The IEA PVPS recently published its latest report on “Trends in Photovoltaic Applications 2022.” The PV industry recorded higher prices across the upstream sector, mostly driven by high polysilicon prices. Other factors involved high silver and aluminum prices, increased logistics costs, and shortage of semiconductors. China remained the world’s largest producer along the PV supply chain, but Malaysia, Vietnam, Germany, the US, India, Norway, Turkey, among others, also gained space.

“I think that the global polysilicon manufacturing capacity will double by the end of this year, compared with the previous year. At the end of next year, I believe, the polysilicon price will be stabilized,” Izumi Kaizuka, principal analyst at RTS Corp., told pv magazine.

At the end of July 2022, the reported spot price for polysilicon was $0.38/kg, an increase from the $0.29/kg at the end of May 2021, and from the $0.10/kg at the end of December 2020.

“In 2022, the high prices [were] maintained for polysilicon due to the demand growth and to the shutdown of several plants, because of the electricity shortage in China,” said the report.

The solar industry used 604,812 tons of polysilicon in 2021, an increase from 497,300 tons in 2020, which amounted to 94% of the global of polysilicon last year. China was the world’s largest producer of polysilicon, accounting for 623,000 tons, followed by Germany with 65,000 tons, and Malaysia with 3,000 tons. Other countries are entering the market or reinstating their position.

“Already in Norway there’s some fronts, and also in Turkey we have manufacturing capacity. I also expect India to increase production … which should take 2 to 3 years,” said Kaizuka. “In the US, some of the polysilicon manufacturing plants had stopped operation, for example REC Silicon’s Moses Lake plant, but now they announced they are restarting the production for solar. The US manufacturing capacity is expected to increase, so the US [polysilicon] production may be active in the near future.”

For the time being, IEA PVSP expects China to remain the global top producer of polysilicon, but with the US import ban on products from Hoshine “future production locations might change”, the report reads. The recent Uyghur Forced Labor Prevention Act (UFLPA) “is also expected to trigger an increase of the US polysilicon production for the PV sector.”

Bigger wafers

Global wafer production amounted to 233 GW in 2021, a 39% increase from 2020, with a production capacity of 415 GW/year, up from 218 GW/year the previous year. Volume and production capacity of polycrystalline wafers decreased, while those of monocrystalline increased “due to the demand for higher efficiency PV modules.”

The spot price for crystalline silicon wafers, which generally follows the price of polysilicon, was $0.78/piece for 158.75 mm to 161.75 mm wafers at the end of July 2022, an increase from the $0.74/piece in November 2021, and the $0.35/piece in January 2021, according to the report. Larger wafers of 182 mm were priced at $0.97/piece.

The past year marked a move to larger wafer sizes, with the market share of 182 mm (M10) to 210 mm (M12) wafers increasing from 4.5% in 2020 to 45% in 2021. Wafers of 158.75 mm to 166 mm accounted for around of 50% of total production.

IEA PVSP expects that the market share of large-sized wafers will increase further and that they will become major products by 2030.

China produced more than 97% of the world’s wafers and exported around 22.6 GW to other PV cell manufacturing countries like Malaysia, Vietnam, Taiwan, Thailand, Korea and India. The first four countries, alongside Norway, already have water manufacturing capacities, and Hungary, France, Russia, Turkey, and Spain also reported plans for new production capacities.

Cell production

Crystalline silicon and thin-film solar cell production reached around 241 GW in 2021, a 35.4% increase from 2020, and global manufacturing capacity was around 441 GW/year.

The spot price for monocrystalline-PERC cells ranged between $0.155/W to $0.18/W as of July 2022, depending on wafer size, an increase from the $0.12/W to $0.14/W in January 2021.The price level has reportedly been stable since November 2021, with some floatation according to demand. Soaring prices for silver, in the order of 22% in 2021 according to the Silver Institute, also played a role in cell’s higher prices.

China produced 82.2% of the global cell production, accounting for around 198 GW of solar cells in 2021, a 46.8% increase from 135 GW in 2021. Malaysia produced 13.1 GW, Vietnam 8.8 GW, South Korea 5.5 GW, and Thailand 5 W.

“Thailand and Vietnam are not subject to the safeguard tariffs by the USA and the production capacities are increasing in these countries,” the report said.

Europe, the United States, India, and Japan also reported production, for which the report did not include figures.

PERC and TOPCon technologies had a market share of 85%, up from 76% in 2020, according to the report. Technologies such as silicon heterojunction (STJ) and back contacts retained a market share of around 5%.

The share of bifacial solar cells reached 50% globally and is expected to reach more than 60% by the end of 2022. “One of the reasons of this growth is that bifacial products are exempted of the US safeguards duties. Also, the output increase with single axis tracker contributed to the market growth,” the report says.

Module output

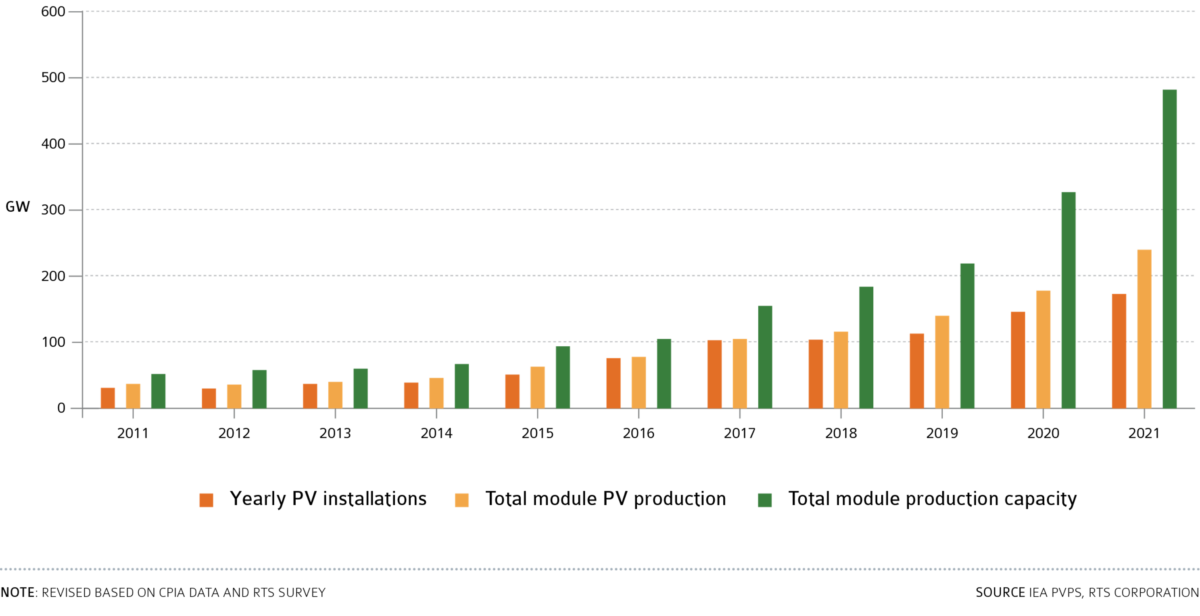

Global PV module production increased to 242 GW in 2021 from 178.5 GW in 2020. High polysilicon prices also increased module prices. In July 2022, the average spot price was $0.256/W for a “typical monocrystalline polysilicon PV module”, according to the report. In January 2021, the average price was $0.192/W, which increased to $0.26/W in October 2021 and slightly decreased to $0.247/W in December 2021.

Glass and polymer materials reportedly also impacted the price of PV modules, with the price of glass having increased by 18.2% and the EVA (ethylene vinyl acetate) price soaring 35% in August 2021, according to a statement issued in September 2021 by five major Chinese PV module manufacturers.

China produced 181.8 GW of modules in 2021, and exported the highest amount ever, 98.5 GW, according to the Chinese PV Industry Association. Vietnam, Malaysia, South Korea, and the US made up the remaining top five of module manufacturers, with 16.4 GW, 9.1 GW, 8 GW, and 6.6 GW of production capacity, respectively.

The market share of crystalline silicon (c-Si) modules was 96.6% in 2021, with monocrystalline accounting for 88.9% of those. More than 80% of PV modules used half-cut c-Si solar cells, and shingled PV module technology was also adopted. Thin-film silicon technologies had a slight loss of market share in 2021, from 3.6% to 3.4%, with around 8.2 GW of thin-film PV modules being produced worldwide, 7.9 GW of which were produced by First Solar.

The report also includes a 2021 ranking of the top five manufacturers in terms of PV cell, module and shipment volume.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.