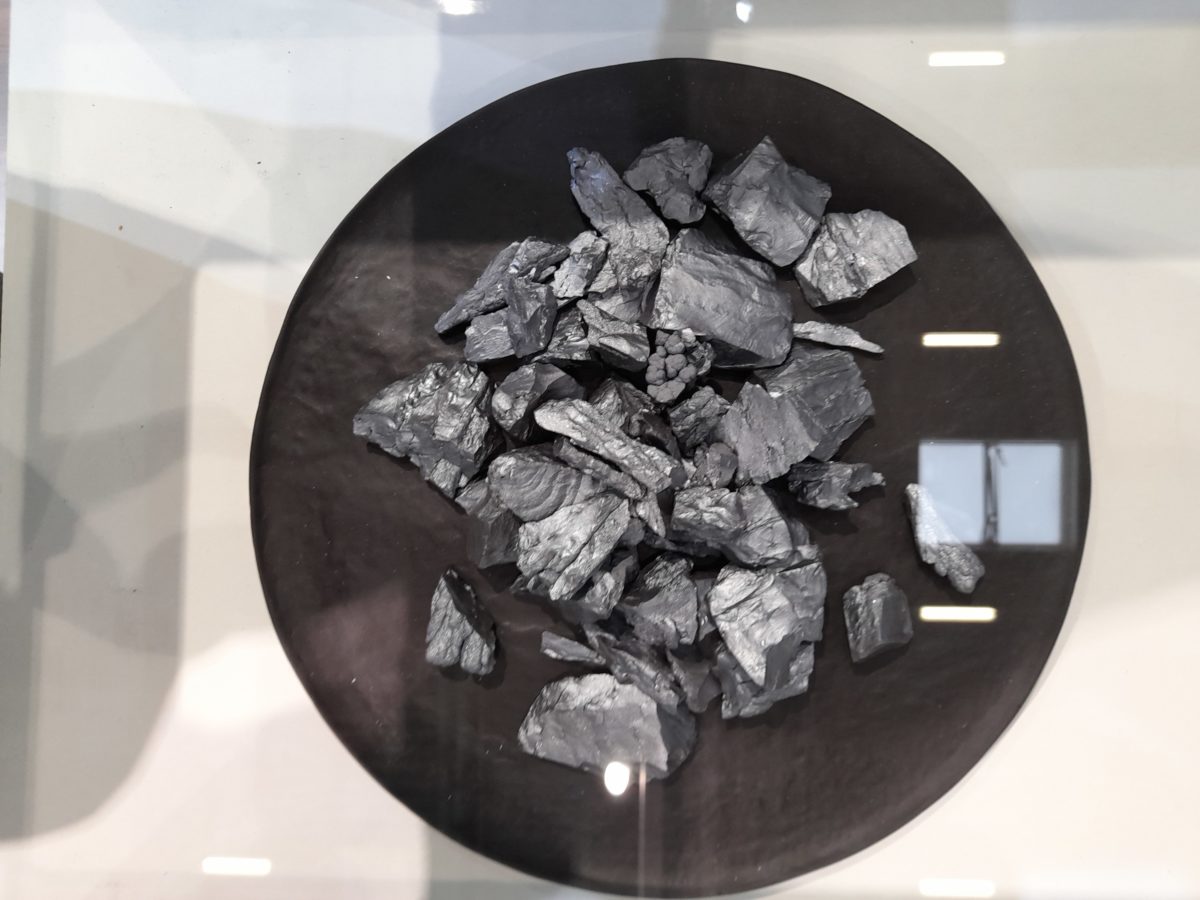

The silicon branch of the China Nonferrous Metals Association (CNMA) this week reported the price of polysilicon reached CNY 255/kg ($40.04, based on yesterday's exchange rate), thus continuing the upward trend that started 13 weeks ago. The latest price had risen 0.32% from last week. The association also revealed polysilicon production output in China this month is expected to be between 54,000 and 55,000 metric tons, with poly imports anticipated to amount to 6,000-7,000 tons. The CNMA estimated wafer production this month will be around 24 GW and said supply and demand will remain tightly balanced.

NYSE-listed polysilicon company Daqo New Energy on Wednesday acknowledged it risks being de-listed from the US exchange in early 2024 unless it opens up its books to US public body the Public Company Accounting Oversight Board (PCAOB). Daqo said it had been identified by financial regulator the US Securities and Exchange Commission (SEC) as having used an auditor whose working paper could not be fully inspected by the PCAOB, possibly after publishing its 2021 results to the SEC. Under the Holding Foreign Companies Accountable Act, in the US, listed businesses who breach that requirement for three consecutive years can be removed from a US exchange. Daqo, via the Cision press release platform, on Wednesday said: “The company has been actively exploring possible solutions to best protect the interest of its stakeholders.”

pv magazine print edition

The Central Committee of the Chinese Communist Party and the State Council have issued a joint document calling for a unified national energy market. Construction of the system should be promoted by improving the oil and gas market, standardizing the construction of oil and gas trading centers, and accelerating the establishment of a unified natural gas pricing system. The authorities also want a national electricity trading center and improvement of a unified national coal trading market. Such public resource trading platforms will enable a unified, national carbon-emission market to be set up and will promote green product certification and labeling.

Polysilicon maker and inverter company TBEA said its net profits rose 196% last year. The business achieved revenue of CNY 61.3 billion, with a year-on-year increase of 37%. Net profit was CNY 7.3 billion.

Battery capacity

The state-owned Xinhua News Agency has reported the country's lithium-ion battery capacity hit 82 GWh at the end of February. Electric vehicle-related capacity reached 30 GWh and stationary storage capacity hit 9 GWh, according to the news service, which was citing Ministry of Industry and Information Technology data.

State-owned clean energy company Beijing Energy International plans to spin off 400 MW of its solar project capacity to investors as an infrastructure real-estate investment trust (REIT), the company announced a week ago. If the move is approved by the authorities, the receipts will be used to finance more solar and wind plants, the developer said.

TBEA-owned polysilicon maker Xinte Energy on Monday reiterated its 100,000-ton-per-year poly fab in Inner Mongolia is on track to open in the middle of this year. The company provided the update while announcing plans to spend CNY 75.4 million on housing for staff at the fab, with the properties to be bought from the Baotou Kangyang Real Estate subsidiary of the Xinjiang Tebian business which is 40% owned by Xinte Energy director Zhang Xin. Xinte also plans to list an unspecified volume of its solar and wind power projects in Shanghai as infrastructure REITs, with the Sunoasis clean power unit of its parent to invest in some of the stock and manage the Shanghai business unit.

Developer Beijing Enterprises Clean Energy last week announced it generated almost 21% less electricity from its solar plants in January than in the same month of last year, when there were more favorable weather conditions. The company said 205 GWh was generated in January 2021 and 162 GWh was produced three months ago. In February, however, the year-on-year comparison marked a decline of less than 1% in output, from 195 GWh in February last year, to 194 GWh two months ago and last month's output rose 2.5% year on year, from 235GWh to 241GWh.

Solar projects

Solar panel glassmaker Xinyi Solar wants to transfer another four solar farms, with a total generation capacity of 650 MW, to its Xinyi Energy non wholly owned solar project subsidiary. The deal will be subject to a vote by Xinyi Energy shareholders and the sale price will be based on the most up to date numbers from the projects concerned, with the Xinyi businesses on Monday estimating a value of CNY 2.56 billion. News of that proposal came four days after Xinyi Energy raised HKD 780 million ($99.5 million) by issuing 188 million shares at HKD 4.14 per share.

Solar developer and investor China Smarter Energy last week said the High Court had adjourned the hearing of a winding up petition against it, issued by investor Nine United, until May 4.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

4 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.