On Dec. 13, 2021, CPUC issued a proposed decision (PD) on reforming the NEM 2.0 net-metering regulations instituted in 2016, by introducing NEM 3.0. The proposed decision – for consideration by the five commissioners at the regulator – came in for severe criticism from celebrities and public figures, including former governor Arnold Schwarzenegger and actor Ed Norton. Professor Severin Borenstein, at the University of California’s Energy Institute, has also considered the merits of the proposed legislation.

Three negative features stood out: a discriminatory grid-access charge of $8 per kilowatt per month, an unprecedented retroactive application of the proposed new rules to NEM 1.0 and NEM 2.0 customers, and a significant drop in the electricity export compensation rate.

Those features would have crippled the economics of rooftop solar. The payback period for solar panel systems would have doubled or tripled. Solar adoption rates would have plummeted.

The proposed decision was totally at odds with the state’s net-zero goals, which include a mandate that all new homes shall have solar panels on their roofs. The premise for instituting such drastic measures was CPUC’s desire to eliminate a cost shift that supposedly penalized the poor and benefited the rich.

The proposal, however, ignored all other cost shifts that arise in the design of electricity rates. It ignored subsidies provided by the state to low-income customers. It ignored the $1.5 billion that the state spends every year on energy efficiency programs which cause usage to go down, creating another beneficial cost shift.

Revisions made

Under pressure from the public, a second proposed decision, released on Nov. 10, suggests removing the grid-access charge and the retroactive provision. Removing those two elements, however, does not make the second draft worthy of admiration.

The “poor-to-rich” cost-shift narrative still permeates the entire document. The sole purpose of the latest proposed replacement for NEM 2.0 is to reduce the growth in installation of rooftop solar panels. That was also the motivation behind the first PD.

The export compensation rate, paid to solar system owners for electricity they inject into the grid, drops dramatically within a few years under the latest proposed revision. Calling the reduction a “glide path” is a misnomer. Essentially, export compensation is being pushed off a cliff.

The latest proposed decision states that its provisions will ensure a nine-year payback period for solar systems. That is doubtful since that’s the current estimate, under NEM 2.0. The payback period will be even shorter for solar systems that are paired with energy storage, according to the latest suggestion drafted by CPUC. Reaping the benefits of such an association is even more doubtful, since storage is still quite expensive.

The latest PD says that all new solar customers will be placed on a new time-of-use (TOU) “electrification” rate. Compared to other TOU rates, this will feature slightly lower energy charges but will have a fixed charge of $15 per month. The non-bypassable charges will remain in effect. Thus, the typical solar customer will be paying a fixed charge of around $25 per month.

The proposed decision is hard to follow, even for trained economists, and the math it contains is even tougher to decipher. Instead of single-mindedly focusing on reducing the cost shift, CPUC should state what the impact on carbon emissions would be in three scenarios: the status quo under NEM 2.0, the first proposed decision for NEM 3.0, and the new one.

CPUC should also explain why the societal cost test – which factors in additional costs and benefits for society at large that do not directly affect the cost of energy supply – was not used. It should also explain why resilience benefits, especially for those with storage, were not considered, even though they were brought up by several parties during the decision-making process.

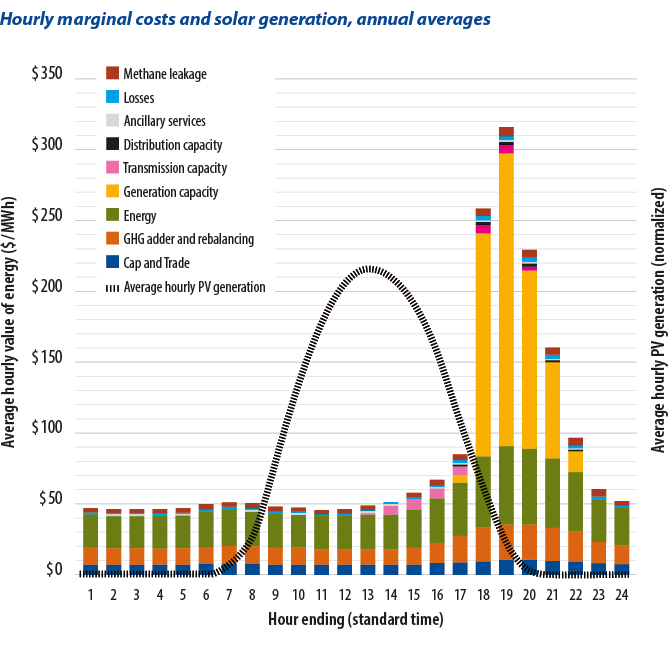

The import rate has an odd, unexplained spike between 9 a.m. and noon. Export compensation gets a drastic haircut. It’s doubtful that customers would understand the proposed rules. For example, various parties have reported the average export rate is $0.08/kWh when the solar output weighted average rate is closer to $0.06/kWh.

The new proposed draft says the intent is to incentivize the installation of storage with solar. In that case, the easiest path would be to double the state’s self-generation incentive for batteries. To make these investments even more attractive, a critical peak period pricing overlay should be added to the electrification rate. If customers agree to that, they are contributing to the state’s load flexibility goals and should be offered a rebate based on the size of their system. To address the fair access issue, the rebate could be doubled for low-income customers.

About the author: Ahmad Faruqui is an energy economist who has worked on rate design issues for more than four decades, on six continents. He has also testified almost 70 times before regulatory bodies in the US and Canada and appeared internationally before governments, legislators, and regulators. He holds a doctorate from the University of California, Davis.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Under the “CARE” program, California households that are low income get a 20% discount on their bills made up by wealthier rate payers already. The only cost shift is from wealthier payers pay more to give low-income rate payers a break. Larger homes pay more because they are shifted also into higher tiers on the rate schedule thanks to “TURN” so that is another rate shift that hurts larger homes. The whole reason Californians went to solar was the higher prices charge to them by utilities in the higher tiers. Making new solar customers give the utility 4 kilo watt hours for every one received back will kill grid connected rooftop solar. Going off-grid, like I have done, will be the only viable alternative if NEM 3.0 is adopted. Off grid solar will cost more to install eliminating the lower income sales segment of new rooftop solar installations and the wealthy, who can afford the off-grid option, will chose it because they still have the highest rates of any segment of rate payers. The more high-income customers that go off grid, the fewer rich people to pay the “CARE” and “TURN” excess fees and costs utilities have heaped upon them. Then when CAISO calls for more grid tied solar with batteries to help. there will be no one to help because they all went off grid. The utilities will be pushing away the very customers they need to sustain the grid both in summer production and in winter sales.