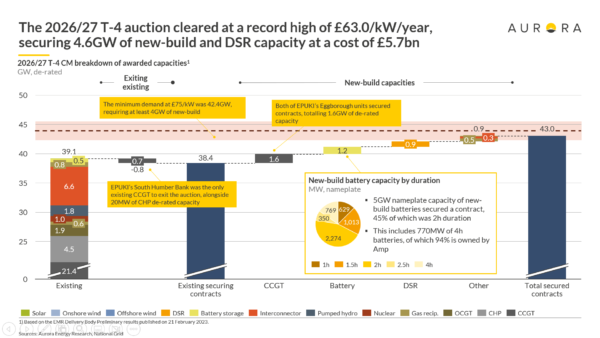

The United Kingdom's capacity market auctions are emerging as a major catalyst for battery energy storage system (BESS) deployment. On Feb. 21, 2023, approximately 5 GW of nameplate capacity in new-build batteries secured contracts in the 2026/27 T-4 Capacity Market auction – effectively doubling the United Kingdom's current pipeline of BESS projects.

Around 45% of the auctioned projects consist of two-hour duration storage systems. Around 770 MW came from BESS projects with four-hour duration, of which 94% are owned by Amp.

Utility-scale BESS projects have proliferated in Britain in recent years, supporting the United Kingdom's growing reliance on renewable energy sources. Grid stabilization services offered by BESS have also expanded in this deregulated market, improving the bottom lines of project stakeholders.

Aurora Energy Research Senior Associate Tom Smout told pv magazine that “battery projects have been performing well economically for the past few years, benefitting from a market with high energy prices and from increased requirements for lucrative frequency response services, for which the assets are particularly well-suited.”

However, Smout noted that large battery projects remain largely unproven in the United Kingdom.

“Our analysis has suggested that durations in the region of two hours are currently optimal in terms of investment return, but a significant component of this is upfront costs, so larger and longer projects may perform better if they achieve significant cost savings or are positioned to take advantage of local grid constraints,” he said.

According to the official documentation, which shows derated capacity, 1.29 GW of BESS projects secured contracts in the latest procurement exercise. The derated capacity is the nameplate capacity multiplied by the derating factor, adjusting for the expected availability of that technology during a system stress event.

Image: Aurora Energy Research

T-4 auctions – Britain’s key procurement exercises – are usually held about four years in advance of the delivery date. Contracts of up to 15 years are available for new-build capacity in the auctions, while existing capacity can only secure one-year contracts.

In February, there were 143 winning battery storage units, more than 90% of which secured 15-year contracts. However, BESS projects accounted for only 3% of the total capacity awarded, with gas claiming the lion’s share of 67.5% of capacity market units.

The T-4 capacity auction cleared at GBP 63 ($71.07)/kW per year, representing the highest clearing price on record. The price was more than double the previous record due to record-low prequalifying capacity and higher capacity targeted by National Grid Electricity System Operator.

According to Aurora Energy Research, the auction procured only 600 MW more than the absolute minimum it could have procured, highlighting how expensive new projects have become, both in terms of absolute cost increases and growing uncertainty for investors.

The latest T-4 auction follows a boom year in 2022, when more than 1 GW of derated BESS capacity won contracts, up from around 250 MW of winning BESS capacity in 2021.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.