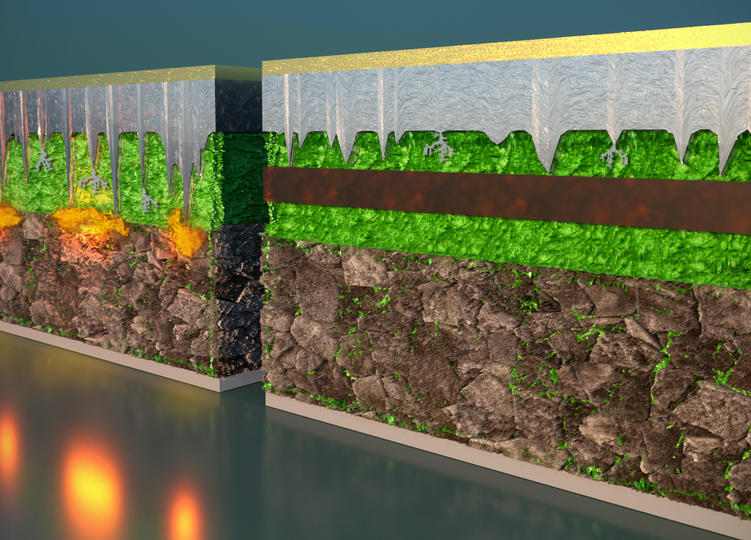

Harvard University researchers have developed a solid-state lithium-metal battery that can be charged and discharged at least 10,000 times at a high current density – marking a big leap toward commercialization. The lab-scale coin-cell prototype has achieved lifetime battery charge rates as fast as three minutes with more than 10,000 cycles. The scientists published their results in Nature and other journals last year. Now, Harvard’s Office of Technology Development has granted an exclusive technology license to startup Adden Energy to develop innovative solid-state battery systems for use in future rapid-charging EVs. The company recently closed a $5.15 million funding round to help it scale Harvard’s lab prototype toward commercial deployment. It aims to develop the battery to a palm-sized pouch cell, and then to a full-scale vehicle battery within the next three to five years. “If you want to electrify vehicles, a solid-state battery is the way to go,” said Xin Li, associate professor of materials science at Harvard John A. Paulson School of Engineering and Applied Sciences (SEAS), and a scientific adviser to Adden Energy. “We don’t see any fundamental limit to scaling up our battery technology. That could be a game changer.”

Prologium has announced its first overseas gigafactory. The Taiwanese solid-state battery cell manufacturer said the facility, which will be built in Europe or the United States, will have an annual capacity of 120 GWh when completed. In Europe, the company has initiated a feasibility study for potential sites in France, Germany, the Netherlands, Poland, and the United Kingdom. A final decision will be made in the first quarter of 2023. Construction is planned to take place in three phases and investments are expected to reach $8 billion over the next 10 years. ProLogium estimates that the plant will create more than 6,500 jobs by 2031. Earlier this year, Prologium announced big investments from Mecedes-Benz and Vietnamese EV manufacturer VinFast. The company plans to launch its first 3 GWh production plant in early 2023, with a significant proportion of its production capacity reserved for VinFast.

SVOLT said it is making significant strides in solid-state battery development. It recently produced a first batch of 20 Ah cells with sulfide-based solid electrolyte, which made it the first battery manufacturer in China to demonstrate the production of this type of solid-state cell. The prototype solid-state cells have an energy density of 350 Wh to 400 Wh/kg, promising a range of more than 1,000 kilometers for EVs. SVOLT recently completed abuse tests, such as a 200 C hot box test and a nail puncture test in which its new 20Ah cells survived unscathed. SVOLT’s Wuxi Lithium Battery Innovation Center and the Ningbo China Institute of Materials Technology and Engineering of the Chinese Academy of Sciences established a joint research center for solid-state battery technology in April 2021. Since then, it has filed 187 patents. The company plans to further expand its R&D in the field of solid-state batteries, as well as in new process technologies to further develop the technological basis for mass production.

Factorial Energy – a US developer of solid-state battery cells for EVs, backed by Mercedes-Benz, Stellantis and Hyundai Motor – has begun construction of a new production facility near Boston. It will house Factorial’s pilot production facility, which will manufacture automotive-sized solid-state batteries at pre-production speed and volume. Factorial will invest $45 million in the facility, which is expected to begin operations in early 2023. Last year, the Massachusetts-based startup announced a major breakthrough when it achieved a capacity retention rate of 97.3% after 675 cycles for its 40 Amp-hour (Ah) solid-state product at room temperature.

Toyota has announced an investment of up to JPY 730 billion ($5.2 billion) for EV battery production in Japan and the United States. The new facilities, scheduled to start production between 2024 and 2026, will increase Toyota’s battery production capacity by up to 40 GWh. Specifically, the Japanese carmaker will invest around JPY 400 billion in Himeji Prime Planet Energy and Solutions. The battery joint venture between Toyota and Panasonic specializes in prismatic automotive batteries. It will also invest JPY 325 billion in its newest North American facility, Toyota Battery Manufacturing, North Carolina.

Honda and LG Energy Solution have announced plans to build a new $4.4 billion lithium-ion battery plant in the United States to meet demand in the rapidly growing North American EV market. The plant will have an annual production capacity of approximately 40 GWh. The pouch-type batteries produced at the new joint venture plant will be supplied exclusively to Honda facilities in North America and will be used in Honda and Acura electric models. While the location for the joint venture plant is yet to be finalized, the two companies aim to begin construction in early 2023, in order to enable the start of mass production by the end of 2025. In August, Honda’s Acura subsidiary announced its first all-electric model. The Acura ZDX SUV is based on the Ultium platform from General Motors and is scheduled for market launch in 2024.

BMW Group said it is commencing in-house, small-scale production of fuel cells for its iX5 in Munich, Germany. The small series of hydrogen cars will go into service in the next four months for test and demonstration purposes, targeting the premium segment. The fuel cells generate a high continuous output of 125 kW/170 hp, paired with an electric motor featuring fifth-generation BMW eDrive technology, and a battery that enables the powertrain to deliver 275 kW/374 hp. BMW has collaborated with Toyota Motor on fuel cells since 2013.

Ganfeng Lithium announced plans last week to invest CNY 21.3 billion ($3.07 billion) in four new production centers. Solar power storage devices will be among the products to be produced at a CNY 6.2 billion fab in Xinyu, Jiangxi province, with an annual production capacity of 10 GWh to be built by October 2023, and at a separate, 6 GWh, CNY 3.5 billion site nearby. A CNY 9.6 billion, 20 GWh facility in Chongqing will make solid-state lithium products for electric vehicles and other transport uses. It is set to have a two-year timetable, with construction to start three months after the land paperwork is signed. A fourth, CNY 2 billion fab will produce 2 billion units per year of small polymer lithium-ion devices for items such as consumer and wearable electronics. Ganfeng Lithium last week posted first-half net profits of CNY 7.35 billion.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

It seems that everyone want a piece of the cake now. Competition is not bad. However, I am wodering if we have enough resources to actualy support the capacities of these new factories. I would like to see a major shift in the way batteries and cell are made to allow more efficient recovery of materials at the end of their life. We need a sustainable and circular economy for batteries to avoid demand shortages in materials for battery, and environment polution.