From pv magazine 07/2021

Prior to SNEC 2021, China’s National Energy Administration issued a notice ruling that PV projects which fail to connect to the grid by the end of the year would be administered by the energy authority in each province and included in the guaranteed grid-connected capacity in the following year. This means grid parity projects approved earlier can postpone grid connection until next year.

In response to surging polysilicon prices, wafer prices rose again at the end of May to a level that was unbearable for cell and module manufacturers. Moreover, global module inventory has reached as high as 25 GW. These factors eased severe shortages and led to a pessimistic outlook.

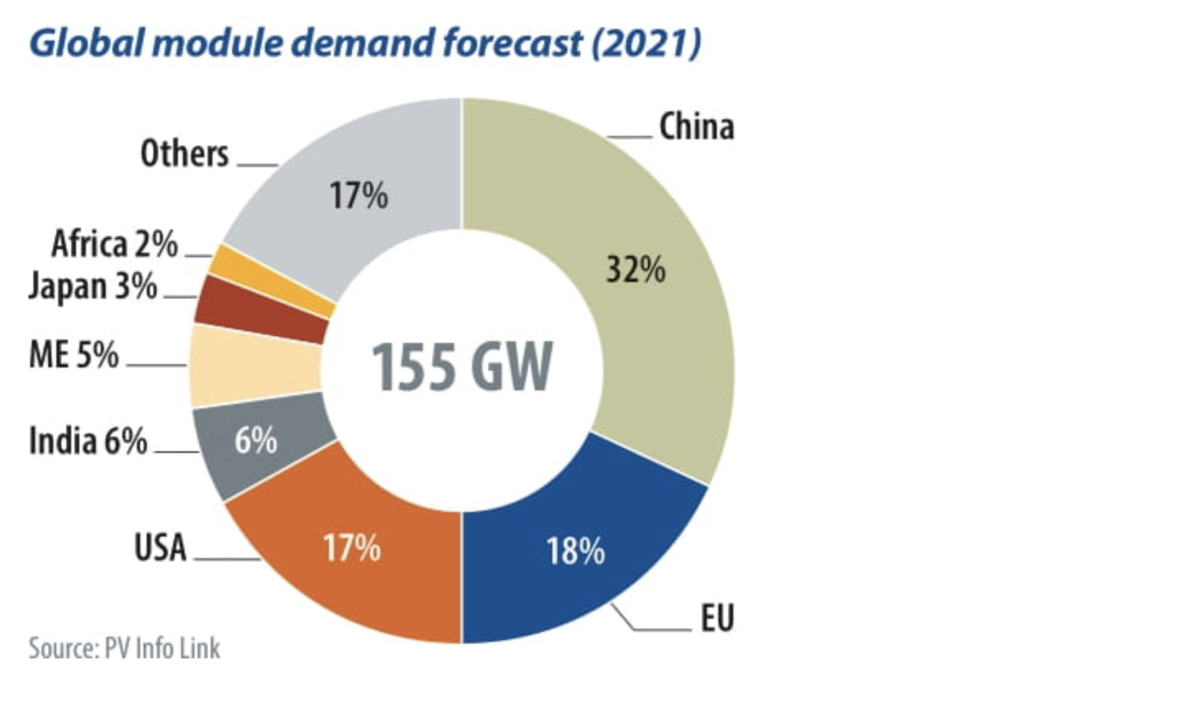

Although grid parity projects are allowed to postpone completion, China demand will not see large impacts, as most projects are developed by state-owned companies working toward targets. In addition, residential projects that wish to earn subsidy payments contribute 15 GW to 17 GW of demand. In light of this, PV InfoLink slightly lowered its China demand forecast to 50 GW, but keeping global demand for the year at 155 GW, as the United States and Europe saw stronger-than-expected solar demand.

With global trends toward carbon neutrality and peak emissions, energy storage and hydrogen were buzzwords this year. At present, the cost per kilowatt-hour for energy storage is around $0.08-0.10. The United States, Europe and China, as well as other countries, saw increasing adoption of storage. More manufacturers introduced energy storage solutions than in previous SNEC years. Apart from lithium-ion battery manufacturers and large inverter manufacturers, vertically integrated companies including Jinko, Trina, Risen, Chint, GCL, and Haitai Solar also provided energy storage solutions.

On June 3, Longi signed a cooperation agreement with Tongji University, announcing their plans to establish a joint lab to focus on fuel cells. Longi also established Longi Hydrogen Technology Co. in March. On the same day, GCL signed a strategic cooperation deal with Siemens (China), Toshiba (China), CSSC Perry Hydrogen Technology, and Beijing Green Hydrogen Technology Development, signaling the company’s entry into the hydrogen industry. With the two wafer manufacturing giants leading the way, a new combination of “silicon, solar, hydrogen” has emerged.

Cell, module tech

SNEC saw most manufacturers showcase next-generation products ready to be commercialized. In large formats, PERC modules mostly feature 550 W to 660 W, while small format modules rated at 400 W to 450 W were introduced for the rooftop sector. The 210 mm n-type modules can reach a power output of 700 W. Manufacturers also promoted smaller n-type modules rated beyond 400 W for the rooftop sector.

In terms of wafer sizes, Longi, Jinko, and JA Solar continue to promote 182 mm modules. Trina showcased 210 mm modules only. Canadian Solar displayed both 210 mm and 182 mm PERC modules, as well as 182 mm HJT modules. Risen is sticking to the 210 mm format.

Module manufacturers showcased high-density module assembly, including narrowed-spacing and tiling. It’s worth noting that, prior to SNEC, Longi released a white paper on “smart soldering” technology. JA Solar, on the other hand, introduced gapless encapsulating technology, indicating developments in string welding techniques.

In terms of cell technology, Longi launched the Hi-MO N series, its first modules with TOPCon cells. Trina and Canadian Solar unveiled their HJT modules for the first time this year. Risen introduced its New “T@N” technology – an n-type cell concept that combines elements of both PERC and HJT.

Whether leading module manufacturer Longi can commercialize its new TOPCon modules and optimize costs will largely impact the pace of TOPCon development next year. At present, required capex for 1 GW TOPCon is $38.4 million to $48 million, which is not significantly higher than $24.7 million to $30.2 million required for 1 GW PERC equipment. Moreover, TOPCon can be an upgrade from existing PERC production lines.

Many new PERC lines installed this year have been earmarked for upgrade to TOPCon, meaning capacity expansion and production of TOPCon will surpass that of HJT next year. However, HJT equipment costs fell markedly this year, from $96 million to $110 million to $54.8 million to $61.7 million per gigawatt, and are moving toward the $48 million range.

HJT manufacturers are also working to optimize the cost of silver paste and other materials. HJT will continue cost optimization this and next year. Most manufacturers will focus on improving technology with pilot lines instead of expanding capacity, and so the production output will be lower than TOPCon.

Price trends

Polysilicon prices rose from CNY 150/kg ($20.60) at the beginning of May to CNY 200/kg at the end of the month, sending modules rated beyond 500 W up to more than $0.25/W. Such a price level is unacceptable for developers and EPC companies. Combined with a surge in ocean freight rates, inventory draw has significantly weakened amid shrinking profits.

With China’s installation rush cooling and low global module demand in the July-August period, manufacturers cut output in June to an average utilization rate of 40% to 60%. This stopped the rise of polysilicon prices, with prices staying at CNY 200-220/kg. As Longi did not release new pricing in mid-June, the upward trend for wafer prices has stabilized.

Looking ahead, prices are not likely to fall in the short term due, to unbalanced supply and demand of polysilicon. Module prices may remain at $0.24-0.25/W. If the price level is accepted in China after recent negotiations, and most projects connect to the grid this year, a new price balance point will be set. However, module prices may be turbulent in July and August, when demand slackens.

About the author

Corrine Lin is the chief analyst at PV Infolink, and she collaborated with her team in Taiwan to produce this article. PV InfoLink is a provider of solar PV market intelligence focusing on the PV supply chain. The company offers accurate quotes, reliable PV market insights, and a global PV market supply/demand database, as well as market forecasts. It also offers professional advice to help companies stay ahead of competition in the market.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.