The former Trina Solar Chief Scientist has been a forceful voice for the sustainability of PV cell and module materials as the industry grows towards gigawatt scale. Veteran solar researcher Pierre J Verlinden has pointed to silver and indium at the consumption levels in high-efficiency heterojunction cells.

Verlinden’s work on this issue has been advanced in additional work conducted by University of New South Wales (UNSW) researchers.

Additionally, he has argued that sustainability in solar pricing should be considered. He says that if race-to-the-bottom pricing prevails, PV cell and module makers will be unable to invest in R&D to advance PV technology, nor will they have the financial wherewithal to honor warranties.

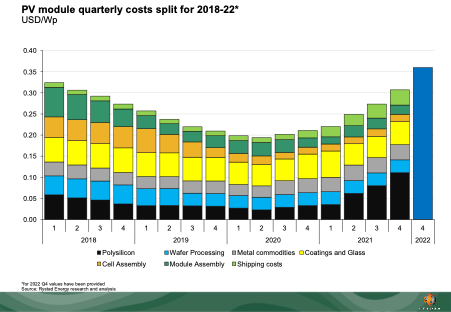

So, with prices trending from US$0.21/Wp in 2020 up to US$0.33/Wp in 2021, as reported by Rystad Energy, does it make for more favorable market conditions and long-term business sustainability for PV cell and module manufacturers? Indeed, with the analyst predicting that module prices will surge to US$0.41/Wp in 2022 it could be argued that a new era of more sustainable pricing is emerging.

Breaking down costs

A closer look at PV cell and module costs, however, reveals that even with higher prices, margins may remain slim, with manufacturers continuing to be squeezed.

In November, Rystad Energy produced an analysis investigating price trends and cost drivers. It concluded that commodity prices across the board have been significantly driving up costs.

“For the modules some of the key ones, polysilicon, silver, copper, aluminum, and glass [which have gone up in cost],” said Dave Dixon, a senior analyst, renewables for Rystad Energy.

Further upstream, the news is worse. PV wafer and cell producers have had to grapple with the biggest cost increase, in the form of polysilicon – with prices surging throughout the year.

“Polysilicon just blows everything out the water,” says Dixon. The raw feedstock for crystalline silicon ingots and wafers increased by 175% in the first six months of 2021 alone. And while new capacity is set to come online, many see high prices continuing through at least the first half of 2022.

These developments are a particularly bitter pill for PV cell and module makers to swallow, as they have made impressive progress in driving manufacturing costs out of their operations.

“There are three key bars [of the chart above] that have come down rapidly – and that is module assemble, cell processing, and wafer processing,” said Dixon. “Module suppliers have done an excellent job in reducing their costs, also thrifting with their commodity inputs.

“We are now at a stage where manufacturing makes roughly 30% of module costs, while inputs comprise around 70% of the cost and those are out of control for the manufacturers,” he continues.

Given these dynamics, higher PV module prices primarily appear to be the result of surging commodity prices, polysilicon chief among them – far from a sustainable outcome.

A significant caveat to this analysis, however, is that end-market demand remains strong. Burgeoning PV rooftop demand, coupled with government and corporate efforts to decarbonize accelerating, market peaks, and troughs – the latter often the precursor to rapid price declines – appear to be a thing of the past.

Rystad expects some 270GW of renewable energy installations, across all technologies, to be achieved in 2022.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

11 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.