TrendForce said it expects prices of polysilicon, solar cells, and modules to drop slightly on the month in February, when Chinese manufacturers unexpectedly raised prices across the entire supply chain.

“Polysilicon prices began to plummet in December last year, so the major polysilicon suppliers started to limit market supply,” the analysts said, noting that the price decrease was related to a strong increase in polysilicon capacity across the Chinese industry. “Subsequently, polysilicon prices in China started to rally before the Lunar New Year holiday this January, rising rapidly to the current range of CNY 220 ($31.55) to CNY 240 per kg.”

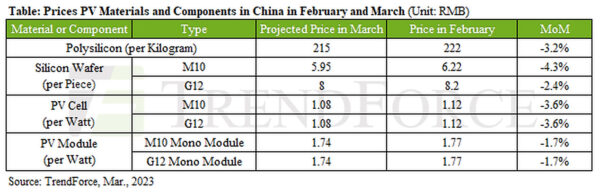

They said they believe that the average price of polysilicon will fall by 3.2% from CNY 222/kg in February to CNY 215/kg in March. Wafer prices, meanwhile, will likely drop by 4.3%, from CNY 6.22 per piece to CNY 5.95 for M10 products and from CNY 8.2 to CNY 8 for G12 products.

Average prices for solar cells should decline 3.6% from CNY 1.12 per watt to CNY 1.08 for both M10 and G12 products. The price of M10 and G12 monocrystalline panels, meanwhile, should fall from CNY 1.77 per W in February to CNY 1.74 in March.

“Wafer suppliers significantly raised their capacity utilization rates because polysilicon supply was expanding again. Therefore, wafer prices will not be able to maintain their upward momentum as supply becomes more plentiful,” TrendForce said. “The temporary tightening of wafer supply also put pressure on cell supply. Nevertheless, there was already widespread anticipation for this round of hikes, so cell buyers mostly accepted higher prices.”

The analysts said module prices will align with the usual range following a drop in prices of materials and components.

“Falling module prices will effectively spur installation demand, and the peak season for installations is expected to arrive earlier compared with the preceding years,” they explained, warning that the Chinese PV industry could face sharp price fluctuations over the short term. “Therefore, module suppliers are mostly optimistic about the market situation from this March onward.”

“In sum, there is still a considerable degree of uncertainty in the development of the global PV market this year,” they concluded.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

This is an interesting article about the fluctuations in polysilicon prices and how it affects the solar industry. It’s good to hear that prices will be slightly lower in March, which should stimulate installation demand. I’m curious to know how these price changes will affect the adoption of solar energy globally. Will it make it more accessible to countries with limited resources, or will it only affect larger markets with established solar industries?

Why are prices this high? In the US in 2015 you could get solar panels @ 21% efficiency for 57 cents per watt. Google cost per what solar panel 2015. I bought a bunch of them then. Why is everyone pretending like solar is so cheap now when it’s double the price?