The record-breaking run in power prices, particularly in Europe, is creating a favorable investment case for solar and wind projects, making it increasingly compelling to develop renewable assets purely based on project economics.

According to Norwegian consultancy Rystad Energy, current spot prices in Germany, France, Italy, and the United Kingdom would all result in payback of 12 months or less. Considering the average monthly spot prices for August in these countries were all well over €400/MWh and the relatively low operating costs of renewables, investing in utility-scale projects appear to be a no-brainer.

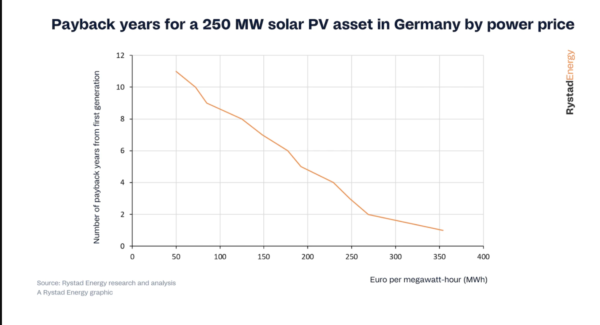

For instance, for a generic 250 MW solar project, assuming a long-term electricity price of €50/MWh ($49/MWh), the expected post tax return is approximately 6% with a payback period of 11 years, Rystad calculates. A price of €350/MWh or above results in a payback period of only one year while a price of approximately €180 – the European Commission’s proposed price threshold results in the payback time of five to six years.

Investors are seeing the opportunity. According to Rystad, capital investments in renewables have increased significantly and are set to reach $494 billion in 2022, outstripping upstream oil and gas at $446 billion for the year.

“Capital investments in renewables are set to outstrip oil and gas for the first time this year as countries scramble to source secure and affordable energy,” says Michael Sarich, senior vice president, Rystad Energy. “Investments into renewables are likely to increase further moving forward as renewable project payback times shorten to less than a year in some cases.”

Rise of storage

High energy prices but also newly adopted climate legislation, including the US inflation Reduction Act and European Union’s REPowerEU plan, are expected to give a big boost to the global energy storage market.

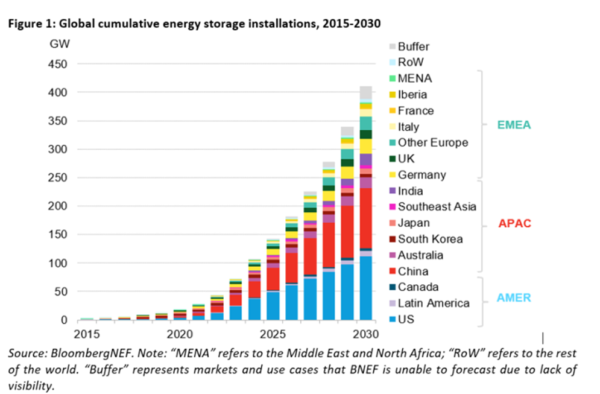

In its latest forecast, BloombergNEF says that energy storage installations around the world are projected to reach a cumulative 411 GW/1,194 GWh by 2030. That is 15 times the 27 GW/56 GWh of storage that was online at the end of 2021.

Driven by recent policy developments, BNEF has revised its previous estimates up by 13% from the ones presented in its 2H 2022 Energy Storage Market Outlook. This is equal to an extra 46 GW/145 GWh. While an estimated 387 GW/1,143 GWh will be added from 2022 to 2030, supply chain constraints will cloud deployment expectations until 2024, says BNEF.

The United States and China are set to remain the two largest markets, representing more than half of global storage installations by the end of the decade. Europe, however, is catching up with a significant ramp-up in capacity, driven by the current energy crisis.

BNEF’s forecast suggests that the majority of energy storage build by 2030, equivalent to 61% of megawatts, will be to provide energy shifting – that is, advancing or delaying the time of electricity dispatch. Co-located renewables-plus-storage projects, in particular solar-plus-storage, are becoming commonplace throughout the world, notes BNEF.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Thanks for the information for the solar payback l read your article l am very impressive

very nice.

Its realy nice information for the solar payback in this setion i am very glad

Impressive yet informative!

the combination of high energy prices and supportive policies is driving increased investment in renewables and energy storage, with the potential for rapid project payback times in certain regions.