China launched what it has described as the world's biggest carbon market on Friday, with the national system for trading carbon emission allowances amounting to 4.1 million tons of CO2 equivalent on its first day, and with the RMB200 million (€26.1 million) worth of allowances traded setting a carbon price of RMB51.23 per ton (€6.69).

That initial price – in a system which at its outset was applied to around 2,000 designated electricity power enterprises according to the state-owned Shanghai Environment and Energy Exchange (initialized to CNEEEX) which will temporarily oversee the process – was around 28% higher than the average cost of carbon determined by previous pilot schemes in seven provinces and municipalities but much lower than the European level of around €50/ton.

CNEEEX said the energy companies included in the initial round of the new system account for more than 4 billion metric tons of carbon emissions annually, around 40% of China's total.

Raw material sourcing

The Shanghai-based energy exchange will temporarily oversee the carbon market until the formation of a dedicated body pledged by China’s Ministry of Ecology and Environment (MEE) when it issued executive law Regulations for Carbon Emission Trading, in December. The regulations took effect in February.

A press conference about the trading scheme, held in Beijing by the information office of the China State Council last week, said the emissions trading scheme would be expanded over the course of the current five-year plan to include emission-intensive industries including steel, cement, petroleum, chemistry and building materials. The 14th five-year plan runs until 2025 and the MEE is working on the emissions standards of such industries, and a quota allocation scheme, with that aim in mind, it was added.

China has operated pilot carbon trading schemes in Beijing, Tianjin, Shanghai, Chongqing, Guangdong, Hubei, and Shenzhen, with the first having started operations in October 2011. Those programs incorporated more than 3,000 entities from 20 carbon-intensive industries including electricity generation, steel, and cement. Central government statistics indicate those forerunner programs to Friday's national scheme had traded certificates related to 480 million tons of carbon to the end of June, with turnover of around RMB11.4 billion (€1.49 billion).

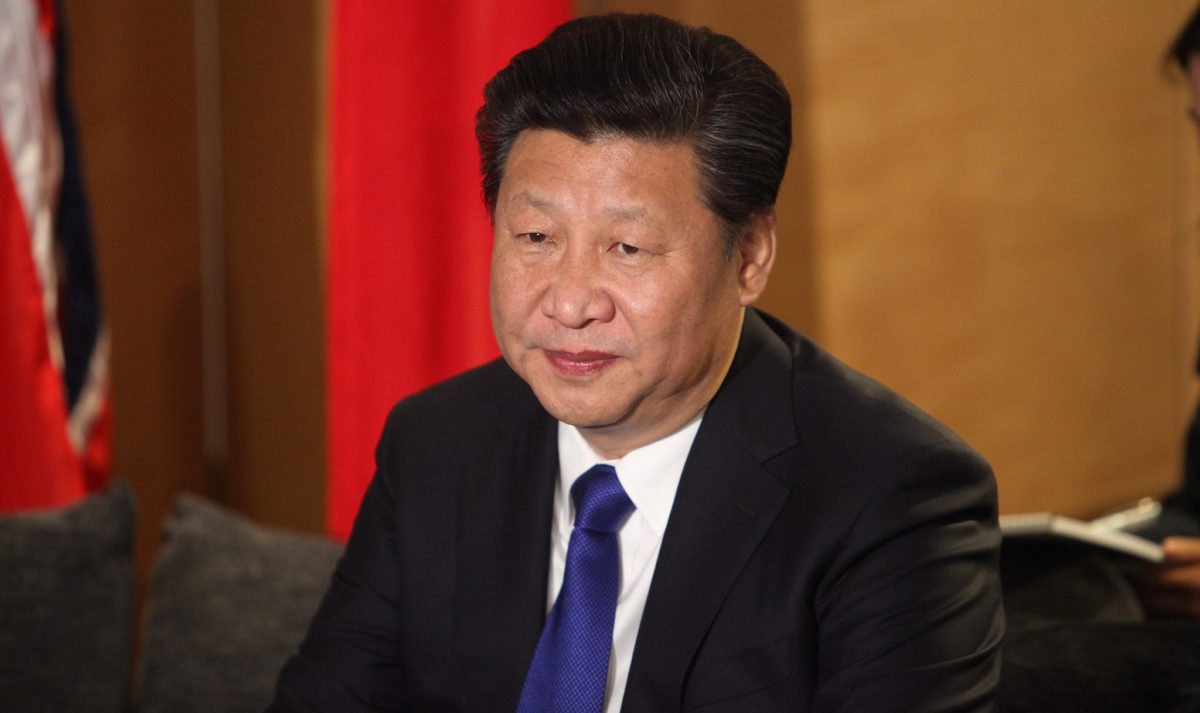

The country has opened the national carbon market to help it reach its stated goal of achieving carbon neutrality by 2060, and delivered on a promise made by president Xi Jinping in a climate summit in April.

Zhao Yingmin, deputy minister of the MEE, has stated in local media that “China is also actively participating [in] the discussion of Article VI of the Paris Agreement, to promote the construction of the global carbon market mechanism under the Paris Agreement,” and the opening of the national emissions trading scheme took place a day after the EU had fleshed out plans for its proposed carbon border adjustment mechanism (CBAM).

Carbon border

The CBAM plan would see the importers of goods made outside the EU forced to purchase carbon allowances, at prices set by Europe's emission trading scheme, to offset the embedded carbon footprints of the imports. It is expected the effectiveness of non-EU carbon trading schemes would be taken into account when assessing whether the carbon emissions baked into the production of imported goods had already been accounted for.

The European Commission is proposing mandatory tracking of the carbon footprint of imported goods from 2023-25 with carbon allowance offsetting to be introduced from 2026.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

What about methane? What if companies and govs switch to natural gas plants? That would make things far more worse. Don’t play games please.