Electricity and gas prices are skyrocketing globally and the tipping point for this unprecedented trend is still not in sight. This situation is putting the entire world economy under strong pressure, and could also cause financial trouble for many energy-intensive companies over the short term.

According to Antonio Delgado Rigal, chief executive of Spanish energy forecasting service AleaSoft, large-scale renewables and the PPA market immediately offer a feasible solution for big energy consumers to get out of trouble, at least in part. And green hydrogen represents the best alternative to gas over the long term, as it is increasingly taking a leading role in the global electricity market.

“With increasing energy demand and with gas replacing coal in many countries where the latter is being phased out, we are heading toward a perfect storm. And it is not clear when we can get out of it,” Delgado Rigal tells pv magazine.

Image: Aleasoft

This trend has been in place for while, but we were still in a “normal” context up until July, as price decreases in the short term were still considered possible, he says.

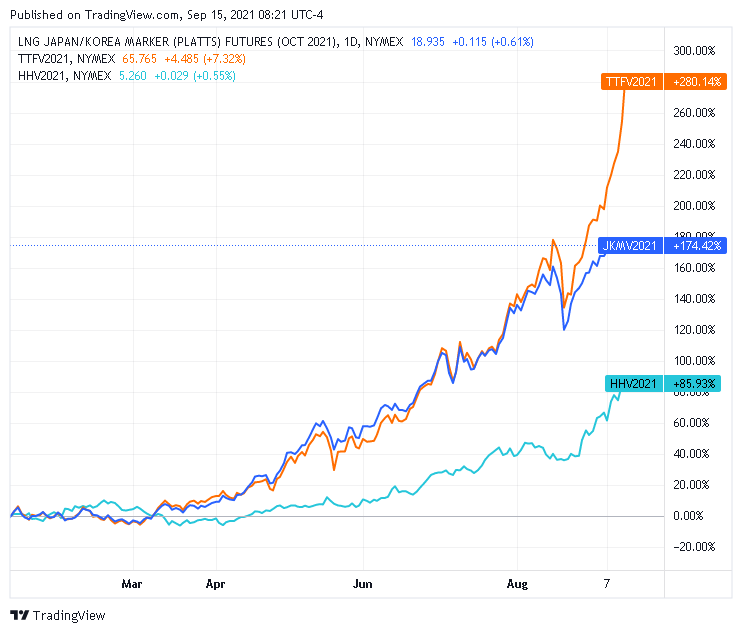

“Since then, gas and electricity prices have been growing at an unprecedented speed and nobody can say at the moment when this will be over,” he explains. “Now, gas prices are increasing exponentially. And not only in European markets, but also in the Americas and Asia, which means that this is a global matter. This is not about Russia, Algeria or Iran anymore … because we are seeing more gas consumption than gas production and, as a consequence, future gas prices are also rising.”

Delgado Rigal says that the simultaneous increase in carbon prices, especially in Europe, could become another factor pushing big energy consumers closer to serious financial issues. “I believe that a one-year moratorium may be introduced for both generators and intensive-energy consumers and this would help provide some relief under these dramatic circumstances,” he says. “This situation may lead to dramatic implications and, eventually, a global economic crisis. However, this is also showing the importance of investing more in solar, renewables and green hydrogen.”

Delgado Rigal is convinced that from a long-term perspective, green hydrogen could significantly reduce dependence on gas.

“In the short term, of course, green hydrogen is not immediately available, but if we consider the current gas price and add it to the carbon price, we can already say that green hydrogen is already competitive,” he says. “If we had implemented faster big green hydrogen production, we would probably not be under the threat of a global crisis. This energy price crisis is a great opportunity for renewables, solar and green hydrogen. It is only about getting greener – this makes us independent from gas.”

Looking at what is happening in different European countries, Delgado Rigal explained that UK and Italy, which are currently seeing the highest energy prices, are the most dependent on gas supplies. France, which is in theory well protected by its huge nuclear power plant fleet, is also seeing electricity prices increase significantly.

“Around 25% of France's electricity is made with gas and other sources and the gas and CO2 prices are also having an impact on this energy market,” Delgado Rigal adds. “France is constantly buying and selling power to other countries, thanks to its nuclear capacity, and this brings into balance the entire European market, but if they had a completely isolated electricity network, they would have lower electricity prices.”

When asked what kind of immediate actions the renewable energy industry may take to take advantage of this crisis, Delgado Rigal says that power futures for 2031 are currently being sold at around €30/MWh, which he describes as a great opportunity for big energy consumers, as they could close very profitable PPAs with a 10-year duration.

“In Spain, we are currently seeing PPAs for solar being closed at prices close to this level,” he explains. “Solar developers are scared of power futures and price cannibalization and big consumers are often shortsighted, but it is time to act now.”

All the big corporations that have secured PPAs over the past few years are currently making big savings compared to all those who are still reluctant, as they now face prices of approximately €150/MWh.

“When electricity prices dropped to their all-time low during the first Covid-19 crisis in the first half of 2020, several big energy consumers that had previously signed PPAs wanted to back-pedal, as they bought power for €40/MWh, but prices at the time were close to €20/MWh,” Delgado Rigal says, noting that this short-term strategy does not consider that what we are experiencing now is an unprecedented crisis. “This is a global tsunami and if this doesn't stop, many energy consumers may have to face bankruptcy, as governments have no tools to mitigate its effects.”

He argues that public investments in renewable energy infrastructure and green hydrogen will be crucial to address the crisis.

“We have a lot of renewable energy available – we just have to increase its consumption via green hydrogen and action can be taken immediately,” he states. “Hydrogen will inevitably replace gas as a fuel and, as much as gas prices remain at this level, this process will be accelerated.”

On the other hand, he adds, green hydrogen is already competitive, given the current price situation.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

I found this article rather strange. Earlier in the year, PV Mag interviewed Thierry Lepercq who heads the HyDeal project. It was very clear from Mr Lepercq’s comments that his project would deliver green H2 at a price lower than either blue H2 or indeed nat gas.

Furthermore, PV magazine has profiled (in 2019, 2020 and 2021) lots of PV projects in Spain and Portugal that have CfD prices (& thus by extension LCOEs) in the range €12 to €15/MWh. At these sort of prices directly coupled electrolysers will deliver green H2 at a price equivalent to nat gas when it was sitting at around €25/MWh. I notice that PV magazine has profiled a number of PV+Wind+electrolyser projects in Iberia – suggesting that if nothing else large Spainish/Portugese energy companies had worked out that green H2 was a low cost alternative to natural gas some time ago.

I am thus somewhat puzzled that it has taken till now for forecasting services and consultancies to recognise this. However, I will leave it to Mr Lepercq to have the last word in the interview he had with PV magazine (excellent interview by the way):

“entrepreneurs and real projects have always beaten “studies” and “experts”, which have consistently proven to lag behind real market forces”.

Lesson to be drawn? Look at project developments they will tell you all you need to know about where “the market” is heading.