Using rugby as an analogy, PV project developers (the coaching team), supported by their stakeholders, i.e., shareholders/EPC/O&M contractors/Lenders (the medical team/sponsors/club board members/fans) and their technical, due diligence, and financial teams (the squad of players), through a lot of hard work (sweat) and emotional stress (bruises), will try to strategize the best way to beat the other bidders (their opponents).

The ultimate outcome (victory) is reached by submitting the lowest tariff and being part of what is considered one of the best renewable energy procurement programs in the world.

The 5th bidding window (BW5), launched this April by South Africa's Department of Mineral Resources and Energy (DMRE) and submitted on August 16, 2021, was by no means an exception and I am positive that once again this BW5 will leave some “scars” on many of the non-winning bidders.

Before providing insight into BW5 and the main stresses, however, I will provide an overview and some facts of the REIPPPP since it launched in 2011. Discussing the challenges that bidders have had to overcome, it will focus on what to expect from the renewable space in South Africa in the coming years and bid windows.

An overview of the REIPPPPP to date

Between 2011 and 2021, the South African Government, through its Integrated Resource Plan 2010-2030 (IRP), and managed by state utility Eskom and the DMRE, have successfully launched and completed four bidding windows for the competitive REIPPPP tender, by allowing the private sector and Independent Power producers (IPPs) to invest in the South African renewable energy market.

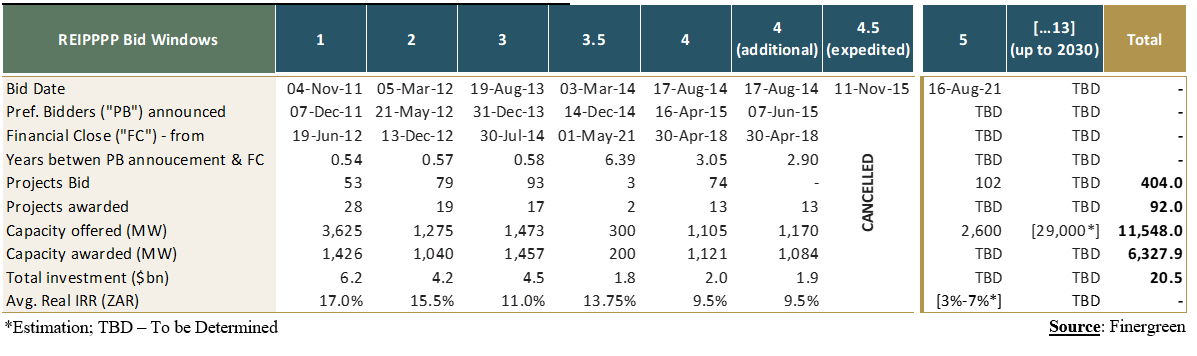

Looking at table 1, the first three BWs (from 2011 to 2013) each took around six months to close their projects after being announced as preferred bidders, while BW3.5, with its two 100 MW CSP projects (Kathu and Redstone), took between two to six years to close, and BW4 approximately three years.

These delays were due to a refusal from the previous Eskom Management Board to sign new Power Purchase Agreements (PPAs) in 2015. Despite this, the government issued an accelerated procurement BW 4.5 in November 2015 for 1,800 MW of capacity from all renewable technologies for all the unsuccessful bidders from the previous BWs. The outcome of this BW was never executed, however.

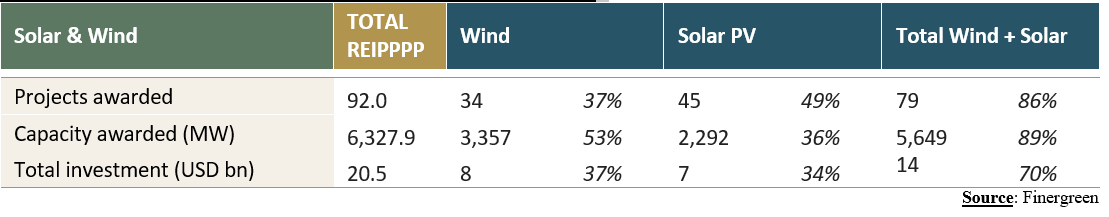

Some interesting facts from Tables 1 and 2 show that between 2011 and 2015 (excl. BW5), 302 bids were submitted with around 30% (92) of the projects receiving approval. From those 92 projects, close to 70% (4.41GW) are already in operation with wind and solar PV projects comprising most of the projects awarded: roughly 86%.

In addition, of the 11.5 GW of total capacity offered, 6.3GW, or 71%, was allocated. Once again, wind and solar PV projects comprised the majority, at 5.65 GW or 89%. While 86% of solar PV projects are located on the Northern Cape and 14% are spread among the other provinces, wind projects are mainly split equally between the Eastern and Northern Capes.

Of the total investment (US$20.5 billion) roughly 80% was raised locally between commercial banks, funds, and development financial institutions (DFIs), showing how strong the financial sector is in South Africa.

Wind projects totaled $8 billion (37%) and solar PV projects $7 billion (34%), which represented around 70% of all projects invested in the REIPPPP. The social-economic and enterprise development impact received around $80 million from the REIPPPP.

The two most important indicators that bidders will fight using all the technical and financial instruments at their disposal can be seen through both the equity Internal Rate of Return (IRR) and reaching the lowest tariff.

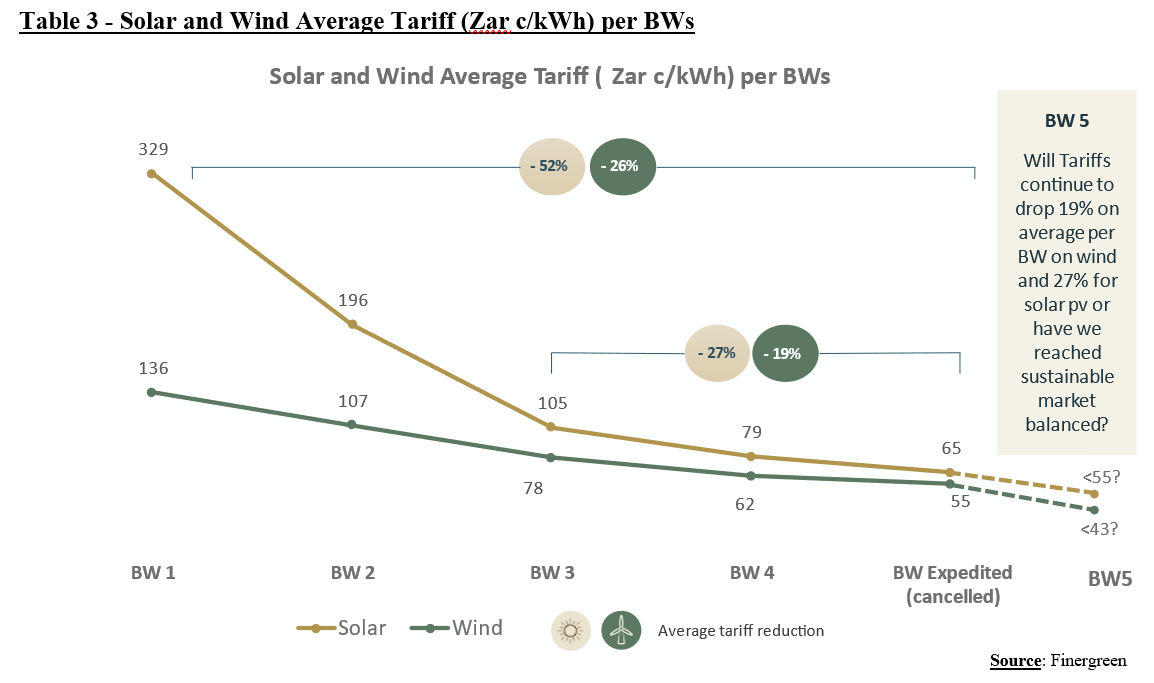

We have seen that while the first rounds offered very high average real IRRs (ZAR) of 17% in BW1, the last completed BW4 presented very skewed IRRs that reached around 9.5% on average. On the other hand, the tariff which drives the IRR has seen astounding reductions from each successive BW, giving bidders the herculean task of finding new financing and technical solutions to reach those very slim IRRs and aggressive tariffs.

We can further acknowledge from table three, that between BW 1 to BW Expedited, the average tariff reduction stands at around 52% and 26% for solar PV and wind, respectively. However, if we consider the average from the most recent BWs (BW3 to BW Expedited), the average tariff reduction dropped to roughly 27% for solar PV and 19% for wind, showing that tariff reductions might become more balanced and sustainable.

What changed in BW 5?

Based on South Africa's new IRP 2019, the coal decommissioning plan requires 10.5 GW of coal to come offline by 2030 and 35 GW by 2050, thus providing a completely different energy mix from the one currently in place, where over 80% of energy generation comes from coal power plants.

The new IRP will enable the potential development of around 29 GW of new renewable energy capacity that should be procured between 2022-2030 from technologies like onshore wind (14.4 GW), solar (6 GW), cogen, biomass and landfill (3.5GW), hydro (2.5 GW), and storage (2.6 GW).

Under Section 34 Ministerial Determination, a fifth bidding window took place in the third quarter of 2021, allowing any IPP to procure 1,600MW of wind and 1,000 MW of solar.

According, to the DMRE, 102 projects have been submitted under BW5 which represents 38% more solar and wind projects than in BW4. Specifically, IPPs have submitted 3.4 times more wind bids than in BW4 for the capacity offered, which means that around 29% of wind bidders in this round have a chance of success. Regarding the solar bids, there were 4.7 times more project bids than in BW4 for the capacity offered, which means that solar bidders have around a 21% chance of success.

Despite the aggressive stats, there were a couple of key changes in BW5 worth mentioning such as:

- Timing: The selection of preferred bidders and the financial close of projects must be completed within a four-month period rather than nine months. Construction periods should also take a maximum of two, rather than three, years. DMRE is placing pressure on bidders to meet the country’s energy demand and also revealing that, due to time constraints, bidders must provide projects that are fully developed, compliant, and ready to be constructed and grid-connected.

- Financial: The introduction of a decommissioning reserve to be implemented from a project’s commercial operation date must cover all costs of decommissioning the project upon termination of the PPA. The partial indexed price was also reinstated from BW 4 and an Equivalent Annual Tariff (EAT) was introduced to comparatively score and rank each bidder's tariffs. Finally, bidders were required to use specified exchange, interest, and swap rates through Appendix R8.

- Agreements: Some PPA risks were transferred to the private sector, such as the usual land and grid connection risks; however, a forecast penalty during operation will be applied if tariffs are reduced by +/- 10%.

- Evaluation weighting: BW5 presented a new weighting evaluation from a ratio of 70:30 in the previous BWs to 90:10, thus providing a greater impact on tariffs vis-à-vis economic development. All other criteria have been retained but are subject to more qualifying measurements by reaching certain technical and legal parameters to be able to score.

- Ownership in projects and contractors: South African shareholding has been increased to 49% with minimum ownership of 25% Black people and 5% Black women.

- Local content: The local content threshold has been kept at 40%, however, there are no more targets – only a threshold to be reached. Exemptions can be applied for, but they will have to go through the Department of Trade, Industry and Competition (DTIC).

BW5 outcome

It’s no surprise that BW5 has once again been a success story: 38% more project bids were received compared to six years ago in BW4, despite all the delays, tariff restructuring, and the Covid-19 pandemic. The bidders had to strategize on all business fronts and make sure they trimmed all sorts of “fat” if they wanted to have any chance of winning. Some of those strategies included:

- Achieving and partnering with top EPC and O&M providers so as to reach the best pricing as well as working/adapting with what the EPC and O&M market suppliers represented at that point of bid submission (i.e., Capex price volatility).

- Comprehending the ramifications of Covid-19, especially on how to best deal with logistics and transportation costs.

- Reaching that unmatched financial structure by contemplating the fluctuations of the loan instruments at their disposal (i.e., JIBAR/CPI, hedging products, etc.). The financial sector in South Africa is solid and since renewable energy, especially for technologies such as wind and solar PV, are better understood by the financial institutions, a lot of the previous risks are no longer a concern for lenders (i.e., the sponsor and lender’s case in a solar PV are both analyzed at P50).

- Compliance with the bid rules (i.e., licensing/permitting, job creation, local content, enterprise & socio-economic development, funding requirements, value for money, etc.).

- Making the best interpretation of the information provided by DMRE during the bid (i.e., limitations on grid connection capacity per region).

Looking at some of the tariffs that have been awarded recently in auctions around the world (i.e., the Abu Dhabi 2 GW solar tender with 1.35 USD c/kWh or Qatar’s 800 MW tender with a tariff of 1.56 USD c/kWh), it is uncertain if BW5 will see a leveling of these tariffs or if they will just continue reducing at a pace of 20-30% per round, depending on the technology, which could see tariffs reaching as low as the 2.5 to 3.5 USD c/kWh (40 to 55 c ZAR/kWh).

However, some of the many key drivers in the REIPPPP such as policy rules and local content compliance, EPC pricing volatility, and Covid-19 uncertainties could halt tariff decreases.

What to expect from REIPPPP in the future

The latest oversubscribed bid has proven the importance of securing a transparent and reliable BW procurement process. Allowing for steady development and investment in local manufacturers and O&M services will see the creation of long-lasting sustainable and wide-ranging skilled jobs for South Africans and further boost renewable investment in South Africa.

If we are to follow the aggressive procurement plan defined in the IRP2019 (BWs 6 and 7 are expected to be launched in the last quarter of 2021, and in early 2022, respectively), the DMRE might have to increase the capacity offered in BW5 and/or overlapping some of the future BWs.

Reforms recently announced by the South African government will also bring more investment opportunities to the private sector for IPPs and their stakeholders. Most importantly, however, will be to close the energy gap that continues to haunt the country through the likes of load-shedding.

Some of those measures include: unbundling Eskom by the end of 2022 into three companies (generation, transmission, and distribution) and finding the best solution to diminish the immense debt Eskom has in its balance sheet; and the new rules from Schedule 2 of the Electricity Regulation Act that exempts any developer from applying for any licensing with Eskom up to 100 MW for embedded generation projects. These will stimulate and expand the potential untapped small/medium-scale market (i.e residential and C&I) in South Africa (i.e, for comparison, Germany has half the solar irradiation of South Africa, but over 40,000MW of installed rooftop solar compared to South Africa’s +/- 450MW).

However, despite the renewable market in South Africa opening its wings to a freer market with more intervention from the private sector, one needs to recognize that the financial precarity of Eskom’s balance sheet and the limited South African National Treasury guarantees might dictate a change or the beginning of a new REIPPPP model through a different government regime in the near future.

Heading to a more sustainable market balance will foster mutually beneficial consolidation of IPPs in the renewable space, opening to a new and vaster M&A market in SA, recognize new development opportunities in the C&I space and key investment areas by increasing profit and bankability whilst reducing major risks, and explore corporate PPAs so to assist the best way to structure projects for any corporate buyers.

One thing is for sure, the renewable market in SA looks bright and with strong gusts of wind, and the industry alongside the South African consumer will be the winner with all these new reforms.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

22 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.