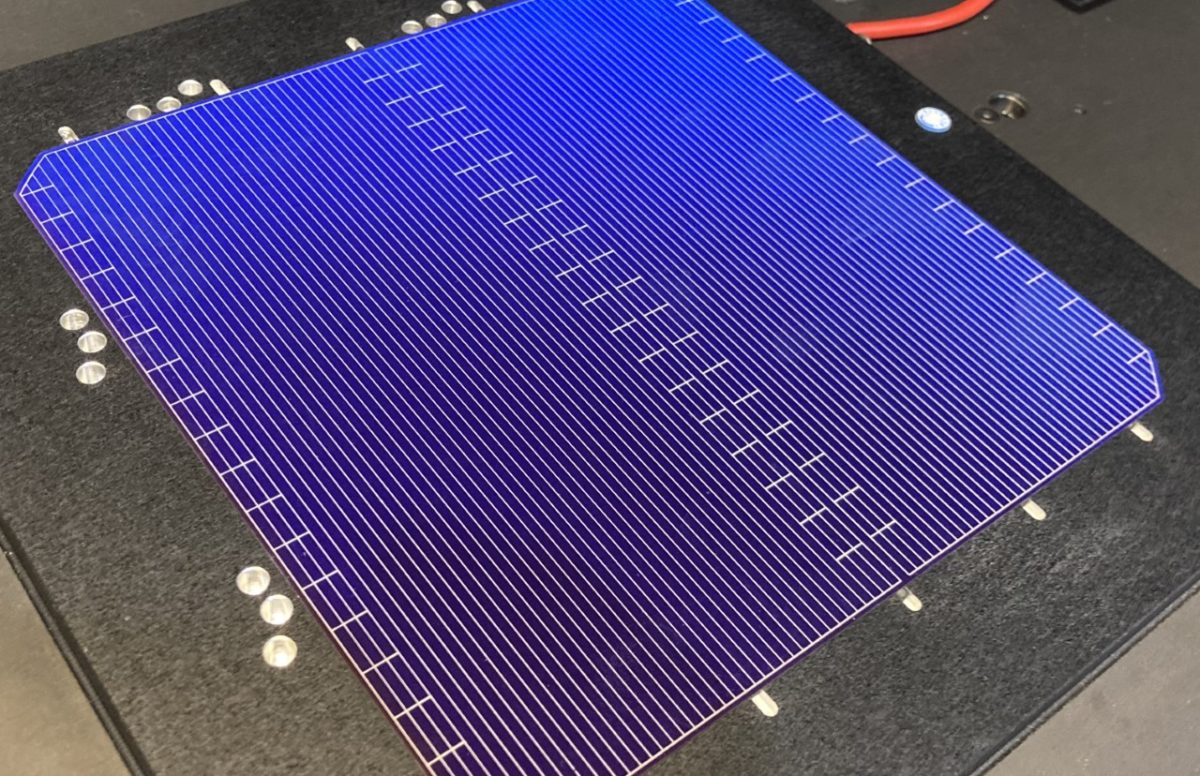

Solar manufacturers Zhonghuan Semiconductor and Longi have both raised the price of their 182mm wafers.

Zhonghuan Semiconductor on Friday announced its 160um-thick wafers had risen in price by RMB0.25 (US$0.04) to RMB6.65 (US$1.05) per piece for a rise of 4% since the previous announcement, on Jan. 26.

Longi followed suit yesterday, raising the price of its “M10” 182mm, “size P” products RMB0.20 (US$0.03) per piece to RMB6.70 (US$1.06).

Pegged

Both producers made no change to the price of their other wafers, with Zhonghuan Semiconductor's 210mm wafers pegged at RMB8.85 (US$1.40) per piece and Longi charging RMB5.45 (US$0.86) for its M6, 166/223mm products and RMB5.25 (US$0.83) for its G1, 158.75/223mm output.

Solar prices have continued to rise since January, with solar panel input material polysilicon having risen from RMB230/kg (US$36.38) in early January to RMB243.60 (US$38.53) this week. Wafers have followed the trend, with Zhonghuan Semiconductor having charged RMB5.70 (US$0.90) per piece at the end of December for its 182mm products, and RMB7.70 (US$1.22) for the 210mm variety. That means Friday's prices marked rises of 16.7% and 14.5%, respectively, since the end of 2021.

Industrial waste heat company Shuangliang Eco-energy has signed purchase orders for Czochralski crystal growing equipment as it bids to expand its solar wafer manufacturing operation.

Shuangliang, in a financial update which yesterday reported a year-on-year revenue rise of 85% last year, to RMB3.83 billion (US$606 million) said it had signed crystal growing equipment supply deals with Chinese company JSG and US-owned peer Linton Kayex.

The buyer, which reported a net profit to shareholders of RMB310 million (US$49 million) from last year's trading, said the JSG deal would be worth RMB809 million (US$128 million) and the agreement with Linton Kayex RMB621 million (US$98.2 million).

U-turn

Cell maker Aiko Solar has abandoned plans for a private share placement which was intended to raise RMB3.5 billion (US$554 million) towards the cost of cell fabs in Zhuhai and Yiwu.

The company cited “changes [which have] taken place in industry conditions, [the] market environment, financing opportunities and other related factors.”

Trading in the stock of renewables developer Beijing Enterprises Clean Energy has been halted since yesterday morning pending “an announcement pursuant to the Hong Kong Code on Takeovers and Mergers which constitutes inside information of the company.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.