pv magazine: What are your thoughts on the 2021 solar market?

Allen Cao, General Manager of International Business, Arctech: The buzzword for the solar PV industry last year was definitely “price rises”. 2021 marked the beginning of China’s 2060 carbon-neutral policy target and a series of favorable policies made the market's sentiment on renewable energy unprecedentedly high. The scaled-up expectation and the mismatch of upstream and downstream production capacity have caused the price of silicon materials to rise. Due to the accumulation of power restrictions and other factors, the price of silicon materials reached a daunting 10-year high in the fourth quarter, and soaring ocean freight costs led to a substantial increase in the cost of installations. These factors meant that module manufacturers suffered inevitable and abundant losses after signing contracts. There were also some breaches of sales contracts on the back of this, which affected the credibility of the solar industry in general.

Allen Cao, General Manager of International Business, Arctech: The buzzword for the solar PV industry last year was definitely “price rises”. 2021 marked the beginning of China’s 2060 carbon-neutral policy target and a series of favorable policies made the market's sentiment on renewable energy unprecedentedly high. The scaled-up expectation and the mismatch of upstream and downstream production capacity have caused the price of silicon materials to rise. Due to the accumulation of power restrictions and other factors, the price of silicon materials reached a daunting 10-year high in the fourth quarter, and soaring ocean freight costs led to a substantial increase in the cost of installations. These factors meant that module manufacturers suffered inevitable and abundant losses after signing contracts. There were also some breaches of sales contracts on the back of this, which affected the credibility of the solar industry in general.

As you mentioned, price rises impacted the solar installation market and required more stringent system cost controls. How has this affected sales of PV mounting systems and trackers?

It is difficult to pass on the increased costs from the supply chain to end-users, which have resulted in the decline of profit margins for upstream component manufacturers. In addition, solar trackers are usually used in large-scale utility PV projects. For projects that have finalized their financial model, the substantial cost increases in the supply chain led to a shortage of project funds, thus project owners had to communicate with electricity power buyers to postpone their project's grid connection time.

For those in the development process, project owners have been on the fence about whether to carry on with the projects. In some price-sensitive markets, a few projects have been forced to change to solutions with lower initial costs like using multicrystalline panels and racks. These factors will cause temporary difficulties for tracker providers in specific markets.

Owners of power plants have begun to pay more attention to LCOE and to pursue more electricity output when the initial investment cannot be effectively reduced. Solar trackers can help them by continuously optimizing power generation, and therefore they are increasingly popular with power stations.

What solar markets are key for Arctech?

Arctech is committed to becoming the world's top supplier of solar tracking solutions. Thus, strategizing the global market has always been our top priority. According to Wood Mackenzie Power & Renewables’ 2021 report, Arctech ranked first in Asia-Pacific in terms of market share for four straight years. In 2021, we realized the 2.1GW Abu Dhabi project together with other large-scale projects worldwide. The company has successfully maintained its leading position in regions including India, the Middle East, and Latin America. The company also witnessed a breakthrough in the US market last year and will continue to focus on this market in 2022.

How does Arctech view the BIPV market?

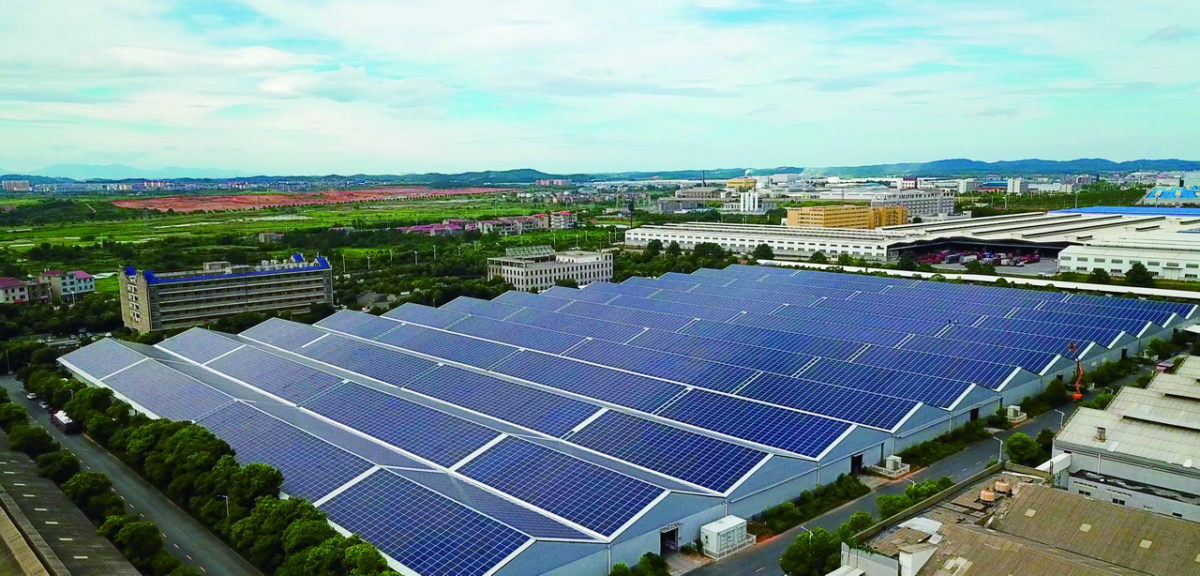

In recent years, Building-Integrated Photovoltaic (BIPV) has become a mainstream solution for distributed photovoltaic power stations. Arctech began exploring BIPV solutions in 2016, and it has managed to expand the application scenarios through the years. For instance, our “Smart Rooftop BIPV Solution” won recognition in the ceramic industry in China. From the 40.9MW Marco Polo Ceramics BIPV project in Fengcheng to the 11.5MW BIPV project in Foshan, and the 120MW BIPV project in Gaoan, Jiangxi, which will soon become the world’s largest BIPV project, the highly innovative and cost-effective BIPV solutions offered by Arctech have helped to create many landmarks. In 2022, Arctech will continue to empower more companies from various industries to achieve zero-carbon transformation with BIPV solutions.

What is Archtech’s manufacturing capacity? Are expansion plans on the cards?

The company currently has a production capacity of 6.4GW, and there is an additional 2.8GW of production capacity at our Fanchang manufacturing base, which is in trial operation. We also have a manufacturing base with a capacity of 3GW in India which is set to enter operation in the first half of 2022. In addition to our own production capacity, we use OEM operators in overseas markets to indirectly expand our capacity and meet the growing logistics cost challenges.

What new products or solutions is Arctech planning to launch in 2022?

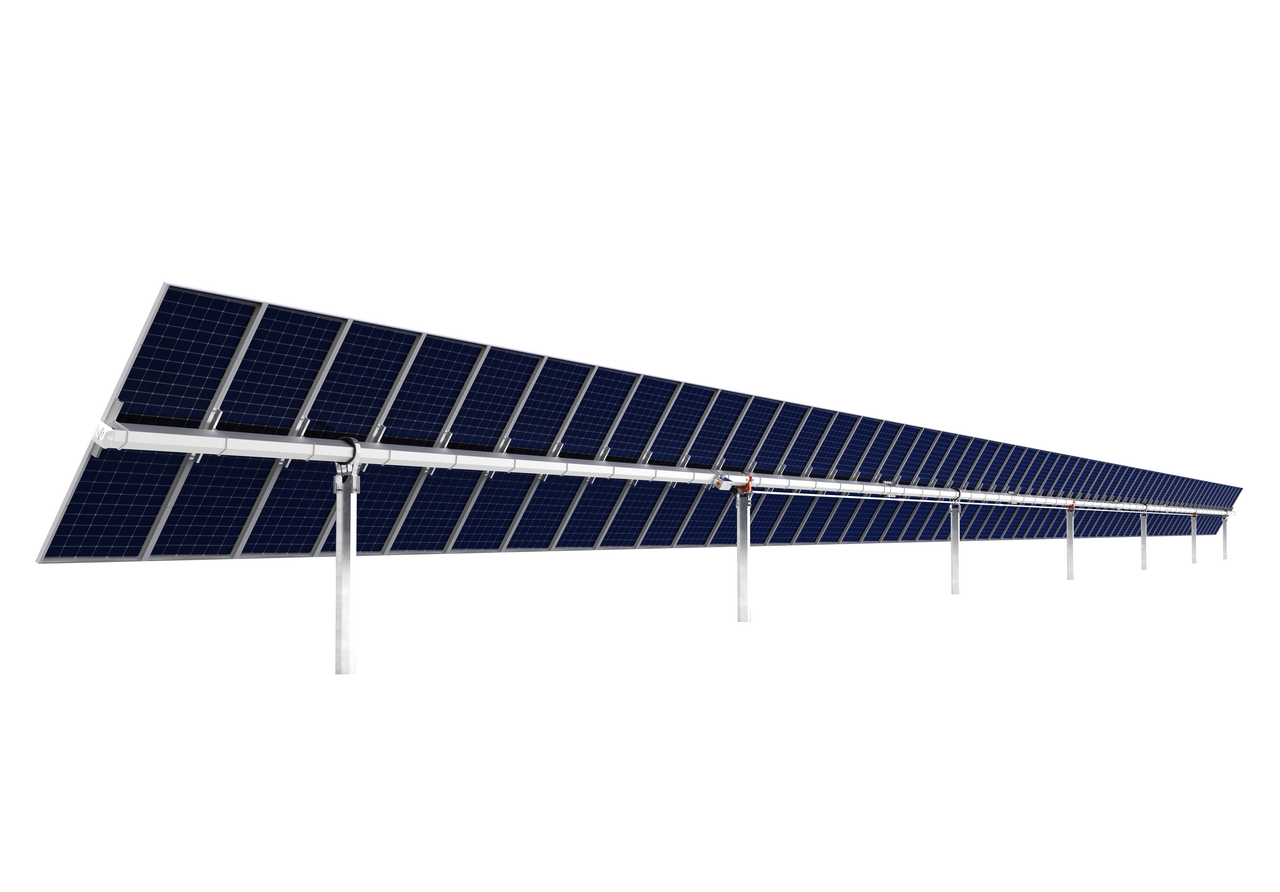

Arctech launched its Skyline II tracking system in October 2021, meaning the company has fully entered the era of synchronizing multi-point driving systems. From the multi-row trackers to SkyLine I (one in portrait trackers) and SkySmart I (two in portrait trackers), to SkyLine II (1P with multi-point driving mechanism) and SkySmart II (2P with multi-point driving mechanism), Arctech has been enhancing its leadership in research and development.

Image: Arctech

SkyLine II is the first 1P solar tracker equipped with multi-point drive mechanisms in the industry. It can be adapted to mount the optimum number of strings per tracker for each PV module, allowing larger bending and torsional capabilities with minimum steel utilization, fewer columns, and they can withstand higher wind stow thresholds. SkyLine II is a very stiff tracker that mounts a synchronous multi-point drive mechanism. It has increased the wind stow threshold to 22m/s, the highest in the industry so far, which allows it to track the sun for many more hours compared to the industry standard. The rigidity provided by the multi-point drive mechanism also allows it to safely stow to 0-degree. A case study in Texas, US, shows how the SkyLine II can generate more power. Compared with other projects that are installed with traditional trackers, SkyLine II allows for an annual energy collection that is 1.6% higher. For a typical plant Capex and PPA pricing in the area was equivalent to an IRR increase of about 0.2% or $3 million more in revenue throughout the life of the project.

How do you see the solar PV market developing in 2022?

2022 will be a year of opportunities and challenges. On one hand, we see that as the price of silicon materials and wafers have begun a downward trend, and the projects postponed in 2021 are very likely to be back on the right track in 2022, it is highly possible that we will witness a sharp rise in year-on-year installation capacity, which is a promising sign. On the other hand, we will face challenges from the market on demanding a stronger delivery capability. We will also stay alert to the challenges and uncertainties on installed costs brought by the coronavirus pandemic, namely high international logistics costs, inflation risks, exchange rate fluctuations, etc. in the coming year.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.