From pv magazine 03/2022

Change is the only constant. That is how we would summarize, in one sentence, the findings of our “European Market Outlook 2022” report. In essence, this report documents a milestone year of major adaptation, the subplot of the much broader journey of the energy transition.

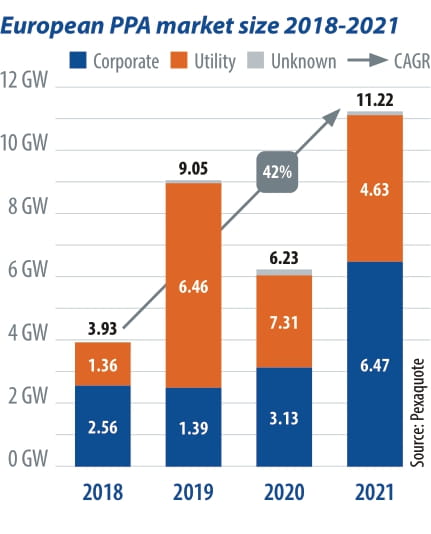

The changes we have seen in the market for power purchase agreements (PPAs) have been forced by turmoil and unprecedented volatility. And yet we have just had another record year, with the most-ever annual renewable PPA transactions completed in Europe – up more than 50% since 2018.

Nevertheless, the impact that volatility has had on those agreements is fundamental to the post-subsidy merchant market. The findings of our report strongly indicate that new operating models for renewables are rapidly emerging, putting proactive energy sales and risk management at the core.

Record year

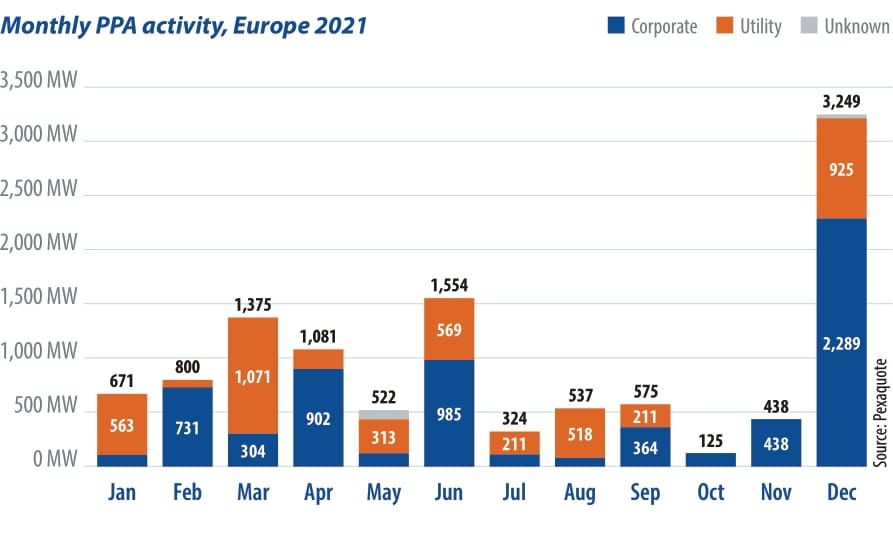

The recovery of PPA deal flow following the pandemic, which saw prices plummet, commenced in the fourth quarter of 2020. The first half of 2021 continued this growth trajectory, sending positive signals to the market that the recovery was here to stay, and market participants had adapted to the “new normal.” But the second half of the year was characterized by an energy crisis that led wholesale electricity prices and price volatility to unprecedented highs across Europe. In October, when the energy pricing crisis really sank its teeth into the PPA market, PPA deal making came to a near standstill, as advanced negotiations were disrupted by the sudden price volatility.

The most conducive environment for PPAs is when price changes are moderate, yet the situation did not normalize throughout the rest of the year and continued into 2022. Remarkably, given the current environment, most transactions that were halted during the price wobbles managed to close before the end of the year, making December 2021 the strongest PPA deal month ever recorded volume-wise.

The corporate PPA market retained its momentum due to both large buyers, such as Amazon, and a supportive environment that pushed more corporates to explore PPAs as a proven, relatively fast and effective route to decarbonize part of the supply chain or their operations. For the first time, the volume of corporate PPAs significantly outstripped the volume of utility PPAs.

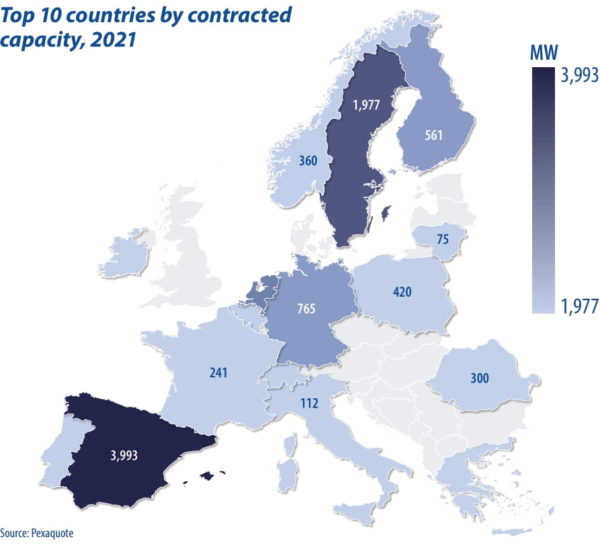

Most PPAs were once again transacted in Spain, with a total of almost 4GW of disclosed contracted capacity – one-third of the year’s accumulated capacity in Europe. In our last outlook, we expected more PPAs to be agreed in Germany and had anticipated that the potential of solar in Italy might be realized. But while Germany is on the ascent, permitting backlogs are still not being resolved in Italy, which is stifling its growth.

Volatility and impacts

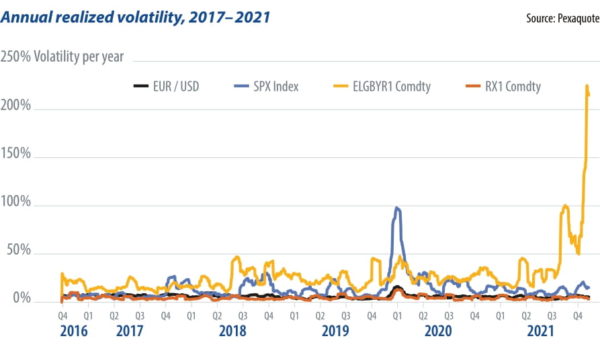

Prices are continuously subject to fluctuation, measured via volatility, which is a central tool to how utilities and trading houses assess financial risk. In 2021 a series of increases in energy-related commodities such as gas, coal and carbon credits drove electricity and therefore PPA prices to new highs. Numerous bullish events led to such increases, such as multi-year low European gas storage levels and a gas to coal demand shift increasing the value of carbon credits.

Annualized volatilities of front-year contracts, a key driver in PPA pricing, reached volatility levels of up to 250% last year – five times the level of usual spikes.

As a result of the fourth-quarter price surge, the principal approach utility offtakers use to risk manage their PPA book, known as stack and roll hedging, was severely impacted. Price correlation between hedges and PPAs broke down. Such price moves resulted in significant mark-to-market losses and cash drains on margin payments.

PPA deal making entails risk transfers between counterparties. At Pexapark we illustrate the price adjustments made by utilities to cover the hedging and warehoused risks as risk discounts to fair value price assessment. Due to the current situation, utilities were marking up their discounts in an unprecedented manner of up to 40%, or halting risk-taking all together.

As utilities and corporates have different risk profiles, and since corporates are procuring electricity for their own use and do not have to manage price risks daily, corporates may outbid utilities for offtake agreements with quality projects. We define the difference in risk profiles as liquidity cost. The differential between the two types of offtaker reached high single- digit €/MWh in key markets. Through 2021, for corporates, the gains of signing have been higher than their risks. They are willing to pay a higher PPA price.

Risk management

This sparked another market shift. Long-term pay-as-produced (PAP) structures have the tendency to become more expensive for the sellers and are rarer in mature markets. The most notable observation of such a trend occurring during 2021 took place in Spain, where project owners and investors found it significantly more difficult to source and close a PAP volume structure. Whenever the option was available, it came at significant discount for sellers compared to alternative PPA structures. This increase in discounts of PAP PPAs led to a surge in interest and demand for baseload-type PPAs – where a fixed volume is agreed for every hour of a period, either monthly or annually.

Shorter-term and baseload-type PPAs already mark a steep change from the typical risk profile used for traditional renewables investment. Changes in daily capture price and lower-than-expected production volumes led to cash outflows and losses in markets such as Sweden. Sustained and continuous high volatility of capture rates makes baseload PPAs more uncertain, leading to a need for new energy risk management approaches.

Market squeeze

We believe the total long-term PPA market will languish in absolute numbers. and availability and pricing for long-term PPAs in many markets will be tested due to the maturity of some markets and the impact of recent turmoil. Even though corporates have an edge at the moment, many PPAs are structured for “sunny weather,” giving rise to more risks for sellers.

A possible scenario could prolong the life of the 10-year PPA market, though. As utilities are born intermediaries, the two offtake types could complement each other, as they have already. Suppose a utility can derisk its stack-and-roll hedging program with a few long-dated corporate offset deals. In that case, a multiple of the offset volumes could be realized in long-term PPA volumes with investors to enable additional renewables build-out.

Next-gen utilities

We also expect that a series of new renewable investment funds will pursue “next-generation utility” style models. Short-term PPAs and baseload structures are pushing investors to upgrade their operating models, with origination teams, portfolio management capabilities and risk management infrastructure. Take a step back, and you can see that these investors are becoming the next-generation utilities. Large funds, in particular, are starting to turn the implicitly given diversification into quantifiable benefits by managing their assets on a portfolio basis.

We predict the launch of new, large funds in renewable investment capitals like Hamburg, London and Copenhagen. Such players will bring the risk management skills of a trading house to the table, aiming to capture higher returns from investing and operating on a portfolio level. We believe that in terms of volume, such investment could start to eclipse the classical long-term PPA market.

Corporate buyer class

Where rules allow, offshore wind capacity offtake contracts could be struck with corporates out of the mega buyer class. Mega buyers, such as global data centre behemoths – like Amazon, large chemical companies and consumers planning Power-to-X facilities, have gargantuan and increasing energy needs.

Their sheer volume needs lead to the only renewables asset class able to generate such volumes, and that is offshore wind. Due to competition, equity may also be required to secure such large volumes. Our basis for this prediction comes from a truly one-of-a-kind deal that took place in 2021, when BASF acquired a 49.5% stake in Vattenfall’s 1.5GW Hollandse Kust Zuid offshore wind farm in the Netherlands.

The PPA boom is part of a much wider, far reaching energy transition. While a few years ago, PPAs were merely a replacement for feed-in tariffs, the market has quickly evolved, and we are now seeing the contours of a new renewables investment and operating model emerging from frenetic deal-making activity.

The market is maturing, and investors and operators of renewables will become bigger, more diversified across technologies and markets, and masters of energy risk management.

About the author

Luca Pedretti is the co-founder and COO of Pexpark. He has more than 15 years of experience in energy risk management for renewables in open markets, and has valuated, structured, negotiated and managed PPA transactions across Europe. Read Pexapark’s full 2022 Market Outlook at: https://pexapark.com/european-ppa-market/

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

4 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.