From pv magazine 08/2021

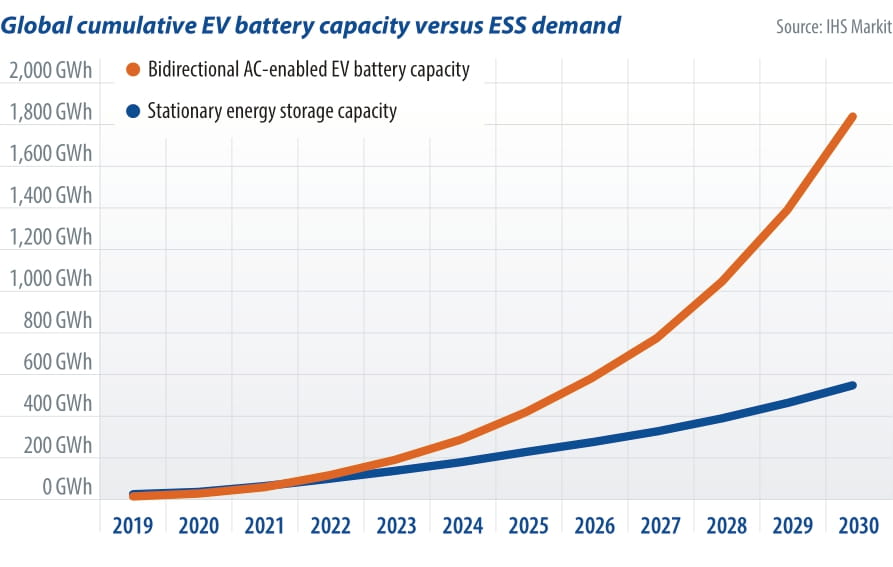

In the energy storage industry it can be easy to think that the growth trajectory is exceptional. Indeed, six months ago, in the IHS Markit Grid-Connected Energy Storage Market Tracker (our bi-annual evaluation of the energy storage industry), we predicted that the industry would double in size in 2021, with installations topping 10 GW for the first time. This is no doubt impressive. However, the changes underway in the automotive space are happening at an even larger scale. With this huge scale, there will inevitably be speculation on how to exploit the idle batteries sitting in the millions of EVs parked at any one time as a grid asset and an enabler for higher penetrations of renewable energy. This interface with the electricity grid, where EVs both charge and discharge, is called vehicle-to-grid (V2G) and could operate at a scale that eclipses the current and projected stationary storage market.

Lower costs

The cost at which this storage capacity could be deployed is, potentially, significantly lower than using separate stationary batteries, as is becoming increasingly common in a range of sectors today. The reason behind this is relatively simple – the capital cost of procuring the storage asset is met by the vehicle owner and is separate from its role as a grid asset. In addition to that, the incremental increase in cost of a bidirectional charger (the key component that needs to be added to an EV/EV charger to enable V2G, compared to the conventional alternative) is falling rapidly, with near parity expected in the next five years. This just leaves the cost of enabling communication and control over the dispatch of the vehicle’s battery, and there are positive signs that this could also be incredibly low.

Automotive OEMs already have over-air communication with their vehicles in many cases, and new EV chargers now invariably come with communications hardware to schedule charging. These communication and control interfaces could be leveraged to control V2G with minimal additional complexity. The combination of these factors will potentially enable V2G to be used as energy storage at an incredibly low cost.

With significantly lower capital requirements and potentially larger scale, the use case of V2G assets is likely to be different to that of stationary storage. As domestic EV chargers are typically 7 kW, and EV battery capacity is 50 kWh to 70 kWh, V2G is inherently a long duration (10-plus hours) asset. The lower cost will enable V2G assets to be profitable on wholesale electricity markets over a narrower price spread than traditional stationary storage assets. For these reasons, it is perfectly placed to provide long-duration balancing services at the intraday scale and play a large potential role in stabilizing wholesale markets under higher penetrations of renewable energy.

Key barriers

While this analysis certainly paints a rosy picture of the prospects for V2G technology, there remain significant barriers to its adoption in the short and medium term. The industry largely remains in the pilot and commercial trial phase, with large challenges remaining before deployment at large scale can take place. While some of these barriers – such as licensing difficulties and lack of bidirectional support in charging protocols – will be overcome in due course, others may be more difficult for the industry.

Although the aggregation of many thousands of EVs has the potential to form a highly valuable grid asset, a key challenge is that it will offer very little value to each individual EV owner. V2G will earn very little revenue per vehicle – this will raise the question of how vehicle owners should be incentivized to make their vehicles available for V2G. Equally difficult is the issue of battery degradation; while there are some clues that batteries will last longer than the vehicle under normal use, there is little information on how V2G affects battery lifetime. This means that in the short term, at least, this will remain a major concern in the minds of many vehicle owners.

In light of the tremendous potential of this technology, with the opportunity to provide storage at huge scale and very low cost, it now comes to the industry stakeholders to overcome these barriers of low customer value and concerns over battery degradation. It remains to be seen whether an effective commercial proposition can be made amongst the web of stakeholders, including auto OEMs, energy suppliers, and flexibility providers, in order to effectively unlock the value of V2G.

Collaboration between these industry players has never been achieved at such an enormous scale before. But is likely to be the determining factor in whether V2G can be an effective enabler for grid storage and decarbonization in the

years to come.

About the author

George Hilton joined IHS Markit in 2020 and has seven years of experience in the clean energy sector. He focuses on energy storage markets in Europe, the Middle East and Africa and has a particular interest in how energy storage integrates with other industries. Hilton holds a first-class Master of Engineering degree in mechanical engineering and a PhD in energy engineering with a focus on energy storage integration with renewable energy and EV infrastructure, both from the University of Southampton, United Kingdom.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.