From pv magazine 11/2021

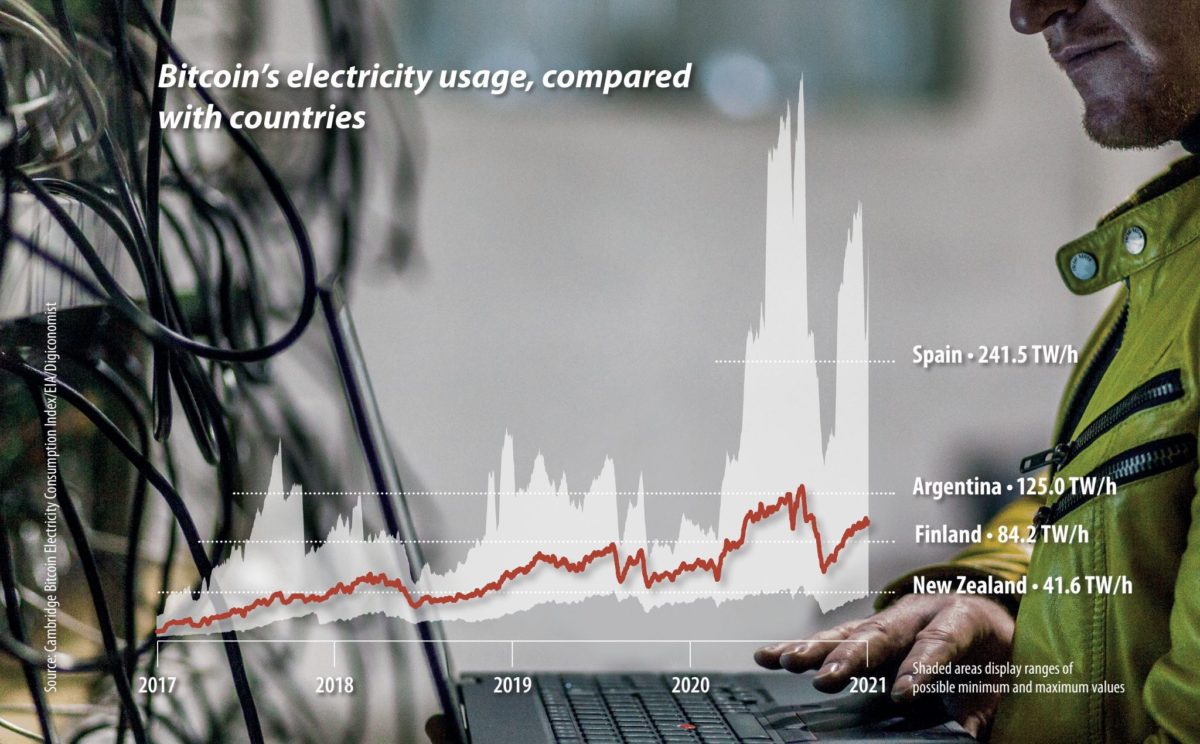

The cryptocurrency Bitcoin is close to using around 0.5% of all the electricity consumed in the world. Bitcoin was estimated to have consumed around 67 TWh in 2020, with nearly 60% of that total supplied by fossil fuels. Bitcoin’s current annualized energy production in 2021 is as high as 170 TWh, although the exact figures are rubbery, given its decentralized operation. Bitcoin is sometimes called “electric money,” due to the continuous use of energy to maintain its network.

By comparison, the country of Argentina’s total electricity consumption in 2019 was 125 TWh, according to the U.S. Energy Information Administration, with 26.5% coming from renewables. Aluminum, known as solid electricity, used as much as 846 TWh in primary smelting in 2020, with nearly 60% of that total from coal sources.

Bitcoin is not alone in the world of cryptocurrency. Another, Ethereum, came later. It is different in that it verifies and records transactions, making it a platform for applications and new developments like digital non-fungible tokens for artwork and collectibles. The Ether network is projected to consume 76.4 TWh in 2021, based on current annualized energy production. Along with many other smaller and emerging cryptocurrencies, this adds up to further terawatts of consumption.

The Cambridge Bitcoin Electricity Consumption Index tracks Bitcoin’s power use, but given the problems with tracing beyond grid compositions in crypto mining regions, it does so through best-guess estimates in combination with high and low possibilities.

At present, it is not correct to assume that Bitcoin is fed only by fossil-fuel sources. Some estimates put Bitcoin’s total use of renewables in a range from 20% to 30%, and even up to almost 75%. The third Global Cryptoasset Benchmarking Study out of Cambridge put the figure at 39%, with most of that figure attributable to hydroelectric power.

The same study found that as many as 62% of miners use hydro in their power source mix, 38% use coal, while just 15% use solar. After a significant ban on cryptocurrency mining in China, the United States is the top destination for Bitcoin mining. The mining primarily occurs in states like Texas, known for its deregulated grid, and Washington, which relies on hydropower. About 35.4% of Bitcoin’s “hashrate,” a term used to describe the collective computing power of miners, is in the United States, up 428% since September 2020.

The amount of interest in Bitcoin surged during the great cryptomania of late 2017, when Bitcoin’s price skyrocketed to around $18,000. At the time of writing in 2021, Bitcoin is worth three times as much, but the mania aspect has settled, and a constant high level of interest persists.

Novel idea

Why Bitcoin? Bitcoin’s novel idea, which emerged via a now-famous technical white paper in 2008, authored by the mysterious Satoshi Nakamoto, an unknown person – or, equally likely, persons, though yet to be identified either way. It involves computing to validate a record of transactions; a database known as a blockchain. Computations are also required to generate new Bitcoins, by attempting to solve difficult mathematical problems based on a cryptographic hash algorithm.

Bitcoin’s scale shows its popularity, but participants are in a constant race to solve the problem to mine (obtain) a new block and receive a reward. That currently happens every 10 minutes or so, and the reward, for the successful active computer, often known as a miner, is presently 6.25 Bitcoins per block, equivalent to around $300,000.

Bitcoin is alluring in many ways – anyone can plug in a computer and potentially solve these problems. Doing so earns more Bitcoins, which grows the supply of the coins, and helps record transactions made using the currency. The combined efforts are known as mining, which by its nature, is decentralized.

Any computer can attempt to solve or guess the answer to the problem. However, highly specialized, application-specific integrated circuits (ASICs) have been engineered to mine at far greater power and efficiency. At launch, a single miner can cost more than $15,000. The issue with ASICs is that they have a limited lifetime as efficiencies increase, and with their specificity comes a lack of utility: miners can’t do other general-purpose computing. That generates tremendous e-waste, with as much as 30.7 metric kilotons of equipment per year, or two iPhones per Bitcoin transaction, according to a journal study from the Dutch central bank and MIT.

The scale of Bitcoin mining, partly in thanks to turbo-powered ASIC miners, is hard to fathom. Some million or more miners make around 140 quintillion guesses every second of the day – that’s 140 followed by 18 zeros.

And part of the ongoing Bitcoin race is that it is capped. Nakamoto capped the number of Bitcoins at 21 million. The strictly finite supply is a key driver of Bitcoin uptake as an asset, and also has a technical effect in that Bitcoin mining gets harder as the supply of Bitcoins gets closer to the limit, extending its valuable lifetime.

Bitcoin – the start of something bigger

Satoshi Nakamoto’s white paper in 2008, which was just nine pages long, created a new financial technology – the blockchain. It is an unregulated system combining incentives to crunch cryptographic problems and simultaneously confirm transactions on a shared database, stored in a decentralized manner, and considered immutable. Bitcoin’s current total value is more than $1 trillion. It is now a mainstream financial asset, yet a divisive one. Alan Kohler, one of Australia’s most experienced financial journalists, and the editor-in-chief of Eureka Report, told pv magazine he sees it as the start of something bigger. “It’s becoming clearer now that Satoshi Nakamoto’s white paper in 2008 was one of those unnoticed great turning points. It changed the world. We’re still working out how, exactly, it did that, but the idea that cryptocurrency and blockchain are passing fads, which a lot of otherwise intelligent people say, will go down in history with Newsweek’s technology writer, Clifford Stoll’s insight in 1995 that the internet was a fad that would end in 1996,” said Kohler. In Kohler’s view, Bitcoin wasn’t invented to be a new asset, but a tool. “Nakamoto, whoever he or she is or they are, was not inventing an investment asset, least of all a wildly volatile and speculative one. They were simply trying to come up with a way of transferring value that didn’t use a third party, usually a bank, as an intermediary to ensure a payment was only made once.” And with that problem came the great idea, the blockchain. “To solve the ‘double spending problem,’ Nakamoto proposed a proof-of-work chain with a timestamp that would form a record that can’t be altered,” said Kohler. “Thus, blockchain was born, allowing any data to be stored in transparent, unalterable distributed ledgers.”

Satoshi Nakamoto’s white paper in 2008, which was just nine pages long, created a new financial technology – the blockchain. It is an unregulated system combining incentives to crunch cryptographic problems and simultaneously confirm transactions on a shared database, stored in a decentralized manner, and considered immutable. Bitcoin’s current total value is more than $1 trillion. It is now a mainstream financial asset, yet a divisive one. Alan Kohler, one of Australia’s most experienced financial journalists, and the editor-in-chief of Eureka Report, told pv magazine he sees it as the start of something bigger. “It’s becoming clearer now that Satoshi Nakamoto’s white paper in 2008 was one of those unnoticed great turning points. It changed the world. We’re still working out how, exactly, it did that, but the idea that cryptocurrency and blockchain are passing fads, which a lot of otherwise intelligent people say, will go down in history with Newsweek’s technology writer, Clifford Stoll’s insight in 1995 that the internet was a fad that would end in 1996,” said Kohler. In Kohler’s view, Bitcoin wasn’t invented to be a new asset, but a tool. “Nakamoto, whoever he or she is or they are, was not inventing an investment asset, least of all a wildly volatile and speculative one. They were simply trying to come up with a way of transferring value that didn’t use a third party, usually a bank, as an intermediary to ensure a payment was only made once.” And with that problem came the great idea, the blockchain. “To solve the ‘double spending problem,’ Nakamoto proposed a proof-of-work chain with a timestamp that would form a record that can’t be altered,” said Kohler. “Thus, blockchain was born, allowing any data to be stored in transparent, unalterable distributed ledgers.”Mining with terawatts

Bitcoin, though, didn’t elegantly chart a new world. Its technical genius is mired in what is called an ugly execution requiring enormous computing power. For all of its faults, it remains the original cryptocurrency, and the computing power thrown at Bitcoin continues, for the most part, to grow.

It is price sensitive, though, and like a traditional mine, such as copper or iron ore, mining operations don’t run long at a loss. Bitcoin miners face similar problems as Bitcoin values fluctuate. Price crashes can make high-cost, low-margin operations unprofitable, which happens regularly during the ups and downs of the crypto market, However, the equipment is too valuable to not be used – lifespans are incredibly short.

The e-waste study from the Dutch central bank and MIT put the lifespan of a top-tier miner at just 1.29 years. After that time, powering the average miner can become unprofitable: Newer miners make huge gains in computational power for the same running costs. With upfront investments of thousands of dollars per miner, rational economics means the miners need to be fully maximized. That makes renewable power options less attractive.

“You have an extremely short amount of time to earn your investment back,” said Alex de Vries, one of the study’s authors. “And if you’re seriously trying to make your money back, or if you care about profit maximization, your winning strategy will be feeding your machine 24/7.”

“Over time, you just can’t compete with new generations anymore because your share becomes so little that your energy costs exceed the amount of money you’re earning. And that’s why the economic lifetime of these machines is limited.”

Intermittency and ROI

For renewable operators, the intermittency of energy sources can be countered by energy storage. In an exploratory paper by ARK Invest researchers, a three-part energy system involving solar, battery, and Bitcoin mining aimed to show the “additional power-monetization tool that bitcoin mining provides.” The benefit comes as Bitcoin miners soak up excess generated energy, and power down to accommodate periods of increased demand or patchier sun.

De Vries, who also runs the Digiconomist website that explores the unintended consequences of digital trends, says the research made poor assumptions about computational power which inflated profitability, assumed low battery costs, and excessively long miner lifetimes. The economic reality seems less clear.

“The obvious challenge is just earning your money back on the Bitcoin miner machine. That’s hard enough because they take quite a while to earn themselves back and you’re paying thousands of dollars for a single machine. So, on top of that, you will have to invest in battery storage which is not cheap either,” said de Vries.

“And if you’re trying to do something here via renewables that’s actually beneficial to someone else, then you will still have to shut down your machines for some period of time. Altogether, it doesn’t look very convincing.”

Nic Carter, founding partner at Castle Island Ventures, an early-stage venture capital firm focused on blockchain, brings another argument to the table. He strongly suggests that major solar generators are set to cut deals with Bitcoin miners “within months.”

“We’re talking large solar providers with gigawatts and gigawatts of energy choosing to improve the economics of their projects by using Bitcoin as an alternative buyer for that energy when the grid has no demand for it,” said Carter.

“What Bitcoin mining can do is be an offtake for that energy during times of peak generation and relatively low-grade demand, when the power would be curtailed or negatively priced. And that’s not just theoretical, that’s absolutely happening.

“These companies, they’re not using it ideologically because they care about Bitcoin. They’re using it because it’s a second independent buyer that has a different profile than the demand of your grid consumer. It improves the economics because it’s just a new option, and it’s always better to have more buyers.”

Carter noted there are several answers to how coin mining economics can work with solar’s lower up-time factor, especially by using near obsolete Bitcoin miners with a low opportunity cost. “It’s a concept called ‘life cycle mining’. You take newer units and you put those in the high-integrity data center with expensive power and you run them 24/7. And the older units, you put on a more intermittent fully green, or green-plus-grid-source power. When the grid demand picks up, or if you’re dealing with a grid which has high real-time spot prices, the miners are off, or they’re drawing power from the grid under just normal circumstances.”

Soviet-era hydro

Energy companies in Siberia, Russia, are finding out just how much interest there is in cheap greener power. Max Matrenitski is the CEO and co-founder of Cyberian Mine, a German-headquartered Bitcoin mining operator that has miners installed in Irkutsk, Siberia.

The location wasn’t chosen by accident. Irkutsk sits on significant Soviet-era cascading hydropower assets that were established on the Angara River. It’s the only river that flows outwards from Lake Baikal, the world’s largest freshwater reservoir. With infrastructure like the Bratsk Hydroelectric Power Station providing 4.5 GW of year-round power, hydropower provides as much as 97% of the grid mix. Local energy provider Irkutskenergo has seen growing demand, far beyond the original 100 MW expected in 2018.

Matrenitski told pv magazine that the Cyberian Mine operation has fluctuated from as many as 4,000 miners installed a few years ago to around 1,200 more sophisticated, expensive miners. A standard high-quality miner consumes as much as 3,250 W, or around 80 kWh per day. Many other mining operations are in the area too.

“There is already a very strong trend toward green energy,” said Matrenitski. “For European clients, most are asking [about promised renewable power] and that is important. We make them aware of the energy system in Siberia.”

Opportunistic vs. altruistic

In other cases, the line around what’s renewable and what’s good for the environment out of mining becomes deeply blurred. Pennsylvania-based Stronghold Digital Mining purchased a coal waste power plant in the state, to power 1,800 mining computers by clearing up and burning 600,000 tons of coal waste per year in Venango County.

The project is being billed as “ESG-friendly,” and receives tax credits from Pennsylvania to burn the waste despite using decades-old furnaces. The company estimates that for each Bitcoin mined, 200 tons of waste coal is eliminated from problematic coal piles that often catch fire, or leach acid waste into the water table.

Other companies and miners are focusing elsewhere. Limpia Creek Technologies is currently powering Bitcoin miners using flared, vented, and stranded natural gas assets in West Texas. Flared methane gases are normally burnt, but using the methane to power Bitcoin miners is more efficient, said to be better for the environment, and the result is new revenue.

Does it matter?

Bitcoin skeptics like de Vries, and advocates like Carter, regularly do battle in public forums and on social media. Carter says that argument without usage is futile.

“With Bitcoin, it’s much harder to grow the significance of the network if you’ve never used it. It affects most people indirectly. Roughly a hundred million people worldwide use Bitcoin. So, the other 6.9 billion people have no concept of what it’s for. It’s kind of the same way as in 1994, when only 100,000 people were on the internet, and everyone else thought it was a weird thing or a waste of time.”

Australian financial journalist Alan Kohler adds that the challenge, like climate change, will not abate soon. “What it ends up being priced at is anybody’s guess, but it’s clearly not going away, and nor is Ethereum, the second biggest crypto that has become the foundation of so much financial innovation.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Impossible to imagine how the huge scam of Bitcoin continues to be permitted?

And even polluting the air, polluting land fills. Polluting the financial markets.

Even if it was run 100% on renewables thats no excuse as these renewables could have been used elsewhere. One can say that Bitcoin simply is a crime against humanity and against environment, climate and life on Earth.

Furthermore its more than dubious privacy makes Bitcoin the preferred payment form for criminal proceeds.

Bitcoin in its private form should be banned.

A correction: It is not proof of work costing these hefty sums. It is the privacy. Public coins are accrately as secure and also are based on proof of woek. But its possible to track who transacted. These public coins are just payment tokens and not speculative.

Bitcoin and private cryoto currency should simply be banned!

For the nth time, cryptocurrency is a libertarian wet dream, a solution to a problem that does not exist. The government, utilities, oil companies, and supermarket chains do not rip you off with ledger fraud, which blockchain systems would prevent if anyone were stupid enough to use them for routine legal transactions. Double-entry accounting, invented in 15th century Italy, ensures that transactions are recorded in multiple ledgers and are readily auditable to detect fraud and correct mistakes (which cryptocurrency does not allow). The current incarnation of capitalism does have numerous flaws, from political corruption to managerial looting to efficiency wages, tax evasion, excessive IP rents and unpriced externalities. The list goes on. Cryptocurrency does absolutely nothing to address them and creates new incentives of its own for misbehaviour. It’s a scam and should be forcibly shut down.

Bitcoin does use depends on a very large amount of electric power to run its data centers. However, that may be fixed to a degree by solar powering all of them.

However, there is another huge problem that I do not can be fixed or addressed – the data centers use an enormous amount of WATER every day – 3 to 5 MILLION GALLONS – same as a city of 30,000 to 40,000 people. A number of these centers are in Ca and the southwest which is undergoing in some areas a decade draught. If the data centers get the water then people and crops do not. The answer is clear the data centers are NOT first or second in the line.

Mr. Trystan Rayner;

This is a remarkable piece and I am forwarding a link to officials at the State of Colorado, USA.

Carl. L. McWilliams

Glenwood Springs, Colorado