In its analysis of renewable power purchase agreement (PPA) transactions that took place in Europe in June, Zurich-based renewable energy consultancy Pexapark found that rising gas and electricity prices have not led to an increase in PPA prices.

The tension between Russia and Europe has continued to increase in the past month. The uncertainty around the reopening of the Nord Stream 1 gas pipeline from Russia to Germany and increased risks in gas storage – whose levels in Europe are currently at 59% of its capacity, slightly below the 61% average of the 2015-2020 period, have led to a drastic rise in gas and electricity prices expected for 2023.

European governments have launched emergency plans and measures. Germany, for example, plans to reclaim 6 GW of reserve coal and oil power plants and is reassessing its exit from nuclear power, while Austria and other countries have approved state subsidies for affected industries. France has announced that it will fully nationalize energy company EDF, which owns most of national nuclear power assets.

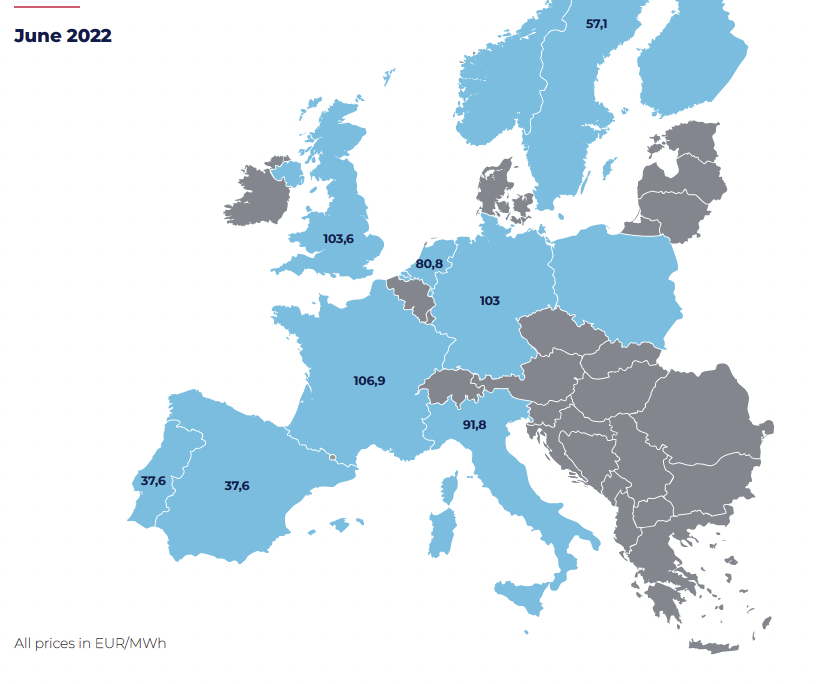

The rise in gas and electricity prices, however, has not been reflected this time in PPA prices. The war continues to prevent the signing of PPAs and has caused prices to rise in most European markets, with Pexapark's Pexa EURO index posting an overall decline of 11.3% month-on-month for June.

Image: Pexapark

The monthly Pexapark index also reported that Estonia saw its first PPA last month between Eesti Energia and Telia, while Denmark has been in the lead in terms of announcements.

In line with the trend of recent months, the vast majority of new contracts were driven by companies, accounting for nine of the 10 deals signed in June, with the remaining transaction carried out by a utility. Solar power dominated the June PPAs with six deals.

The total new capacity announced amounts to about 380 MW. However, most of the announcements did not reveal the exact capacity under the PPAs. The largest agreement by volume in June was between Statkraft and H2 Green Steel for the supply of 2 TWh per year of hydroelectric energy for seven years. These large volumes will be used to power a green hydrogen electrolyzer for green steel production in Sweden.

Analyzing the first six months of the year, Pexapark said there was a decrease of around 15% in PPAs and 44% less new capacity compared to the activity of the first half of 2021, which was the strongest to date.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

3 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.