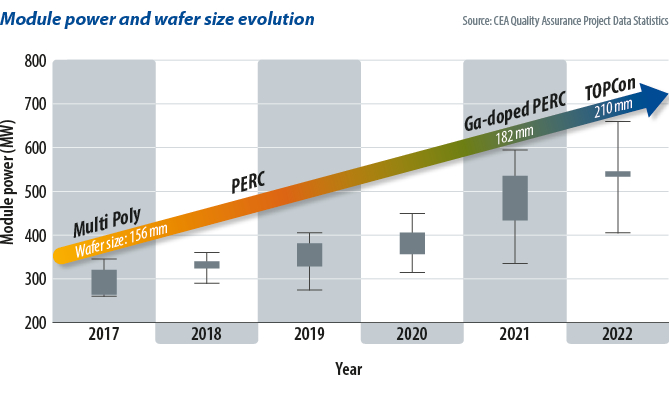

Developments in PV module technology have accelerated since 2018. The chart above – based on CEA quality assurance data – shows the most common modules for utility scale projects in 2017, varied by technology, had a glass-backsheet structure and featured 72 six-inch cells – a module type launched in 2008.

Since 2018, we have witnessed the transition from multicrystalline aluminum back surface field cells to mono PERC (passivated-emitter, rear contact) devices; the adoption of half-cut cells; the dominance of bifacial, glass-glass products; the introduction of multi busbar devices; a shift to larger wafers – 166 mm, then 182 mm, then 210 mm; the emergence of gallium doped p-type wafers; and, most recently, the rise of n-type cells – predominantly n-TOPCon (n-type, tunnel-oxide, passivated contact) products.

Wafer sizes grew to reduce costs. Market share today is split between 210 mm and 182 mm wafers as the advantages of each depends on project specifics. As production lines can be altered to produce either size, market share is fluid.

While “exotic” formats such as 218 mm wafers are unlikely to prosper, 182 mm variants have emerged, such as 182 mm wide by 185 mm products designed to minimize white space between cells in the long direction of the module. Trina Solar recently launched a 182 mm wide by 210 mm tall wafer. Ultimately, such variants are dependent on M10 or G12 solar ingot platforms and supply chains.

N-type moves

N-type (negatively-doped) solutions made an impressive entry in 2022 with several gigawatts of TOPCon generation capacity shipped already. TOPCon and heterojunction (HJT) cells are the main high-efficiency contenders to replace mainstream, p-type PERC cells. TOPCon and HJT cell architecture can be applied on p-type or n-type wafers but years of research have convinced manufacturers only n-type TOPCon and HJT variants can achieve an optimum efficiency-cost relationship.

TOPCon leads the race for now as legacy PERC cell production lines can be upgraded to produce it, whereas HJT requires retooling. TOPCon is also cheaper, thanks mainly to lower capital and operating expenditures.

Rival high-efficiency technology, interdigitated back contact (IBC) solar, has been touted as the “end-of-the-road” single-junction silicon PV technology because going beyond 26% conversion efficiency requires tandem cells. IBC cells have their contacts on the rear side, theoretically offering the highest efficiency for single-junction devices. However, front-contact TOPCon and HJT cells can become back-contact devices and several manufacturers appear to have planned such development. Longi, however, has chosen a p-type IBC architecture that probably uses PERC and TOPCon passivation.

The pros and cons of competing cell technologies are summarized in the following table, in which IBC refers to any passivation method, although properties such as bifaciality and tooling capital expenditure (capex) are linked to back-contact cells. An intense effort is under way to reduce the silver content of HJT devices.

Pros and cons of competing cell technologies

| PERC | TOPCon | HJT | IBC | |

|---|---|---|---|---|

| Total capex | Low | Medium | High | High |

| Opex | Low | Medium | High | High |

| Tool supply | Very mature | Good | Limited | Limited |

| PERC upgrade | NA | Yes | No | No |

| Silver usage | Low | Medium | High | High |

| Cell efficiency potential | Low | High | Higher | Highest |

| Energy yield: temperature performance | Baseline | Good | Very good | Good/very good |

| Energy yield: bifaciality | Baseline | Higher | Highest | Low |

Levelized energy cost

The pace of n-type expansion will rapidly accelerate once technology and cost hurdles are surpassed. Module buyers will accept a price premium on n-type if high efficiency and improved energy yield reduce capex and the LCOE.

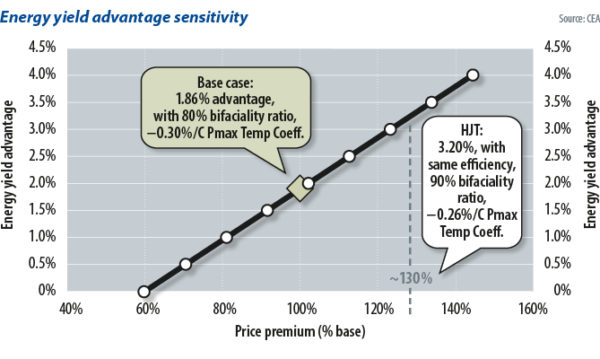

To measure such savings, CEA studied a 100 MW system on single-axis horizontal trackers in Spain. PERC and TOPCon cells were compared. Balance-of-system component costs were assumed from several sources, module cost and price data points were taken from CEA’s “PV Price Forecasting Report” and price tracking. PVsyst was used to measure energy yield.

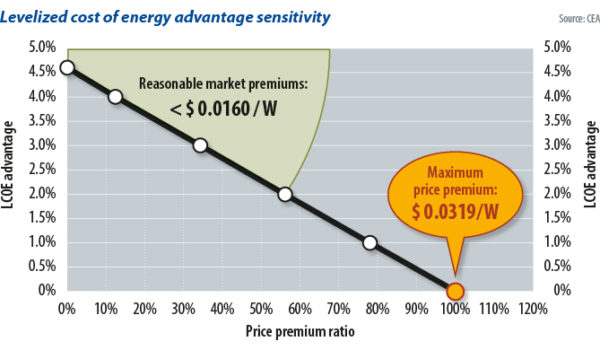

For the analysis, CEA defined a “maximum price premium” metric to indicate the amount a high efficiency module could command over a PERC panel without surrendering LCOE advantage.

CEA equalized the LCOE for PERC and TOPCon systems, deriving the TOPCon module price by adding the maximum premium to the PERC module baseline. Calculations showed TOPCon manufacturers can charge a premium of up to $0.0327/W over PERC without LCOE suffering. While buyers would not pay the maximum premium for zero LCOE advantage, they would pay extra for some LCOE gain. The following chart shows the sensitivity of the LCOE advantage to the price premium, with premiums below 50% of the maximum figure resulting in LCOE advantages of 2.5% or higher. In this scenario, a premium of less than $0.016/W would be reasonable.

The price premium for HJT modules – similarly efficient to TOPCon but with higher energy yield – could be roughly 30% higher than for TOPCon: around $0.005/W. HJT manufacturers must work hard to reduce their cost delta with TOPCon and aim for an efficiency lead.

Modules are lowering the LCOE but pushing past tipping points accelerates the rate of change, making it difficult to estimate development timelines. As a web of factors influence LCOE, manufacturer claims need verification.

About the author: George Touloupas is the senior director for technology and quality at solar and storage advisory Clean Energy Associates.

About the author: George Touloupas is the senior director for technology and quality at solar and storage advisory Clean Energy Associates.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.