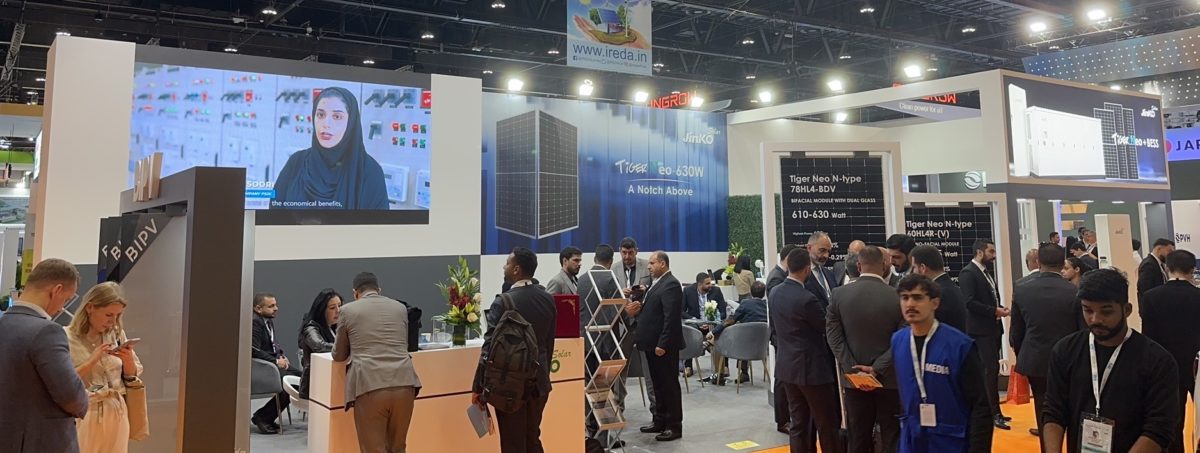

The 2023 edition of the World Future Energy Summit in Abu Dhabi attracted most of the heavyweights of the Middle Eastern renewables industry, as well as all big manufacturers of solar modules and inverters from China. The event showed that pandemic disruptions and supply chain issues are not slowing down demand in the region's markets.

Official figures on the numbers of exhibitors and attendants were not released prior to publication, but the size of the event has increased from years past, with some some observers estimating that it may have grown by up to 50%. The nature of attendees has also changed, with more professionals participating to search for business opportunities.

Several projects in the Middle East have been delayed in recent years, but now they are being resumed and are slowly going online. New projects are also being announced and big pipelines are consolidating in markets such as Saudi Arabia and the United Arab Emirates.

Key markets

However, local analysts are calling for a conservative approach to these markets, as they are driven by very low bids in energy auctions, with strong pressure on prices. However, the market is trying to find a balance between low prices and the volatility of the supply chain.

“We always considered the WFES the develop our strategy for the region in terms of products and technology,” Mohammed Saadi, head of technical services and product management at Chinese module maker JinkoSolar told pv magazine. “This is our second edition and we saw significant improvements. There are more global players and we also see consultants and media.”

Saadi said demand is increasing across the entire Middle East and North Africa (MENA) region.

“For this and next year, we should ship up to 8 GW of solar modules in these markets,” he added, noting that the hottest markets for the utility-scale business might be Saudi Arabia, the Emirates, Egypt, and Morocco. “For the distributed generation segments, the most interesting markets should be Iraq, Egypt, Tunisia, and Yemen, where last year we shipped more than 100 MW.”

Marwan Al Jaber, JA Solar‘s sales director for the Middle East, told pv magazine that the Chinese company received a lot of serious inquiries at the Abu Dhabi event.

“Demand is increasing even in some of those Middle East regions where there is no regulation and something is also now moving in the residential business,” he said. “The most active market right now is Saudi Arabia, especially for the utility scale segment, as well as for commercial and industrial projects.”

He said Lebanon is also growing, despite its deep financial crisis, due to chronic energy shortages.

“Solar energy is the most reliable source of electricity right now,” Al Jaber stated. “At this regard, Yemen is also an interesting market.”

Bright Sun, the chief marketing officer MEA&CA for China's Longi, told pv magazine that the module manufacturer met new and old customers at the Abu Dhabi event.

“We see the market accelerating in MENA and we also see companies from Central Asia and Africa joining the event here,” added Sun, who claimed that regional demand will more than triple year on year for Longi in 2023.

“We already signed a deal for a big project in Saudi Arabia and also in the UAE and Qatar,” he said.

Mohit Shrimal, marketing director for Huawei, told pv magazine that this year was the fifth consecutive year that the inverter manufacturer has a presence at the Abu Dhabi event.

“It offers easy market access not only to the Middle East but also to Africa,” said Shrimal. “Inverter demand here is increasing despite the technology challenges and chip shortages and we expect a very fruitful five-year period.”

Hydrogen hopes

Mohammad Youssef, a spokesperson for Chinese inverter maker Sungrow, said the success of the Abu Dhabi event underscores the “prosperity” of the market.

The market will see strong growth in the utility-scale segment this year, but we also expect impressive growth in the distributed generation business,” he told pv magazine. “We also started to make first shipments for storage energy systems but, compared with more mature markets such as the United States and Europe, their economical viability remains challenging.

Ray Luiz, regional director of MENA for inverter maker TBEA, said that Saudi Arabia and the United Arab Emirates are the most promising markets. He noted that both string and central inverters are gaining acceptance throughout the Middle East. “It depends on the client's request, but we tend to offer boths solutions in all these markets,” he said.

A spokesperson for Austrian inverter manufacturer Fronius said the Abu Dhabi event was well attended by PV product distributors.

“We keep seeing strong demand in the C&I business, although the residential segment remains limited in volumes,” the Fronius spokesperson said. “It will likely become a big market likely in the next couple of years. Jordan are Saudi Arabia probably the most promising markets in this regard, as well as Yemen and Lebanon.”

Given UAE’s green hydrogen ambitions, it is no surprise that Abu Dhabi Sustainability Week (ABSW), which also took place last week, gave pride of place to its Green Hydrogen Summit (GHS).

Executive Director Masdar Clean Energy Fawaz Al Muharrami told pv magazine that the company is aiming for 100 GW of renewable capacity by 2030. He said approximately 25% of this will be devoted to green hydrogen production (or its derivatives), with the target of producing 1 million tons of green hydrogen per annum by 2050.

But while green hydrogen is verging on becoming a buzzword before it becomes a booming market, at least one speaker at the ADSW Green Hydrogen Summit didn’t forget the key word – sustainable. Wale Shonibare – the African Development Bank’s director of energy financial solutions, policy and regulations – said that when it comes to green hydrogen project development in Africa, “we don’t want to repeat the mistakes of fossil fuels,” He added that “local communities” also deserve consideration.

“Africa’s No. 1 problem is energy access, so we need to integrate local communities into the value chain,” continued Shonibare, who noted that green hydrogen offers African nations an export market in hard currency which can be used to develop local infrastructure.

In the midst of entertaining the enormous scope of the green hydrogen future and how it can help hard to abate industries and fossil fuel dependent economies transition away from carbon-intensive resources, it was interesting to note the concept of “additionality” was also on the lips of attendees.

A tangential concern in green hydrogen development in developing regions like sub-Saharan African is the water intensity of inherent processes and how they might affect already water scarce areas. However, Masdar’s head of business development for green hydrogen, Dr. Faye Al Hersh, told pv magazine that the amount of water required for electrolysis is not as significant as some people might think.

“The majority of the water required for the green hydrogen production process is actually for cooling, and this does not need to be desalinated water, it can be seawater for example,” said Al Hersh.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

4 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.