits and unlock economic development in rural areas.

These solutions have the potential to be game-changers for Africa and shall for sure attract a lot of attention of investors and development partners in the coming years. In an attempt to shed more light on the realm of possibilities of PUE, AFSIA will be releasing its first PUE catalog at the end of April to show the extent and impact of those various solutions already available in the market.

More to come

There are already many minigrids in operation, and many more to come. But many more have been under development, and others have been recently announced. No doubt that with this new development about profitability, we could soon see an explosion of such projects finally being financed and built.

Here is a non-exhaustive list of project announcements and developments over just the past few weeks:

- In the Democratic Republic of the Congo, Nuru has secured $1.5 million to expand its minigrids in Goma and build new ones in Kindu and Bunia. In Bukavu, Bboxx has launched a pilot installation to bring electricity to telecoms operator Orange and more than 600 households, with local business GoShop handling engineering, procurement and construction. Bboxx and Orange plan to roll out 24 more of their telecoms-anchored networks to provide electricity connections to 150,000 people within two years.

- WeLight has raised $20 million from EDFI ElectriFI, the European Investment Bank and Triodos, to build minigrids in Madagascar. This comes on top of the previous $30 million raised previously to power 120 villages.

- In East Africa, the World Bank has launched 136 minigrids across Kenya. This is a welcome move for the minigrids companies which started operations in Kenya several years ago but have since gone through high levels of uncertainty and challenging policy in the country.

- In Sierra Leone, AFSIA member InfraCo refines its collaboration with minigrid veteran PowerGen to pilot a new financial model and further increase the number of minigrids in the country.

- And in Nigeria, the current poster child of minigrids in Africa, several initiatives are being led simultaneously. The Rural Electrification Agency (REA), which benefits from one of the largest support programs of the World Bank, has announced the development of 51 additional minigrids on top of the initial 12 built through the first call of the REF program. Nairobi-based financial services company CrossBoundary Energy Access said it will finance and own the Nigerian minigrids being planned by Engie Energy Access over the next four years. That $60 million investment is set to provide more than 150,000 electricity points and is backed by results-based funding from the World Bank which has previously been reported as offering $350 per new user.

Husk Power ambitions to expand the six minigrids it has installed in Nigeria’s Nasarawa state to more than 100 such networks in 2023 and 500 by 2026.

The minigrid space continues to attract a lot of attention from development partners. But with the recent demonstration that minigrids can actually generate profits, there is no doubt that commercial finance players will jump on the bandwagon, with eagerness to make an impact in Africa and make a profit.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

“With a cost per connection of around $500 in the best case” – says who? That seems very very high. gold wires?

This is a very interesting article and it looks at the solutions that we need as a country facing energy crisis and I’m interested in becoming one of the drivers implementing the solutions

am interested in this mini grid