A state-driven bail-out of a Chinese renewables company could lead to 735MW of new solar generation capacity, including agrivoltaic and fishery-PV pilot projects.

Solar, wind, and clean heat project developer Beijing Enterprises Clean Energy yesterday revealed the major transaction which prompted trading in its shares to be suspended from Monday last week until this morning.

With the renewables developer facing a HK$3 billion (US$383 million) loan repayment in June, an attempt by China Shandong Hi-Speed Financial Group Ltd (CSFG) in November to purchase almost a quarter of the company's stock for HK$1.27 billion (US$162 million) fell through this year due to concerns Beijing Enterprises would not be able to secure sufficient shareholder, investment fund, and financial authority approvals.

pv magazine print edition

CSFG, which has the Shandong Gaosu Group owned by the government of Shandong province as its controlling shareholder, has instead returned with an offer to purchase 48.8 billion new shares in the clean energy developer for HK$0.096 (US$0.012) per share.

The new stock would be the equivalent of around 77% of the currently issued shares in Beijing Enterprises and would enable CSFG, via its Profit Plan Global Investment Ltd subsidiary, to hold 43% of the enlarged company while generating a net HK$4.68 billion (US$598 million) for the developer.

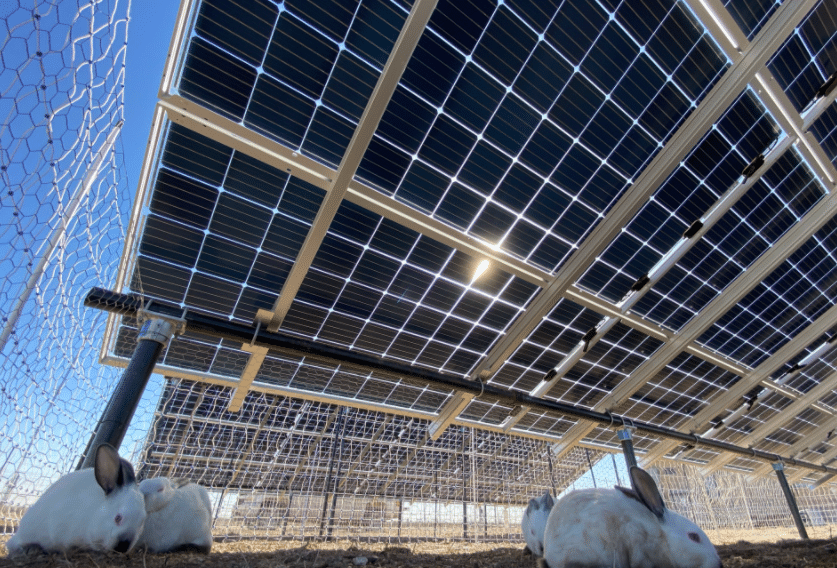

Beijing Enterprises yesterday told the Hong Kong Stock Exchange it would use some of that windfall to finance 80MW of new, conventional solar park generation capacity; a 100MW agrivoltaic pilot project; a 50MW fishery-PV pilot; and 505MW of other agri and aquaculture-linked photovoltaic generation facilities.

The developer, which has the stock code Be Clean Energy, will have to settle debts of HK$469 million (US$59.9 million) in the second half of the year, on top of the HK$3 billion due to an, unnamed bank. Be Clean said it is still attempting to refinance the larger of those two commitments. If the developer fails in that effort, it will have to devote around 64% of the money from CSFG's shares subscription to settling the debt, plus around 10% of the windfall for those other, second-half commitments.

If Be Clean manages to keep its creditors at bay, it said yesterday, it would instead spend HK$1.82 billion (US$232 million) of the shares cash on debts due after June and HK$1.7 billion (US$217 million) repurchasing stock in its Tianjin Beiqing Electric Smart Energy solar and wind development unit. Be Clean last month walked away from a plan to spin off the Beiqing Smart unit on the Shanghai exchange via a complex asset swap with third party SEC Electric Machinery Co Ltd, which would have become a Beijing Enterprises subsidiary.

Shareholder votes

The proposed bail-out will need to be approved by independent shareholders in Be Clean, who will also be asked to approve a waiver to the requirement that CSFG also make an offer to buy the rest of the stock in the developer. Independent investors in CSFG will also have to approve the proposed subscription to the Be Clean Energy shares.

Although CSFG would only own 43% of the enlarged Be Clean, in the event of the plan winning approval, it would nominate eight members of a new 12-person board, according to the announcement made yesterday.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.