Clean energy demand will continue to rise

The past year has seen rampant inflation in fossil fuel prices as the war in Ukraine and related restrictions on the gas supply from Russia have driven up costs. The result of these price shocks has been that climate change, as the primary driver to date for the transition to renewable energy, has been surpassed by cost and energy security concerns.

Electricity from natural gas generation is now six times as expensive as wind power in some parts of Europe. The price disparity is driving renewable energy production – especially in markets where pricing structures ensure high levels of remuneration.

Image: ESS Inc

California has seen some of the most innovative municipalities take major steps forward towards a net-zero electricity grid. A good example is the Sacramento Municipal Utility District that is looking to work with ESS to deploy 200 MW/2 GWh of energy storage capacity which, when coupled with renewable energy sources, will remove the equivalent of 284,000 metric tons of CO2 emissions per year and provide enough energy to power 60,000 homes for 10 hours.

In Europe, the Russian war in Ukraine – and in particular the use of energy starvation as a strategy – has highlighted the need to move beyond reliance on energy from unreliable and unpredictable states. While the US has shown prescience in ensuring energy security, much of the world is now catching up.

In 2023, we can expect to see a silver lining of the crises which erupted in 2022 as renewable energy comes to the forefront, with mainstream investment in solar, wind, and energy storage.

Strategic procurement will be vital

Global supply chain and product availability has been severely disrupted over the past two years due to the pandemic, geopolitics, and trade barriers creating an imbalance between demand and supply. This imbalance is expected to continue to widen as demand for renewables grows rapidly in most major markets and supply struggles to keep pace.

Many producers of essential clean energy equipment, such as solar panels and inverters, are already sold out for several years, with new orders beginning from 2026. As a result, different players are entering long-term supply agreements and reserving manufacturing capacity. Competition for long term equipment supply is not limited to project developers and owners. Governments also recognize the stiff global competition for scarce resources.

The establishment of strategic reserves by market participants, to ensure equipment availability, is increasingly possible.

Microgrids will be major

When US utilities decide to invest in solar and energy storage, their thinking will be as much about resilience as about cutting carbon emissions. With parts of the country ravaged by wildfires, floods, and other climate-driven crises, transmission from central generating facilities has become increasingly problematic. The deployment of micro-grids based on solar and energy storage protects against that vulnerability while also doing its bit for net-zero grid goals.

The emergence of solar and wind microgrids has been facilitated by the arrival of low cost and reliable battery energy storage. From commercial and industrial applications in Pennsylvania to utility scale projects in California, demand for sustainable, resilient microgrids is growing.

A global grid will emerge

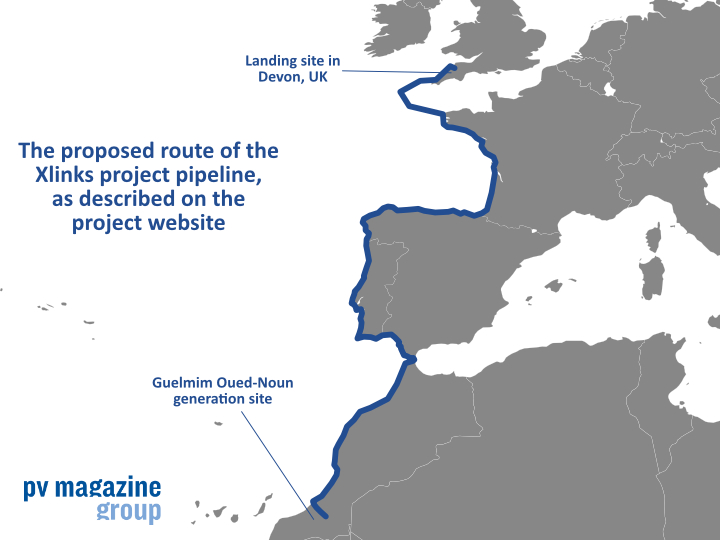

The surge in investment in renewable energy is being matched by creativity in energy innovation; solar farms in northern Australia could soon be supplying electricity to Singapore and plans are developing for Moroccan solar and wind farms to power British homes.

These continent-scale grid projects, while seemingly at odds with the aforementioned trend towards microgrids, are in fact the perfect complement. Such one-way interconnections from clean-energy rich regions to demand centers will provide new energy sources that will cut costs, reduce energy vulnerability, and curb carbon emissions.

The vast Australia-ASEAN Power Link project will include a 10 GW solar park with a transmission line to supply power to Singapore. Construction is planned to start by the end of 2023 with commercial operation set to begin in 2027. The Power Link will cover almost 20% of the electricity consumption of Singapore and dramatically reduce the country's dependence on liquefied natural gas imports.

The Xlinks project set to bring solar energy from Morocco to the UK was scheduled to get under way next year, although the startup this week announced political upheaval in the UK has cost it a year. The project is intended to provide 10.5 GW of zero-carbon electricity from the sun and wind – enough to deliver 3.6 GW of reliable energy for an average of 20-plus hours per day. This would provide low-cost, clean power to more than seven million homes, with 2030 set as the original target date for that milestone, and equates to around 8% of the UK’s electricity needs.

Such global grid projects have been enabled by breakthroughs in two key technologies:

- Highly efficient high-voltage DC electricity transmission lines needed to transport power across huge distances of 4,500 km, from Australia to Singapore, and 3,800 km from Morocco to the UK; and

- Long duration energy storage to harvest the solar and wind power when it is needed, with the Australian project planning for 30 GWh of battery storage while Morocco is planning to build a 20 GWh battery system.

About the author: Alan Greenshields is Europe, Middle East, and Africa director for US-based iron-salt flow battery company ESS Inc.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

The XLinks project which plans to generate clean power from 10.5 GW of solar and wind generation capacity in southwestern Morocco and transmit it for use in the UK needs to take into consideration that many industries may relocate in the sun.

Instead of moving the power to ageing industrial heartlands, the countries on the south shores of the `Mediterranean may find that they become ‘Europes’ new industrial base.