Such a wonderful use of light...

Is it a Goya? A Vermeer? A Delacroix? No, it's actually Bisol's Supreme Monocrystalline PV Module BDO 360-365 Wp, writes Blake Matich. Ana Gorinšek, Bisol Group's head of marketing, said the inspiration behind the module's presentation at Intersolar 2021 is the sense of craftsmanship the company has for the PV canvas, from which it guarantees 100% power output for 25 years with a 0% effective degradation rate.

It may not be as eye-catching as a Vermeer, but it's just as obsessed with sunlight.

Seeking a new challenge? Solax is hiring

Hangzhou-based inverter maker Solax is expanding its product range with the addition of utility scale string devices. At the Solax booth, pv magazine met Luan Kuqi and other members of the team.

Kuqi is heading the company’s European expansion and is seeking after-sales specialists to drive further growth, as finding qualified staff is increasingly becoming a challenge for solar companies.

The new Huawei Smart PV Controller

Huawei is launching its latest product for the utility-scale sector. With the application of 210 mm high-current PV modules, the string current will reach 20A, and conventional inverters generally face DC current limitations.

The latest Huawei Smart PV Controller SUN2000-215KTL-H3, therefore, supports the maximum MPPT current which is 100A and can connect up to 5 strings. So it can effectively solve the problem of DC current limitation.

Come check it out at booth B5.510!

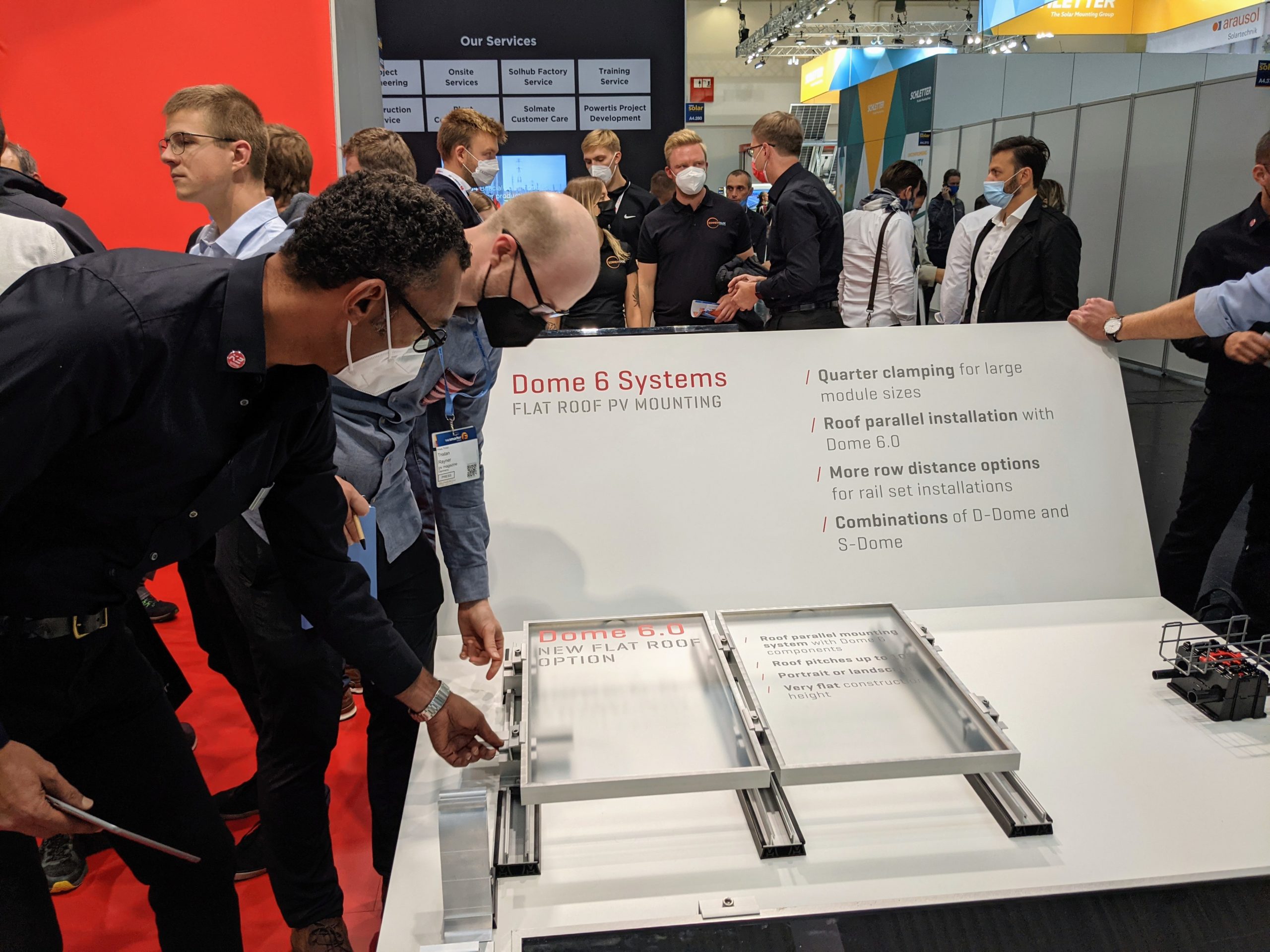

K2 reveals the Dome

K2 Systems has its first flat-mounted PV product coming out in December, and Middle East and North Africa regional sales manager Mohamed Abdelzaher walked pv magazine‘s Tristan Rayner through the company's new, all-aluminum Dome 6.0 system.

Designed for high wind loads and equatorial-adjacent regions, and reportedly offering savings of around 10% over the fixed tilt range by K2, the Dome 6.0 can lie completely flat or be tilted up to 10 degrees, in portrait or landscape orientation, and be either fixed or ballasted.

Abdelzaher said he expects the product to be a best seller in his region where, on the Gulf Coast, winds of up to 180kph can occur.

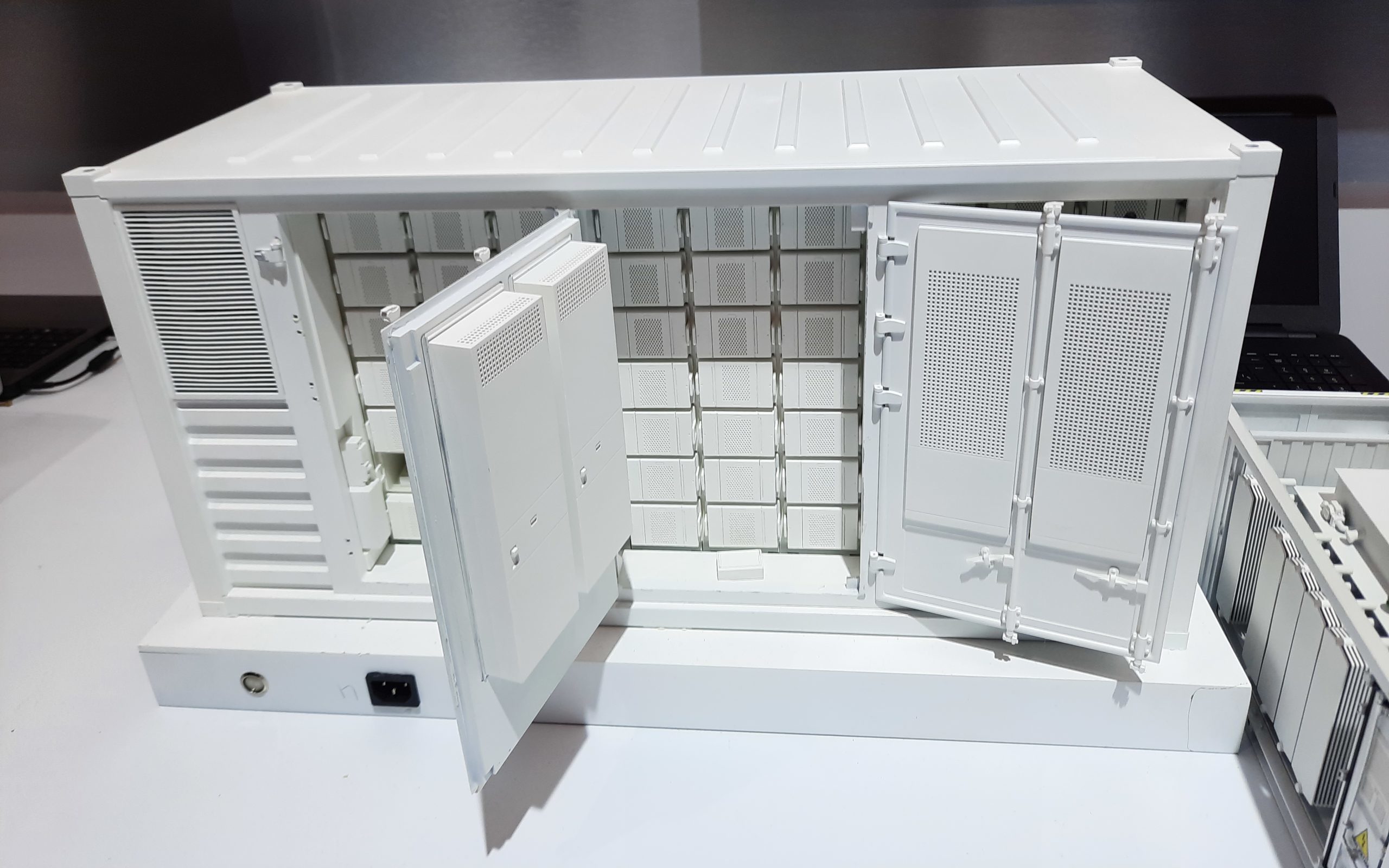

Second-life battery use, Ritt large

As more and more EVs hit the roads, there will be more electric vehicle batteries available for sustainable reuse, writes Blake Matich. Spanish second life EV battery company BeePlanet Factory is doing just that, taking used EV devices from its partners Nissan and Mercedes-Benz, and giving them a second life in PV, wind and off-grid power installations.

In the residential sector, second-life, 5-10 kWh batteries remain highly efficient, according to BeePlanet Factory product engineer Alfonso Urrizburu, who said the same was true of the 40 kWh-1 MWh range used for commercial and industrial applications. Until now, the reused batteries have been stored in cabinets produced by Rittal (see the photo above) and deployed in France and Spain, but Urrizburu says the company plans to expand its distribution next year and produce its own range of high-density batteries, enabling more of the Rittal battery cupboards to be racked in a container.

When it comes to the (relatively small) fire hazard of lithium-ion batteries, of course, there is even more research needed into device reuse, however Urrizburu says that though “it may be counter-intuitive, the batteries are actually safer than stationary ones,” pointing to the record of automotive batteries already on the market.

The off-grid uses of reused batteries are another boon. Urrizburu highlighted Spanish power company Iberdrola's use of BeePlanet's second-life devices for fast-charging systems in grid dead spots, such as on the highway between Madrid and Valencia.

Newshounds?

Here's another pro show tip, this time from our own Blake Matich: In Halle A6, beware the angry-looking giant husky.

The dog's owner, Aionrise, a U.S. company that manufactures solar modules in the Caucasian state of Georgia, has trained the Sherlockian-proportioned hound to pose for photos with visitors to Intersolar 2021, including myself and fellow pv magazine editor Tristan Rayner.

Upgrades mean a boom for equipment suppliers

Italian equipment supplier Ecoprogetti’s booth has been packed to the rafters for the whole show but our Mark Hutchins somehow managed to corner marketing manager Michele Caddeo today. (He's a tenacious one, that Mark, like a dog with a bone, as Michele could probably testify.)

Here's what Mark had to report: “Michele told me business is good, with many customers requiring entire new solar production lines to be able to process new and enlarged wafer formats.

“The latest tools for production on show at the Ecoprogetti booth include a combined cell cutter and stringer – cutting a whole step out of module production; and an automated system for junction box potting – which is one of the final production steps to still be carried out manually, at least until Ecoprogetti came along.”

The word on the street

Mingling with attendees at Intersolar can bring unexpected insights, as Tristan Rayner has discovered. Naturally, some curious attendees are looking to see the cutting edge of new developments for their own homes. Other professionals, such as large solar developers are exploring options, and there are also those spotted by pv magazine minutely inspecting, and photographing, what the competition has to offer.

One surprise conversation Tristan had was with a Polish developer looking to more or less immediately source modules, on a “very short timeframe.” Why? Because Chinese supply is constrained or simply unavailable, and European manufacturers aren't keeping up: There is huge demand and material delays.

Frank Tafani and Christy Glykol, sales managers at French solar manufacturer Recom, suggested their 750 MW panel production capacity is dealing with the situation despite the challenges. Normal delivery timeframes are being extended by two months or more, and the ability to provide accurate pricing and availability is difficult, with every day presenting new difficulties. Recom hopes a new facility due online in the first half of next year will supply larger, 550 W modules.

Over at Spanish manufacturer Eurener, sales director Pasquale Zazo said he’s never had more interest in modules, with last year's 200-220 MW of production sure to be exceeded this year, despite shortages of some key materials. Production has been increased where possible, Pasquale said, although delivery timeframes have extended from a normal 2-4 weeks out to 6-7 weeks, as the crunch continues.

There was better news at heterojunction panel supplier Hevel. Anton Usachev, deputy CEO for corporate communications at the Russian company, said Hevel is experiencing no delays and capacity can match demand. The smaller percentage of the market held by HJT – compared to PERC products – is not experiencing the issues of the wider industry, he said.

No, that's not a Dalek

Pictured on the right is a happy, proud Martin Moldenhauer, procurement officer at ccc-wallbox, writes Marian Willuhn.

On the left is the reason he's beaming so broadly. Ccc-wallbox has enclosed its EV charger not in nasty plastic, but in a special natural fiber, flax, and natural resin mix. The casing is produced in a carbon-neutral manner and is said to pose no harm to the environment. There is no plastic inside the charger, either, as a smiling Moldenhauer explained.

“We don’t go electric because we hate the V8,” he said, “but because we want to become sustainable. To do that, we must think of the materials we are using.”

That attitude gets a huge thumbs-up from pv magazine‘s UP Initiative.

We've had a visit from NSEFI's Pranav Mehta

pv magazine publisher Eckhart Gouras, right, welcomed Pranav Mehta to the our booth at Intersolar Europe today.

Pranav is chairman of the National Solar Energy Federation of India, a key industry body aiming to advance solar energy in the nation.

As a key spokesperson for Indian solar, Pranav spoke about the strategic importance to the country of a vibrant PV manufacturing market and, as the nation emerges from the Covid-19 pandemic, said we can expect important developments on the PV production front.

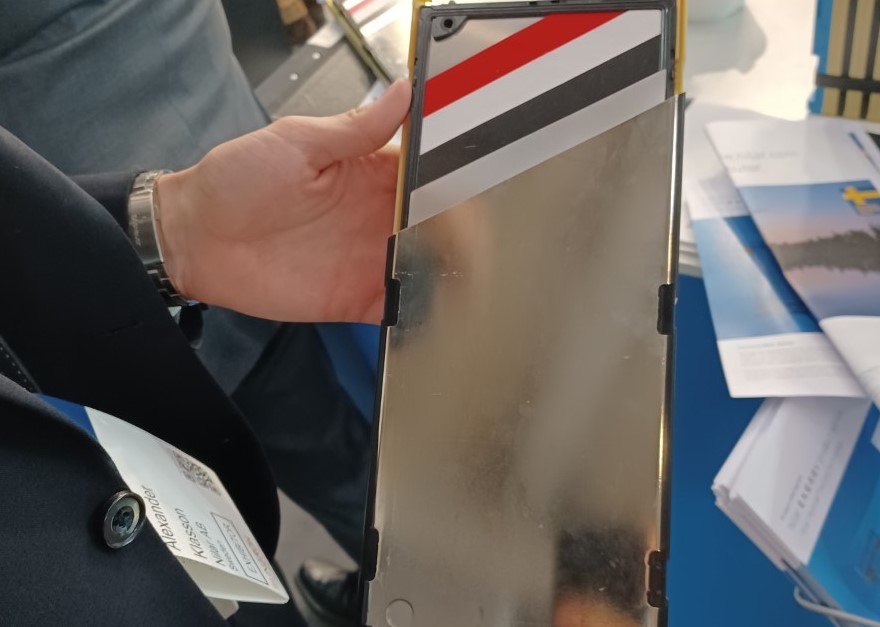

Forget meatballs, Swedish lasagne is where it's at

Blake Matich brings us this culinary delight.

Due to the flammability of lithium-ion and the need for longer-duration storage, alternatives and complementary battery energy storage systems are a hot topic and this is particularly true when it comes to stationary storage. The lightweight advantage of lithium-ion makes it ideal for EVs, and the sooner large scale stationary storage alternatives become available at scale, the more critical raw materials required for lith-ion batteries can be used to transition the transport sector.

Enter Swedish battery storage manufacturer Nilar. Of particular interest is the company's Hydride battery which, despite its bi-polar design, is far more stable … than manic.

As Nilar application engineer Alexander Klasson told me, the nickel plates are “laid horizontally on top of each other, like the layers of a lasagne … so instead of cables, the current goes through the entire pack.” In effect, the whole stack is the cable.

What is really interesting, is the stability and sustainability of the device. Unlike lithium-ion, Hydride batteries are not flammable, thanks to their water-based electrolyte. Klasson said the Research Institutes of Sweden tested the system by putting packs inside a chamber and setting them on fire.

What is more, Klasson spoke of a new technological feature: gas chamber holes which run through the layered cell plates. “The electrolyte dries as it ages and degrades,” he explained, “leaving excess hydrogen behind.” The gas chamber holes allow an oxygen hose to be attached which “restores the battery by creating a whole new water electrolyte,” refreshing 120 cells at once.

The battery, set for release next year, is slightly too heavy for EV application but seems a promising alternative to lithium-ion.

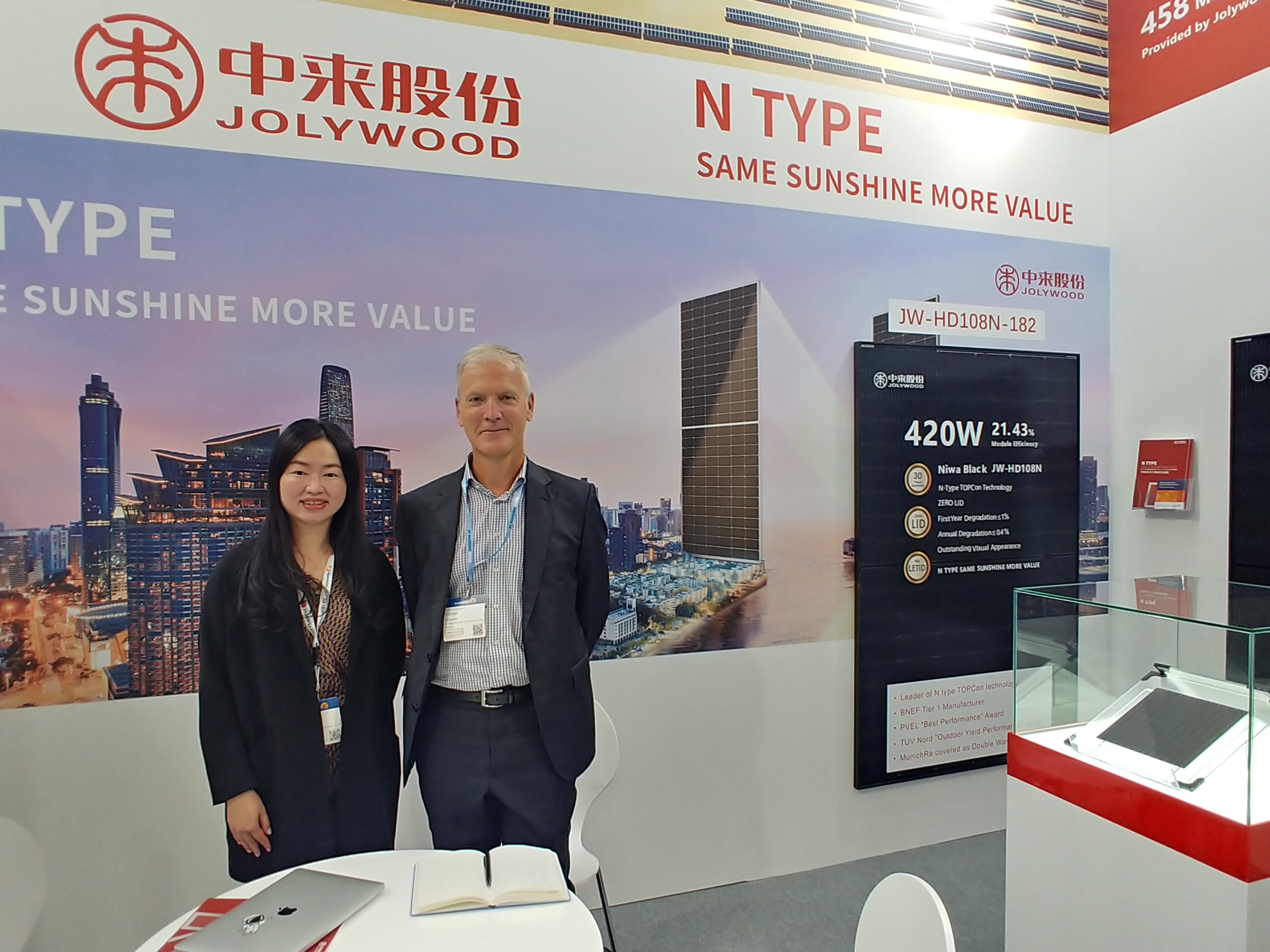

Never mind the electricity, we want more capacity

Chinese solar manufacturer Jolywood is already the market leader for n-type panels, currently operating around 3 GW of cell and module capacity, and expecting to reach beyond 4 GW by the end of the year, writes Mark Hutchins.

And with other PV manufacturing giants launching n-type products this year, Jolywood is scaling up to ensure it keeps its place at the top table: European sales director Cathy Huang this morning discussed plans to bring a massive 16 GW of new cell and module capacity online, in two phases over the next couple of years.

The bulk of the new fabs will be in China, but Jolywood is also building out new production capacity in Indonesia, to meet demand there and in the U.S.

Like many on the show floor this year, the company has been hit by rising prices across its supply chain, and expects them to remain an issue indefinitely – with high shipping prices a particular concern. Those issues will affect module suppliers regardless of technology, said the manufacturer, however Jolywood estimates prices for its n-type TOPCon modules will add up to just €0.02/W above those of mainstream PERC modules – and it expects to achieve significant savings by reaching its ambitious new production scale alone, with more savings and improvements planned for the new lines as well.

Marian gets into top gear

Our Marian Willuhn has headed over into an adjacent hall at Intersolar and found it looks more like a motor show.

A surprising amount of cars fills the B6 hall, writes Marian. Though the crowds have come to see solar panels and batteries, the display of shiny new EVs is attracting a lot of interest. And who can blame them, as there are lots of fancy innovations mustered.

Charging point manufacturer Alfen offers lots of flexibility and says its products be used with any “back office,” by utilities and system integrators.

Flexibility is also on offer at Smappee, where grid operators can adapt charging power according to their needs. At home, the Smappee system could help homeowners use as much of their own solar power as possible.

And if charging needs to be fast and more than grid friendly, Huber+Suhner have a solution. The company improves charging cables with a cooling agent and, without its tinkering, charging at 500 A for long periods could lead to a painful surprise when disconnecting the cable.

Coming up short

The shortages which have delayed solar installation in Europe are set to continue for the rest of the year, according to two representatives of analyst IHS Markit at Intersolar, whose names will be familiar to pv magazine readers.

pv mag print chief Jonathan Gifford quizzed IHS executive director of clean energy technology, Edurne Zoco, and associate director Cormac Gilligan, about the prospects for European solar. The responses were none too encouraging.

“The issues are lower utilization rates, strong demand, and the high cost of inputs,” said Zoco. “This combination is what is making prices quite volatile.”

Her colleague added: “At the same time, there is no certainty about how long these restrictions will last, whether just for Q4 or into 2022.”

The low utilization rates mentioned, in China, are linked to reduced electricity supply, as directed by the authorities, with some industries in badly-affected provinces having been forced to reduce output by up to 90% in September, compared to their August figures. In the solar world, polysilicon and glass makers have been among the segments hit by such restrictions.

“In Q4, a large proportion of [module] production is allocated for China, and will absorb much of this constrained supply of modules,” added Zoco. “Therefore, the availability of modules outside of China could be restrained.”

Long on efficiency, short on BoS costs

With solar manufacturers keen to show off their new products, Michael Fuhs dropped by the Longi Solar booth, where technical service manager Vitor Rodriguez showed off the company's new Hi-Mo N panel.

The n-type TOPCon module offers one per cent more absolute efficiency than its p-type PERC predecessor, Rodriguez said, adding the panel features “a new cell technology.”

The Longi rep said first-year degradation has been reduced to a, guaranteed, less than 1%, as compared with 2% for the p-type version.

Even with an added cost that is likely to come in at around €0.02/W for the shiny new model, throw in the raised efficiency and that still means a strong business case for utility scale solar farms, according to Rodriguez, especially with reduced balance-of-system costs.

The Longi agent confidently predicted the n-type module will be available next year. Whether that will hold true in the face of the current electricity shortages across Chinese factories remains to be seen.

Come and say Hi!

[TRADESHOW

]

Rise and shine! @Intersolar day 2 — here we are!

Our team is ready to welcome you on booth #A6.540. Come by!#pvmagazine #tradeshowsandfairs #intersolar2021 pic.twitter.com/5nG761RujT

— pv magazine (@pvmagazine) October 7, 2021

It's not even 10.30 a.m. and we've already descended into toilet humor...

The solar conference is back and so is the marketing, points out Tristan Rayner, who can't seem to break his apparent fascination with what might be termed ‘the rear side' of the solar business.

Everyone is trying to conjure up a memorable tagline and German business Premium Mounting Technologies is no different, says Tristan.

The image above speaks for itself and pv magazine feels a double salute is due to the company's marketing department. Not only did its creative geniuses hit upon the idea of sponsoring the loos, they also avoided the temptation of indulging in far less savory wordplay about the company's initials, or anything to do with mounting. Sadly, pv mag‘s blog editorial staff has no such scruples.

Somebody sensible, please drag us up out of the gutter.

'We need to find another way'

Critical raw materials were the focus of a virtual presentation this morning at Intersolar, given by Deborah Jones, director of research at the French National Scientific Research Council at the Charles Gerhardt Institute for Molecular Chemistry and Materials, in Montpellier.

As part of Intersolar 2021's Green Hydrogen Forum, Jones spoke about “Science supporting the path to sustainability,” with a particular focus on the materials needed for fuel cells and hydrogen technologies – such as electrolyzers and other components used for green hydrogen production.

“Recycle, reduce, replace equals sustainability” said Jones, who discussed research into replacing rare elements such as iridium and platinum, and the pivotal need for more studies, writes Blake Matich. Iron, for instance, is a great substitute for platinum in cathodes but nevertheless, “the only way to stabilize iron-based cathodes is a small amount of platinum.”

Other issues, such as the persistence of poly and perfluoroalkyl substances (PFAS) in the environment – such as those used by PEM electrolyzers – is a serious “future sustainability consideration,” said the speaker, especially as “hydrocarbon ionomer alternatives have not yet proved sufficiently close to the properties of PFAS.”

“We should restart and regain the research into alternatives, such as novel hydrocarbon ionomers,” added Jones, who said she was confident science can find ways to make the materials required for the energy transition, sustainable.

Huawei opens up on its new inverter features

We popped over to the Huawei booth just before the lights came down on day one of the show yesterday, to say thanks for sponsoring this here blog, and our correspondent Cornelia Lichner was given a tour of the company's new inverter offering.

At a popular booth, Hariram Subramanian, chief technology officer of the Huawei development center in Nuremberg, showed us the latest features of the company's large scale solar devices. The new 215KTL H3 inverter can be used for large PV modules with power outputs ranging from 500 to 800 W. It has four MPP trackers, to which up to 19 strings can be connected.

The model anticipates a development that transmission system operators are increasingly concerned about. As more and more conventional power station rotating masses disappear, the network loses stability. Together with storage systems, however, inverters can replace those masses. The new inverter from Huawei not only outputs a clean sine curve, it can also actively dampen resonances in the harmonics, and thus influence the grid. Together with a storage system such as Huawei's new Luna 2000 2.0 MW, which has a capacity of 2,000 kWh, the inverter can create and shape the grid and thus be an anchor in the event of disruption, providing grid companies define the way such systems could help, that is. A short circuit ratio of 1.2 is an important indicator for this, added Subramanian. A new type of DC circuit breaker in the Huawei device also prevents the power plant causing network disturbance.

In another piece of good news, the new inverters are said to be saving expense by offering higher power density, and that cost saving will not be eaten by price increases, Subramanian said. And all the components on show at Intersolar are readily available despite the shortages which have dogged other manufacturers of late.

Everyone likes a freebie, right?

You can never accuse pv magazine of failing to dig down into the real issues of the day to come up with the solid gold information you and your business need – and our boy Tristan Rayner has come up with the goods again.

Tristan has spotted, for those of you arriving at the Messe West metro station for today's show, that there's a free bus – the number 99 – which offers a shuttle service to the trade show entrance at Messe Ost.

Plus, and please keep this info under your hat, there's a hot rumor doing the rounds that you can sneak into Intersolar using the southern entrance to the venue, providing you already have your show pass.

It's time to talk floaters

Intrepid pv magazine newshound Tristan Rayner is in the … No, wait, let me rephrase that. Erm… okay, I'll just let Tristan explain:

One of the emerging topics at Intersolar this year is floating PV. While strongly present in Asia, and with progress in the U.K. and the Netherlands, Germany's floating PV is being described as still in “kinderschule.” So said Peter Kroger, at Prymian Group, which provides cables for the solar market, including for floating PV, with Peter wisely noting: “Water and energy are a difficult mix.”

Frank Czernie, from TUV Rheinland, explained the industry has more than one problem with water: Component failures are increasing – from cables to connectors – especially in the hard, acidic waters of old mine sites, for example.

Yet another problem is soiling; bird life in water is rich, varied, and very capable of “covering” a floating panel. Cleaning is a great deal harder than it is on land.

German solar module cleaning companies are still in the test phase and Hycleaner CEO Andreas Grochowiak said he has a solution he's tested in Bilbao, using the battery-powered ‘Black Solar Facelift,' with more testing to come.

Over at solar cleaning company Helios PV, managing director Hermann Staudinger said his company would be having a first test to clean floating PV with its ‘Agile' cleaner, another battery powered device, with partner Zimmerman helping provide a test as soon as this month.

More experienced is Pol Duthoit, co-founder of Solarcleano, who cleaned his first floating PV installation to the west of London back in 2018. Duthoit says the industry has a long way to go: it may only take an hour for someone to learn how to operate a robot cleaner on a solar park on land, but learning how to clean floating PV panels can take “months and months,” with the battery-powered SolarCleano F1 the machine of choice, of course.

Why? It’s all in the float. It’s too easy to miss a spot while the panels bob up and down on the water. Duthoit noted one system from French floating PV manufacturer Ciel et Terre was particularly difficult to treat, with its floats moving more than others, from Baywa re, for example.

And there's time for just one more insight: Cleaning floating modules is around 30-40% slower than fixed panels, partly due to just how much soiling (read, poop) is present on the panels. “Sometimes you can’t even see the color of the panels due to the amount of white residue,” was how Duthoit put it, somewhat politely.

Prices are rising for home solar panels

pv magazine‘s Michael Fuhs managed to battle through the crowd surrounding German developer Baywa re's booth to chat to Friedhelm Enslin, head of sales for the exhibitor's installer business.

Friedhelm said the cost of even home solar panels has risen €0.05-0.08 per Watt over the last year, thanks to well-documented supply chain issues and a rising polysilicon price.

That adds to the difficulty for installers, who can face a nervous wait between quoting for a home solar job and taking receipt of the panels, not to mention begging the question: ‘How far can prices rises until solar becomes too expensive for business clients?'

The good news is that Baywa at least still has modules for customers, unlike some other engineering, procurement and construction businesses, although Friedhelm pointed out, component shortages are also affecting solar system parts such as energy meters and storage systems, which means customers of the German business may have to prepare for a three to four-month wait for the most in-demand items.

Baywa, the sales rep said, is doing its utmost to shoulder the burden so its customers don't have to.