In recent years, the global installed capacity of wind and solar has shown steady growth and now energy storage is expected to follow in their footsteps. According to Taiwanese analyst TrendForce, lithium iron phosphate (LFP) battery storage has significant advantages over other technologies and is becoming the primary installed capacity of new energy storage around the world.

This echoes earlier findings from US analyst Wood Mackenzie, which predicts that LFP’s market share will surpass nickel-cobalt-manganese (NCM) in 2028. Last year, NCM still accounted for half of the market, but LFP batteries began to grow in prominence due to their competitive cost, long lifecycles, and high safety performance.

According to TrendForce, the cumulative installed capacity of global renewable energy in 2021 stood at 3,064 GW. This highlights the pressing need for energy storage to balance intermittency.

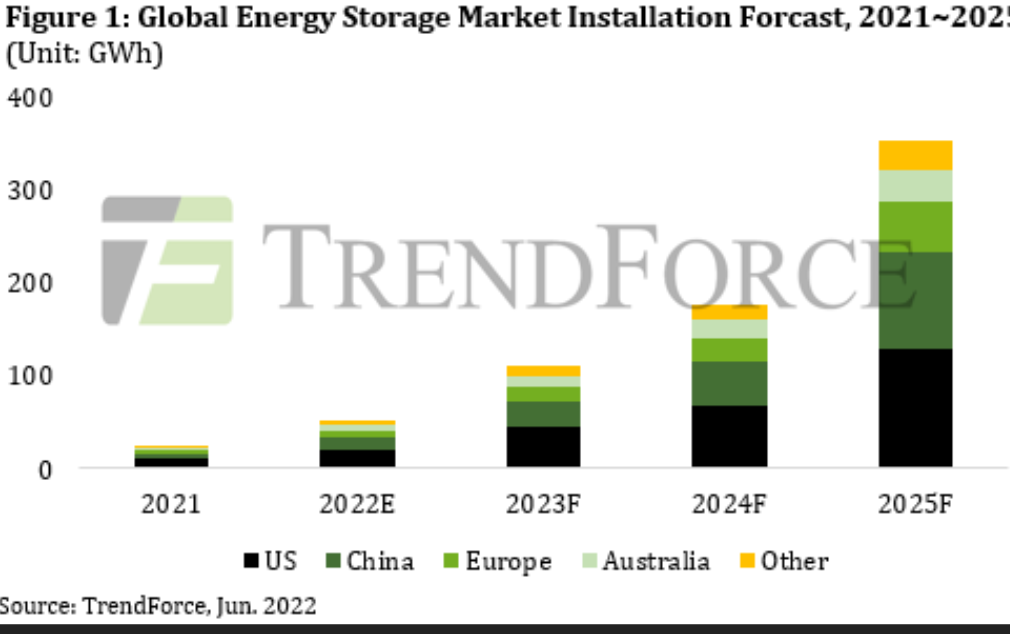

In 2021, the global energy storage market maintained a high growth rate. Newly installed capacity was 29.6 GWh, up 72.4% year on year, said TrendForce. Going forward, the global energy storage market is set for rapid expansion, reaching 362 GWh by 2025.

China is soon expected to overtake Europe and the United States. According to TrendForce, the country’s energy storage market is expected to break through 100 GWh by 2025.

In the United States, due to the current stagnation in newly installed pumped hydro storage capacity, future growth will focus on electrochemical energy storage. Newly installed capacity in the United States is predicted to reach 136 GWh in 2025. Meanwhile, Europe is predicted to install 54 GWh by 2025 buoyed by various geopolitical forces at play, said TrendForce.

Looking at the battery storage market, TrendForce noted that the dominance of South Korean manufacturers, such as Samsung and LG, has been reduced to a certain extent. This is partly due to the accelerated expansion of Chinese battery makers that remain faithful to the LFP battery tech, such as BYD and CATL.

When it comes to energy storage power conditioning systems (PCS), the bulk of them originate from solar inverter manufacturers. This market segment is expected to become increasingly competitive in the future for established players, such as SMA and Sungrow, as well as newcomers.

TrendForce said system integration will see relatively fragmented competition, with small- and medium-sized companies in the majority. However, some leading upstream companies, such as Sungrow and NextEra Energy, will also be part of the mix, it added.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.