Portuguese government advisory body and permitting authority the Direção Geral de Energia e Geologia (DGEG) has extended the deadline for developers who secured solar project capacity in national tenders in 2019 and 2020 to bring their sites to fruition.

Previously, national tender program rules stipulated developers would have to secure generation licenses within 18 months for project sites subject to environmental impact assessments, and within a year for facilities that did not require such permits. Those grace periods have now been extended to 37 and 27 months, respectively, as a result of the Covid-19 pandemic, the DGEG said last week.

Few tendered projects are installed

The tenders held in 2019 and 2020 appeared to set new world records for the low price fixed for the solar-powered electricity generated at the most competitive sites, although there was some dispute about whether the tariffs generated accurately reflected how all the energy concerned would be sold.

The 2019 exercise set a low of $0.016/kWh (€0.01435 at today's exchange rate) and that benchmark fell to $0.01316/kWh (€0.01180) the following year but few of those solar projects have actually been installed yet, with construction yet to begin on the vast majority of the 1.15GW of generation capacity allocated in 2019 and the 670MW earmarked in 2020.

Some of the 2020 projects are still in the process of land acquisition while others are beginning their environmental impact assessments.

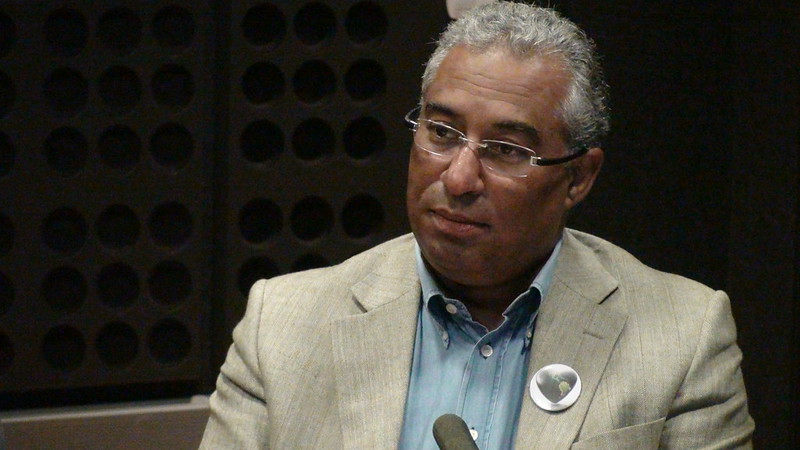

The new, centre-left Socialist Party government of António Costa – which secured an unexpected parliamentary majority yesterday in a snap election called after the previous left-wing coalition it had led collapsed – is set to oversee a floating solar tender in the spring.

João Garrido, founder and manager of Lisbon-based utility scale solar consultant Caparica Solaris, told pv magazine the pandemic was not the only reason for delays in solar plant construction.

The consultant pointed to “climbing prices of … equipment (e.g. panels, cables etc) and the fact that some investors are locked in contracts with very low [solar electricity price] tariffs. One should note that some projects are locked into tariffs [of] around $22/MWh [$0.022/€0.01973 per kilowatt-hour] and the market [wholesale electricity] price at present is above $220/MWh.”

The PPA market segment

With the large scale solar capacity driven by national tenders slow to take shape, the “merchant solar” route to market – where solar fields are developed without government support, to sell direct to electricity consumers which sign power purchase agreements – is still blocked by the refusal of the DGEG to process a mountain of applications.

A previous Costa-led government had, in 2019, attempted to define a policy framework for merchant renewables facilities but the apparently loosely-written nature of that permitting regime prompted a flood of applications for a mammoth 253GW of generation capacity, most of it solar, by Feb. 2020.

An overwhelmed DGEG halted the processing of merchant solar project applications in March 2020, stating it was doing so as a safety measure to halt the spread of Covid-19. That stop – which does not apply to self-consumption, pilot plants, or hydrogen projects – was this month extended through March and the prospect of merchant solar applications starting to be processed from April appears slim after the DGEG said it was reconsidering the criteria which should be applied to such generation sites. The government body said it was doing so in “the context of high prices for natural gas, which impacts the price of electricity [and] reinforces the need to invest in the transition to a more sustainable energy model based on renewable energies.”

Solar consultant Garrido said the frequently-changing nature of the proposed merchant solar rules is leading to uncertainty and chaotic licensing rather than a clear regulatory landscape.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.