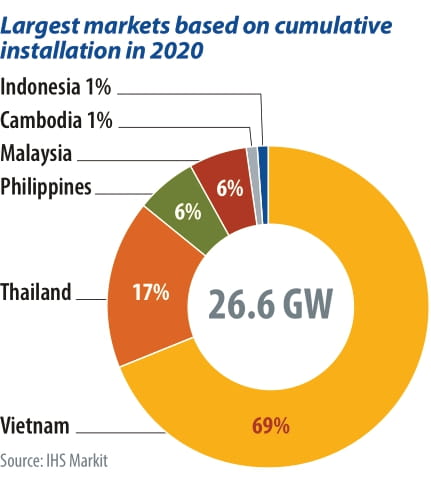

By the end of 2020, Vietnam, Thailand, the Philippines, and Malaysia had installed 98% of the operational PV capacity in Southeast Asia. But Vietnam was the only country that continued to steadily install PV systems throughout 2020. About 76% of installations in Vietnam came from the rooftop segment, thanks to a looming FIT deadline. The remaining 24% were ground-mount projects under the feed-in tariff (FIT) 2 regime. Thailand and the Philippines are currently driven by rooftop installations up to 5 MW. In Malaysia, large-scale solar (LSS) projects have contributed to recent growth beyond rooftop systems. As emerging markets, Cambodia and Indonesia have also seen some development in large-scale projects.

Solar support

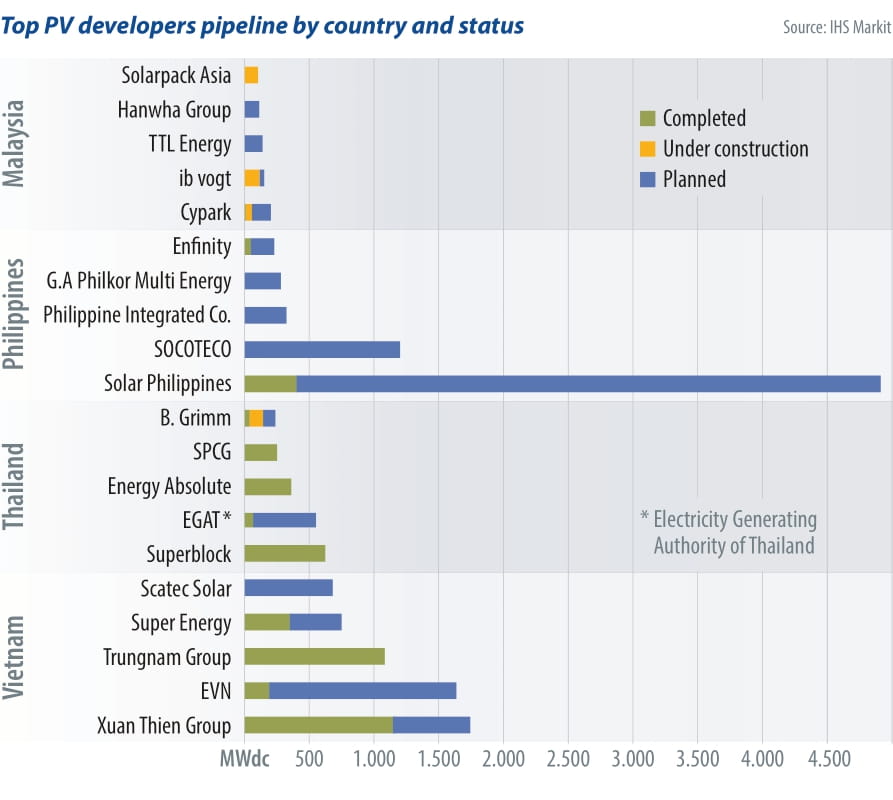

Vietnam passed 9.2 GW of rooftoop installations in 2020. However, 2021 will see it slow down unless new support is approved by the government. As per the proposed draft of National Power Development Planning (PDP) VIII, 9.1 GW of ground-mount PV projects are in the planned and pre-planning stages. Of this, 6.3 GW is targeted for completion by 2025 and 2.8 GW by 2030. These projects are planned to come under direct PPAs, with 400 MW to 1 GW of capacity in the PV auction scheme. PDP VIII also mentions an 18.6 GW target by 2030, which had already been achieved by 2020. This target is likely to be revised upward in the final version.

Thailand’s installation activity picked up from 2019, but was hit by Covid-19 in 2020. As per government data, there were no new ground-mount installations in 2020. However, the C&I sector continued without much interruption. IHS Markit projects steady growth, with projects mainly built for self-consumption and not grid export.

Malaysia continues to be driven by utility-scale projects under its LSS program. With the exception of 2020, the government has awarded PV tenders annually since 2017. As of 2021, the upper project size limit was raised to 100 MW. The LSS4 PV tender in 2021 awarded 823 MW of PV capacity, with projects to be installed in 2023 and 2024. The first tender, LSS1, awarded 450 MW, followed by 563 MW in LSS2 and 490 MW in LSS3. While LSS1 projects have been fully commissioned, 311 MW of LSS2 projects are pending completion in 2021 and 2022 (LSS capacity figures are given in AC). Strong oversubscription of tenders indicates the capacities of future LSS tenders are likely to remain stable or increase.

The Philippines rooftop market is thriving. PV systems for direct consumption at malls, schools, cold storage, and factories are all increasing, as permits are easy to obtain. The Philippines is a clear example of a market driven by the competitiveness of PV, with no need for explicit policy support.

Myanmar’s ongoing political crisis has created great uncertainty around the 1 GW of PV projects awarded in 2020. Most of these were won by Chinese developers such as Sungrow Renewables and China Machinery Engineering Corp. (CMEC), at an average tariff of $0.0422/kWh, with the original completion deadline on March 9, 2021. However, with the current situation, developers are reconsidering projects and may pull out. Funding is not widely available, as most financing entities are not ready to provide loans.

Laos relies on hydropower and coal, and exports a great deal of electricity at certain times of the year. Hydro declines in the summer, however, and the government ends up importing. To diversify the electricity mix, Laos has started allotting PV projects, such as the 76 MW PPA between nValid Precision Engineering and Electricite du Laos (EDL), or the intent of Wealth Power Group to build 580 MW of PV.

Cambodia’s government has installed 260 MW of PV capacity, mainly in ground-mounted installations outside of any auction scheme. Since 2019, the government has been working on a 100 MW auction scheme in collaboration with the Asian Development Bank. In 2019, the government awarded 60 MW of capacity to Prime Road Alternative Company.Another 40 MW of capacity is at the second stage of tendering. Apart from the auction scheme, 455 MW of unsolicited PV plants are at different stages of development – mainly very early stages.

Indonesia’s PV market is dominated by 125 MW of ground-mount installations. The government has a target of 6.5 GW PV capacity by 2025 and 45 GW by 2050. As per our project tracking, Indonesia has 841 MW of PV projects in the pipeline, including 174 MW of floating PV. State-owned electricity utility company Perusahaan Listrik Negara (PLN) is also working on a PV auction mechanism.

Southeast Asian markets cover the full range of opportunities for the PV industry. At the same time, regulatory uncertainty elevates risk for investors in several regions. Despite this uncertainty, more and more developers and suppliers are seeking to capture a share of the 27 GW that we forecast will be added through 2025.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.